XPeng has outperformed Tesla in 2025, driven by strong delivery growth, expanding EV lineup, and improving margins.

- XPeng’s diversified EV lineup spans premium SUVs, sedans, MPVs, and budget models.

- This allowed the company to respond quickly to shifting demand while leveraging AI-driven software, in-house chips, and advanced driver-assistance systems.

- Improving gross margins and early investments in robotics and AI technologies have strengthened its long-term growth narrative.

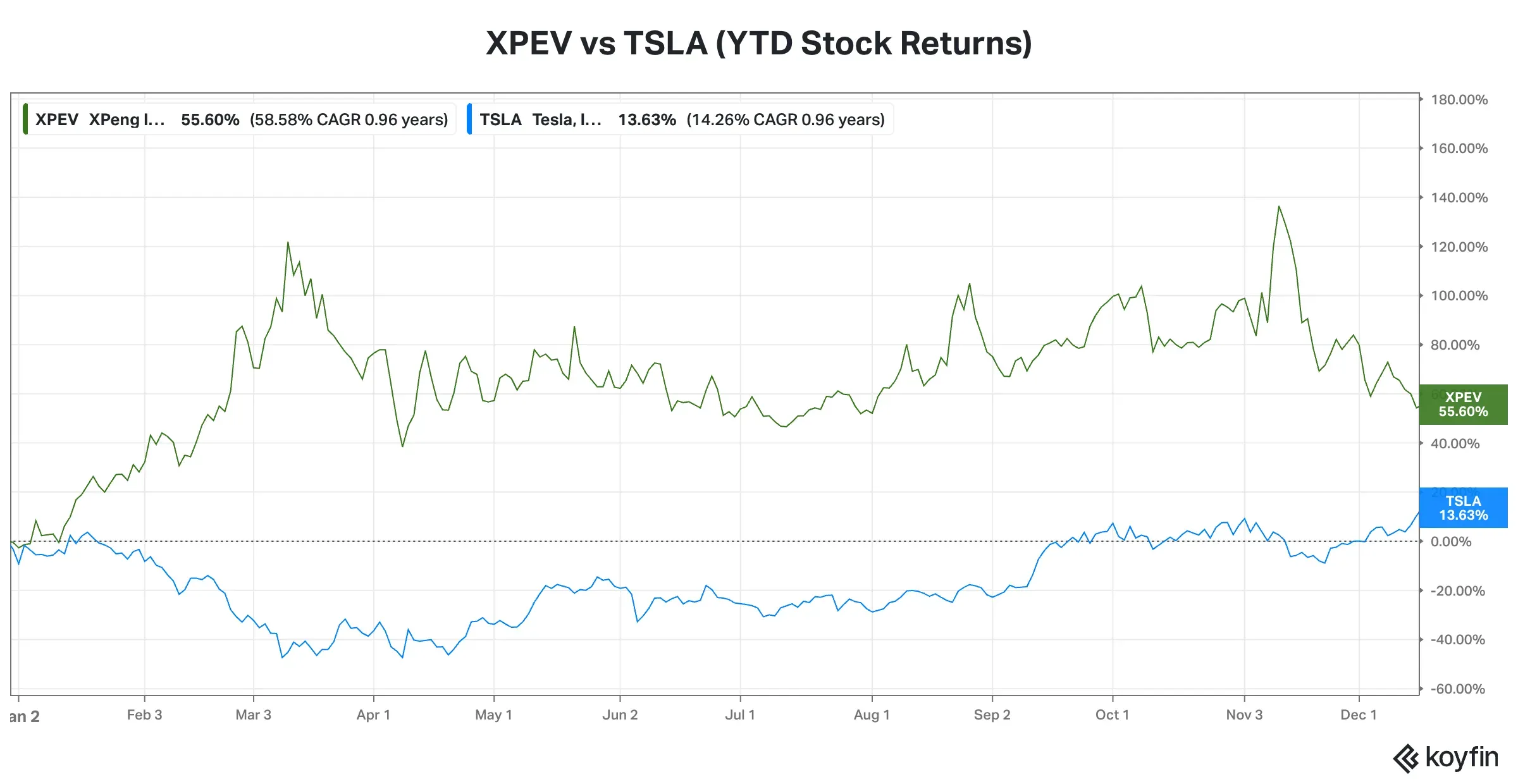

Tesla, Inc. (TSLA) stock had a sputtering start to the year but came back from behind to trade with handsome gains as the year draws to a close. If Tesla’s second-half pick-up has left you in awe, wait till you hear about this smaller player, whose market capitalization is roughly one-ninth that of the U.S. electric-vehicle (EV) giant.

