An analyst says Bitcoin is deeply discounted relative to long-term models and liquidity trends, with historical patterns suggesting sharp mean reversion ahead.

- Bitcoin is trading about 35% below its implied long-term fair value.

- Backtesting showed that past extreme deviations always reversed, with strong 12-month returns.

- Based on the historical pace of correction, he projected Bitcoin’s price could reach $113,000 by June 2026, $145,000 by October, and $162,000 by early 2027.

A crypto analyst said on Sunday that Bitcoin (BTC) is trading at its deepest statistical discount in history, arguing that long-term mathematical models point to a sharp mean-reversion rather than a slow recovery, on Friday.

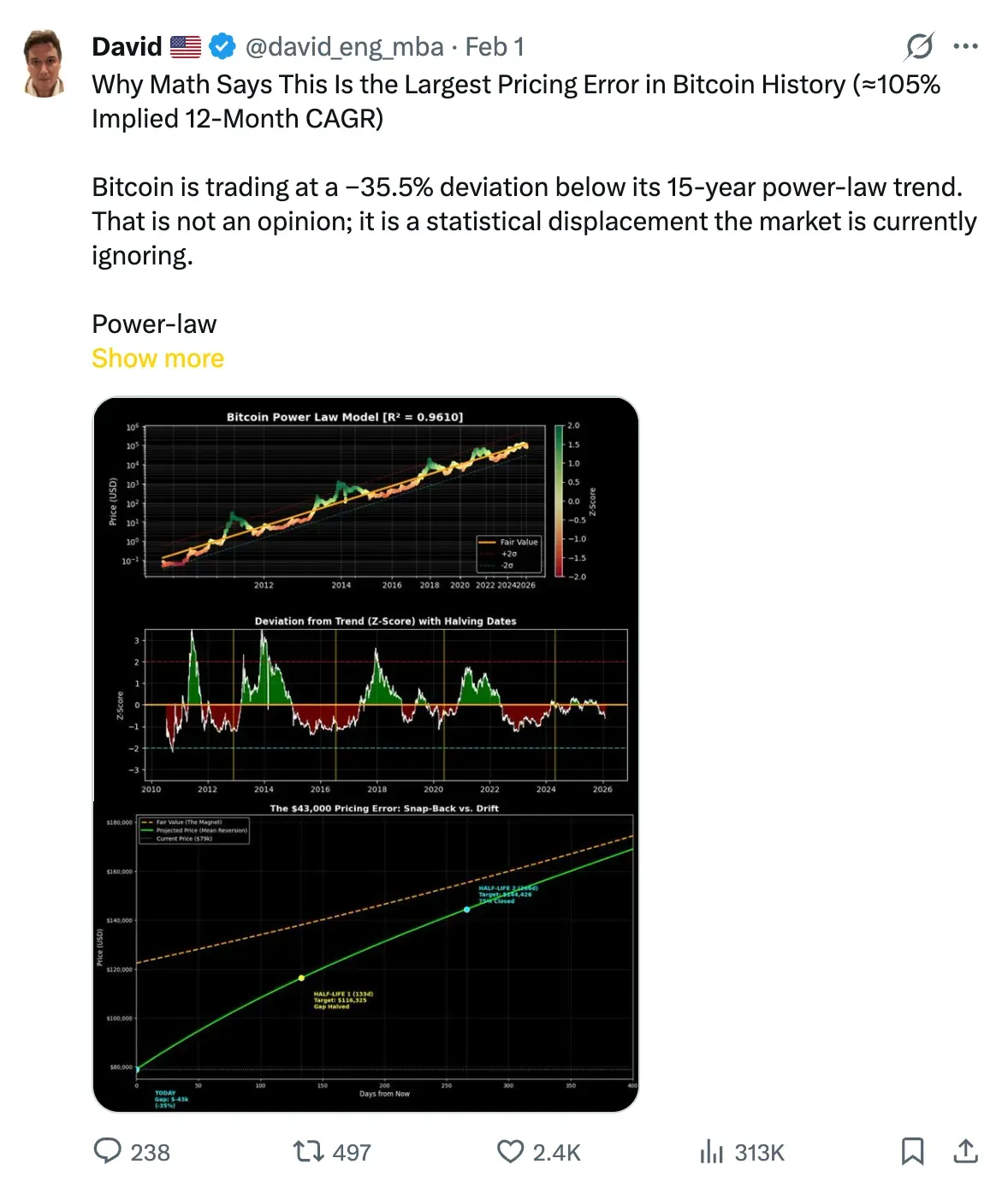

A managing director of an energy company, David, said Bitcoin was trading at a 35.5% deviation below its 15-year power-law trend, calling the move “not an opinion” but a “statistical displacement the market is currently ignoring.” He noted that Bitcoin’s implied power-law fair value sits around $122,425, compared with a spot price near $79,000, placing the asset firmly in a historical “oversold” regime.

David described his framework as rooted in engineering rather than theory, arguing that Bitcoin has a “thermodynamic floor” because every coin requires real energy and work. He noted that when prices approach production costs, miners shut off, issuance slows, and selling pressure collapses, while prices far above cost bring supply back into the market. He described this as a bounded system where price compresses for long periods before snapping higher, which is why mean-reversion models apply.

Bitcoin’s Price May Lag Behind Bull Predictions

The analyst back-tested every comparable oversold event since 2010 and found that Bitcoin delivered positive returns over the following 12 months each time. Based on the historical pace of correction, he projected Bitcoin could reach $113,000 by June 2026, $145,000 by October, and $162,000 by early 2027, far below what many bulls had earlier predicted.

Bitcoin (BTC) was trading at $76,712, down by 2.4% over 24 hours. On Stockwits, the retail sentiment around Bitcoin remained in ‘extremely bearish’ territory, as chatter levels around it improved from ‘extremely low’ to ‘extremely high’ over the past day. The apex cryptocurrency last saw this price point in 2024.

Raoul Pal Flags Liquidity Discount

The analyst's view aligned with comments from Real Vision CEO Raoul Pal, an entrepreneur and macro investor, who said Bitcoin is deeply discounted relative to global liquidity trends.

In a recent Coin Bureau podcast, Pal said Bitcoin should be trading closer to $160,000 based on how global liquidity and the Nasdaq have historically tracked. Pal described the current market as a “technical year,” arguing the gap reflects timing rather than weak demand. If liquidity conditions continue to improve, he said the discount is unlikely to persist.

Read also: Justin Sun’s TRON Faces Fresh Allegations As Lawmakers Question SEC’s Pause

For updates and corrections, email newsroom[at]stocktwits[dot]com<