AMD stock slumped 17% after the chipmaker issued a conservative outlook, while Q4 revenue, minus an unexpected boost from China, barely met targets.

- Wood’s Ark Invest bought $34 million of AMD shares on Wednesday.

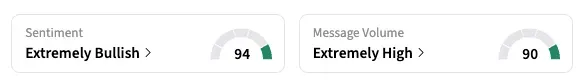

- Stocktwits sentiment for AMD climbed higher in the ‘extremely bullish’ zone, with retail investors seeing the dip as a great opportunity to buy the stock for the long term.

- Wednesday’s slide puts AMD stock in the red for the year.

Advanced Micro Devices, Inc.’s stock drew buzz on Stocktwits after retail investors digested its latest earnings, with a sharp slide in the stock price and notable investor buying the dip.

AMD stock declined 17.3% on Wednesday, its worst drop since May 2017, before rebounding 2% higher in the after-market session. The chipmaker reported mixed results the previous day, but rising expenses and conservative first-quarter guidance triggered the selloff.

Meanwhile, Cathie Wood’s Ark Investment Management disclosed that the ARK ETF purchased $34.2 million in AMD stock on Wednesday. The fund also bought $15 million in Tesla shares and $22.8 million in Tempus AI shares, while selling $73 million in Teradyne shares.

On Stocktwits, retail sentiment for AMD climbed higher in the ‘extremely bullish’ zone (94/100), which it entered soon after the chipmaker reported its results late Tuesday. The ticker drew ‘extremely high’ chatter.

“Now Cathie Wood comes in at buys 34 million dollars worth today that should give you some confidence that large players will come in,” said a user, while several advised buying AMD stock at the current price with a long-term view.

AMD Q4 Results Recap

AMD’s revenue rose 34% to $10.27 billion, surpassing estimates, although a significant chunk of that came from unexpected chip sales in China.

“Overall results weren't all that much beyond 'in line' without the China boost," Bernstein said in an investor note, implying that analysts’ consensus estimates did not forecast the China revenue.

Operating expenses jumped 27% to $3.8 billion, after jumping 30% in the preceding Q3.

The company’s Q1 revenue forecast of between $9.5 billion and $10.1 billion came in below Wall Street’s projection of $9.42 billion.

Analysts’ views post the earnings report were broadly divided, but some still believe the performance was healthy. “We believe investor expectations may have gotten too optimistic,” TD Cowen analysts said in an investor note, adding that in any other context, the report would be seen as “very solid.”

Following Wednesday’s slide, AMD shares are now down 6.5% for the year. They climbed 77.3% over 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<