Guangzhou, Guangdong-based XPeng, Inc. (XPEV) has seen its shares surge by about 56% versus Tesla’s 14% gain. Its outperformance is driven by its nimbleness in adapting to changing EV market dynamics, its use of artificial intelligence-enabled vehicle technology, and its foray into robotics.

Source: Koyfin<

XPeng’s Lineup

Founded in 2014, XPeng took four years to launch its first model, the G3 SUV, and the company began deliveries of its second model, the P4 four-door sedan, in 2020. The company’s current vehicle lineup includes the following models:

| Vehicle Type | Range (CLTC) | 0-100 km acceleration | Other features | Starting Price | |

| X9 | Ultra smart 7-seater (multi-purpose vehicle) | upto 702 Km | 5.7s | -XOS Tinaji In-car OS -XNG full-scenario ADAS -Qualcomm Snapdragon SA8295P chip | 350,000 yuan |

| G9 | Premium SUV | Upto 585 Km | 4.2s | -full-scene AI voice control -XPilot Assist advanced tech | 248,800 yuan |

| G6 | Coupe SUV | Upto 427 Km | 4.13s | -XPeng full-stack Lofic architecture -XPilot Assist advanced tech -Sensor suite | 176,800 yuan |

| P7 (new) | Sports sedan | Upto 576 Km | 4.1s | -XPilot Assist -in-house Turing AI chips | 219,800 yuan |

Source: XPeng<

XPeng also has a lineup of budget EVs marketed under the Mona subbrand. It launched the Mona M03, a hatchback coupe, in August 2024. It has a starting price of under 120,000 yuan and is pitched against Tesla’s Model 3 in China.

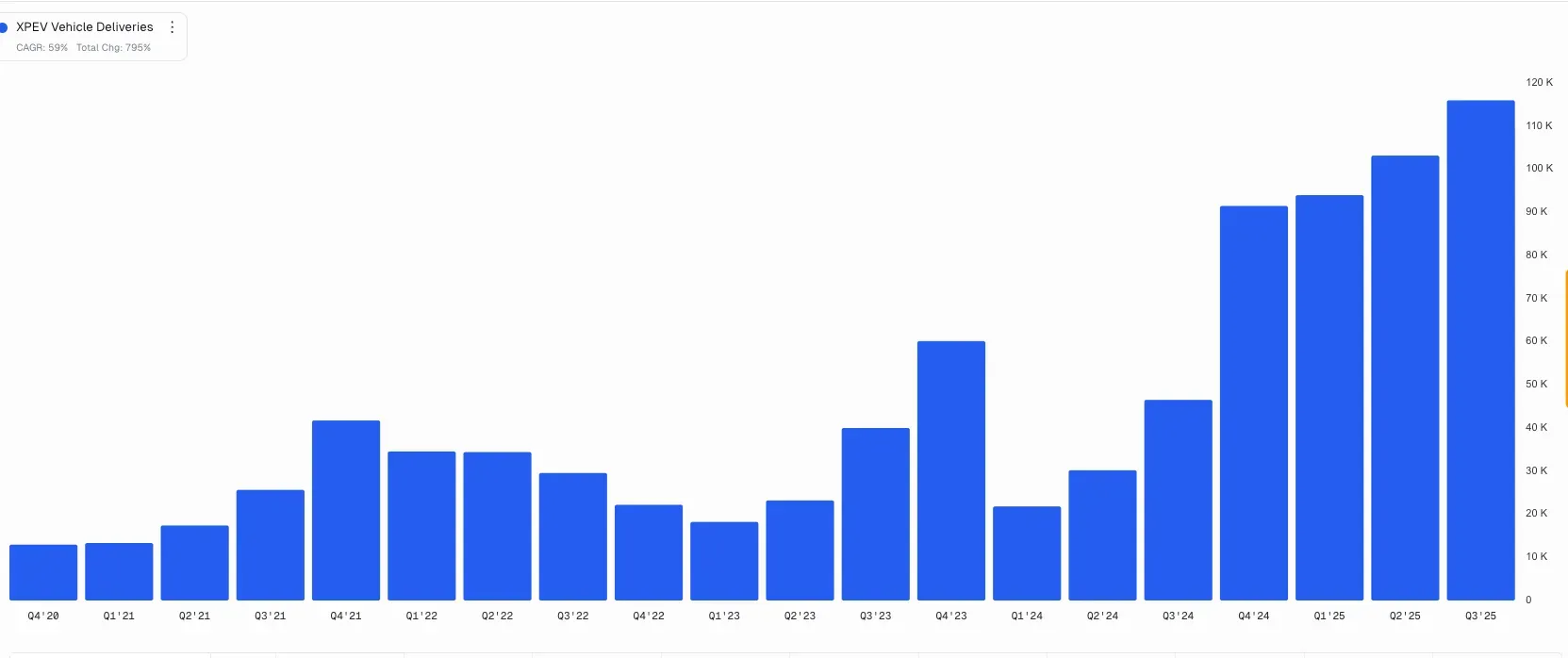

XPeng’s Deliveries Momentum Accelerates

Quarterly deliveries are at a record, with sales showing sequential revenue growth since the first quarter of 2024. The third-quarter results released in mid-November showed a nearly 150% year-over-year (YoY) increase in deliveries to 116,007 units. The company rolled out its one millionth EV from its factory in November.

