Christopher Goes argued that privacy-focused blockchains face issues that go beyond any single project.

- Glider Airdope said the Cosmos ecosystem is “pretty much dead,” citing projects shutting down, scaling back, or exiting the network.

- Goes said funding and validator economics have deteriorated, with the Interchain Foundation’s treasury now focused mainly on Cosmos’s native cryptocurrency, ATOM.

- ATOM remains well below its 2021 peak, trading near $2.62 amid rising competition from Ethereum layer-2 and modular blockchain ecosystems.

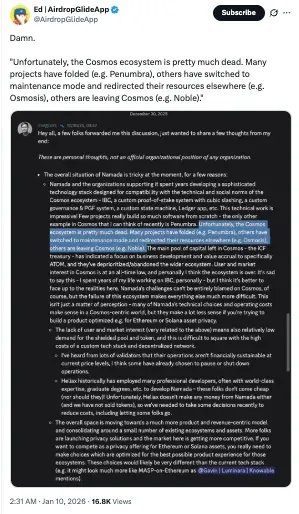

Ed, the founder of crypto management portfolio Glider Airdope, warned on Friday that the Cosmos ecosystem is nearing collapse.

On X, Ed quoted remarks from Anoma co-founder Christopher Goes, who wrote that “the Cosmos ecosystem is pretty much dead,” citing multiple projects shutting down, scaling back, or leaving the network altogether.

“Many projects have folded,” said Goes, “others have switched to maintenance mode and redirected their resources elsewhere, and others are leaving Cosmos.”

Cosmos’ native token, ATOM, has struggled to regain momentum amid broader competition among layer-1 and modular blockchain ecosystems. The token remains well below its 2021 peak, even as capital has flowed into Ethereum layer-2 networks and alternative modular frameworks.

Currently, Cosmos (ATOM) is trading at $2.62, down nearly 94.16% since its 2021 high. On Stocktwits, retail sentiment around ATOM was in ‘extremely bullish’ territory, as chatter levels improved from ‘high’ to extremely high over the past day.

Funding And Validator Pressures Weigh On Cosmos

According to Goes, there are challenges facing privacy-focused blockchains, but he argued that the issues extend beyond any single project and reflect deeper problems across Cosmos.

“The main pool of capital left in Cosmos, the ICF treasury, has indicated a focus on business development and value accrual to specifically ATOM,” Goes wrote. The ICF treasury refers to funds managed by the Interchain Foundation, the Switzerland-based nonprofit that oversees development of the Cosmos ecosystem.

He also pointed to declining market participation, saying that “user and market interest in Cosmos is at an all-time low,” making it increasingly difficult for projects to justify the high costs of maintaining custom infrastructure.

He believes that validator economics have also deteriorated, writing that he has “heard from lots of validators that their operations aren’t financially sustainable at current price levels,” with some already choosing to pause or shut down. Goes suggested that privacy-focused applications might choose ecosystems like Ethereum (ETH) or Solana (SOL), where demand, liquidity, and infrastructure are stronger.

Read also: Crypto Markets Grind Higher As Traders Eye CLARITY Act Markup

For updates and corrections, email newsroom[at]stocktwits[dot]com.<