Athira Pharma secured exclusive rights to a Phase 3 breast cancer drug and announced a $236 million financing package to support its development.

- The company secured the exclusive global licence from Ohio-based Sermonix Pharmaceuticals.

- Athira announced an upfront private placement financing of $90 million, which includes warrants that could provide an additional $146 million if exercised.

- The stock is on track to open at its highest levels in over a year.

Shares of Athira Pharma, Inc. (ATHA) jumped over 60% in premarket trading on Thursday after the company secured exclusive rights to a Phase 3 breast cancer drug and announced a $236 million financing package to support its development.

ATHA stock is on track to open at its highest levels since November 2024.

Licensing Deal With Sermonix

The clinical-stage biopharmaceutical company acquired an exclusive global license (excluding Asia and select Middle East countries) from Sermonix Pharmaceuticals to develop and commercialize lasofoxifene, a selective estrogen receptor modulator (SERM) for the potential treatment of metastatic breast cancer. The asset is currently in the Phase 3 ELAINE-3 trial, with topline data expected in mid-2027.

As part of the agreement, Athira will issue Sermonix a pre-funded warrant to purchase roughly 5.5 million shares and is also obligated to make milestone payments up to $100 million, along with royalties on net sales ranging from sub-single to low-single digits, depending on territory and performance.

$236M Financing Program

To support the program, Athira announced an upfront private placement financing of $90 million, co-led by Commodore Capital, Perceptive Advisors, and TCGX, with participation from multiple investors, including Blackstone Multi-Asset Investing and NEA. The financing includes warrants that could provide an additional $146 million if exercised.

The proceeds are expected to fund lasofoxifene development through key clinical and regulatory milestones, supporting operations into 2028.

How Did Stocktwits Users React?

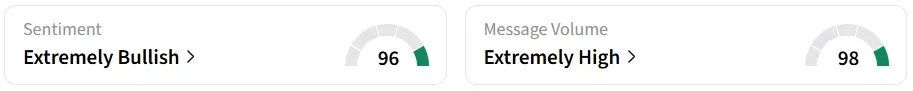

Retail sentiment on Stocktwits flipped to ‘extremely bullish’ from ‘bearish’ a day earlier, amid ‘extremely high’ message volumes.

One user sees a strong setup with the potential for the stock to climb to $20. It is currently trading close to $7.

Another user expects further gains post-dilution.

Athira had completed a 10-for-1 reverse stock split of its common stock, which became effective on September 17.

Read Also: A $151B Pentagon SHIELD Contract Has Put This Smallcap Satellite Stock Back On Traders’ Radar

For updates and corrections, email newsroom[at]stocktwits[dot]com.<