Technical indicators like RSI support Cipla’s bullish run, while recent breakdown past key support level signals bearish momentum for Adani Enterprises, according to the analyst.

SEBI-registered analyst Dhruv Tuli of Ascend Wealth noted Cipla’s strong technical breakout backed by momentum and volume, while flagging a breakdown in Adani Enterprises below the ₹2,645 level, invalidating its earlier bullish setup.

Let’s take a closer look at his recommendations:

Cipla

The pharmaceutical stock has recently seen a trendline breakout past the ₹1,500 - ₹1,550 zone, Tuli highlighted.

The breakout is supported by the relative strength index (RSI), which is climbing above 70, a sign of strong bullish momentum. A noticeable surge in volume adds conviction to the move, indicating institutional interest.

Despite the recent rally, the stock remains in the buy zone, with further upside potential on the charts, Tuli added.

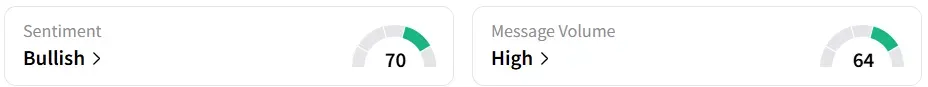

Retail sentiment and chatter on Stocktwits increased this week. Sentiment turned ‘bullish’ from ‘bearish’ last week, amid ‘high’ message volumes.

Cipla shares edged 0.35% higher at ₹1,575.50 in afternoon trade, having gained 3.24% year-to-date.

Last week, Cipla reported a 10% rise in net profit to ₹1,298 crore for Q1 FY26, while revenue grew 4% to ₹6,957 crore.

Adani Enterprises

Tuli said that despite a breakout above the ascending triangle being on the radar, the stock reversed course. It failed to sustain above the ₹2,645 mark and has now broken below the rising trendline, signaling a potential breakdown. This move invalidates the earlier bullish setup, he added.

According to classic trendline trading principles, the stock movement should be treated as a breakdown until proven otherwise, the analyst said.

A further decline will be confirmed if the price falls below the low of the breakdown candle. Tuli recommended staying on the sidelines till the structure develops.

The company recently entered into an agreement with Mettube Mauritius to jointly manufacture copper tubes for the HVAC industry in India. As part of the deal, Adani will divest a 50% stake in its subsidiary Kutch Copper Tubes to Mettube and simultaneously invest 50% in Mettube Copper India.

Adani Enterprises’ shares climbed 0.8% to ₹2,548.80. YTD gains are also at the same level.

For updates and corrections, email newsroom[at]stocktwits[dot]com<