Other than both companies being in the cryptocurrency space, the shares of Circle and Bullish were trading below their IPO levels.

- Ark Invest reduced the pace of its crypto dip-buying on Wednesday after heavy activity earlier in the week.

- The firm did not add shares of Robinhood or Bitmine Immersion Technologies, two of its largest recent crypto-related purchases.

- ARKK and ARKF both continued to add holdings in Bullish and Circle Internet Group.

Cathie Wood-led Ark Invest dialed back its crypto dip-buying spree on Wednesday, opting not to add more Robinhood (HOOD) or Bitmine Immersion Technologies’ (BMNR) shares while continuing to add stocks of Bullish (BLSH) and stablecoin issuer Circle Internet (CRCL) to its portfolios.

The ARK Innovation ETF (ARKK) added 56,451 shares of Bullish and 11,637 shares of Circle. Meanwhile, the ARK Fintech Innovation ETF (ARKF) added 26,643 shares of Bullish and 3,231 shares of Circle. he shift marked a pause in Ark’s recent buying of Robinhood and Tom Lee-backed Bitmine, which had been among the firm’s most aggressive crypto-related purchases on Monday and Tuesday.

Circle, Bullish Shares Trade Below IPO Price

Among Ark Invest’s bucket of select crypto-linked equities, Circle and Bullish are both companies that launched in the public arena last year and they’re both trading below their initial public offering (IPO) price. Shares of Bullish are down nearly 70% while CRCL’s stock has dropped around 20% since its debut.

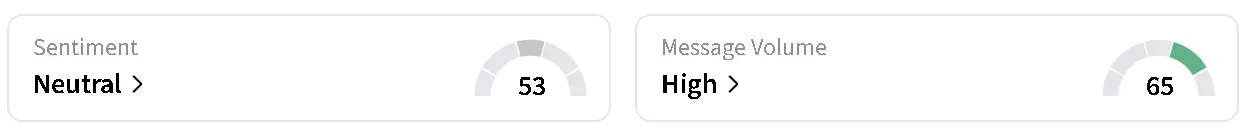

CRCL’s stock edged 0.47% lower after hours following a drop of nearly 2% in the regular session. On Stocktwits, retail sentiment around the company remained in ‘neutral’ territory, accompanied by ‘high’ levels of chatter.

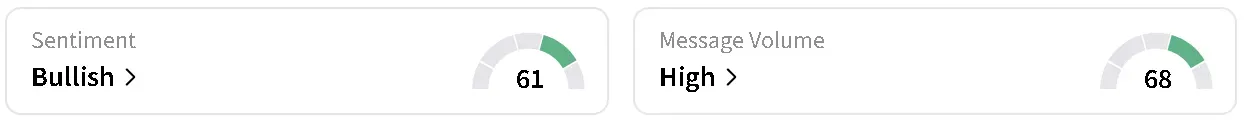

In comparison, BLSH’s stock moved 0.73% higher in overnight trade after a fall of 1.59% in the regular session. Retail sentiment on Stocktwits around the Peter Thiel-backed crypto exchange was in the ‘bullish’ zone with message volume at ‘high’ levels.

Diverging Retail Sentiment Between ARKK And ARKF

Both Ark Invest’s flagship ARKK and its crypto-focused ARKF rebounded in after-hours trading, though retail sentiment diverged sharply between the two. Activity on both Stocktwits streams surged during Cathie Wood’s crypto dip-buying spree, with message volume up 130% for ARKK over the past week and climbing 166% for ARKF.

One user warned that Wood’s dip-buying should push ARKK’s price to $50 from its current level above $70.

Another user joked that Cathie Wood and Fundstrat’s Tom Lee might secretly be the same person.

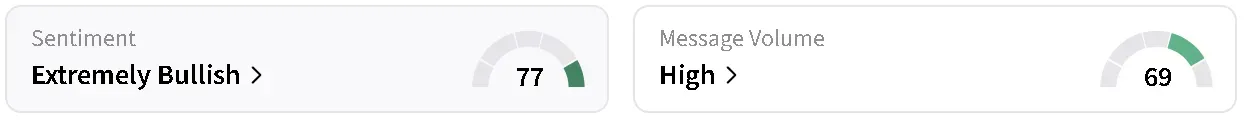

ARKF’s price rose 1.17% in after-hours trading after sliding 4.16% during the regular session. Retail sentiment around the fund sat in ‘extremely bullish’ territory over the past day, supported by ‘high’ levels of chatter.

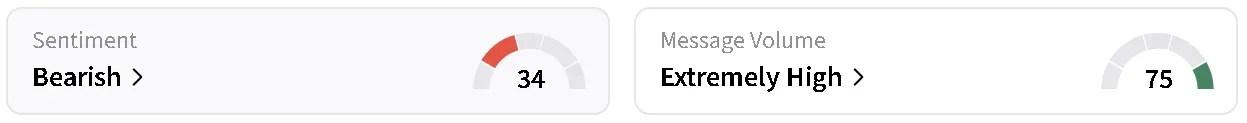

ARKK’s price, meanwhile, edged 0.55% higher overnight following a steeper 4.7% decline in regular trade. Despite the bounce, retail sentiment around the flagship fund remained in the ‘bearish’ zone, even as chatter stayed at ‘extremely high’ levels.

Read also: Cathie Wood’s Ark Invest Adds More Robinhood, Coinbase, Bitmine Shares In Crypto Dip Buying Spree

For updates and corrections, email newsroom[at]stocktwits[dot]com.<