Source: The Fly<

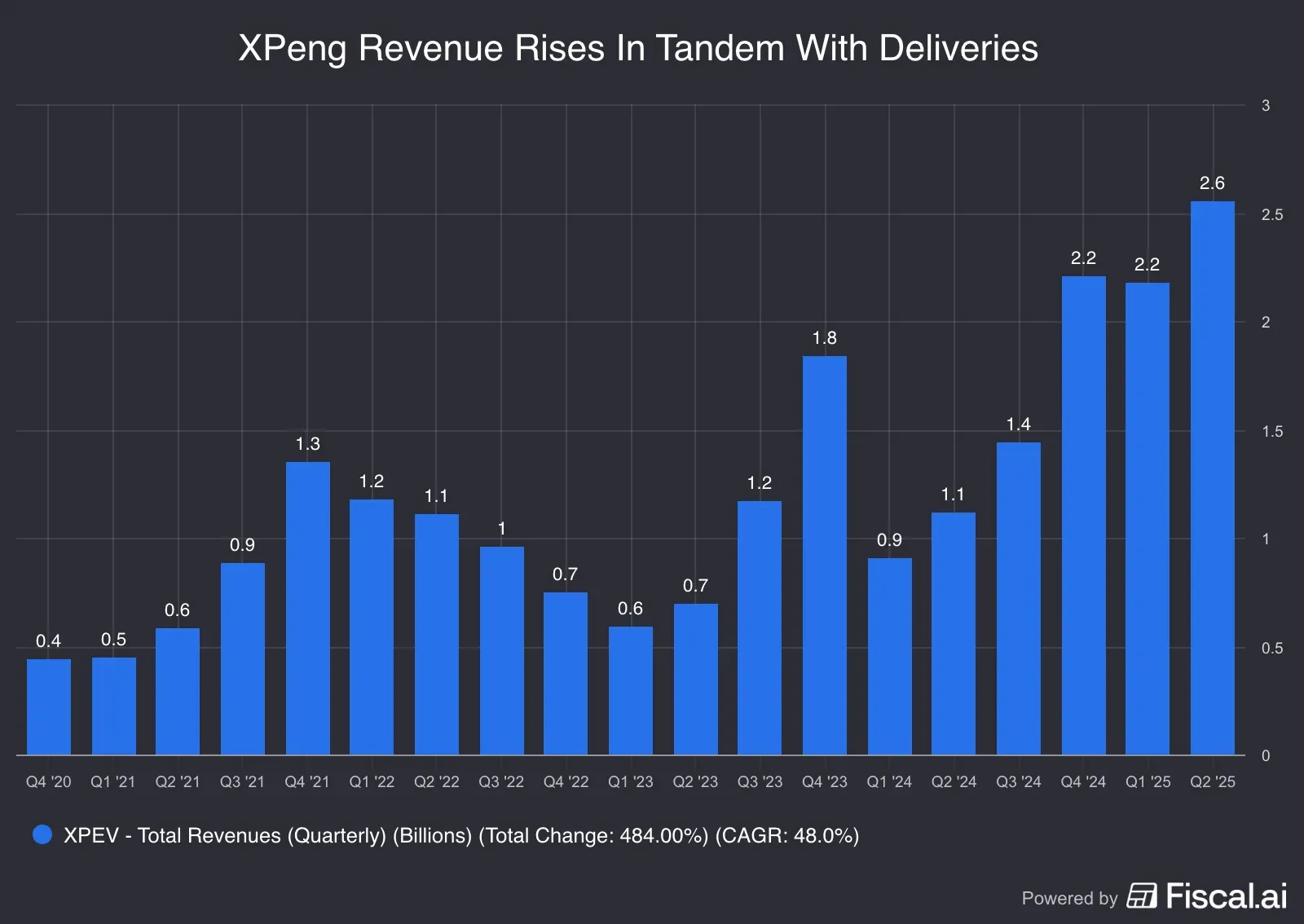

The revenue growth has kept pace with the rise in deliveries, with the latest quarterly number doubling from a year ago and rising 11.5% from the previous quarter.

Source: Fiscal.ai<

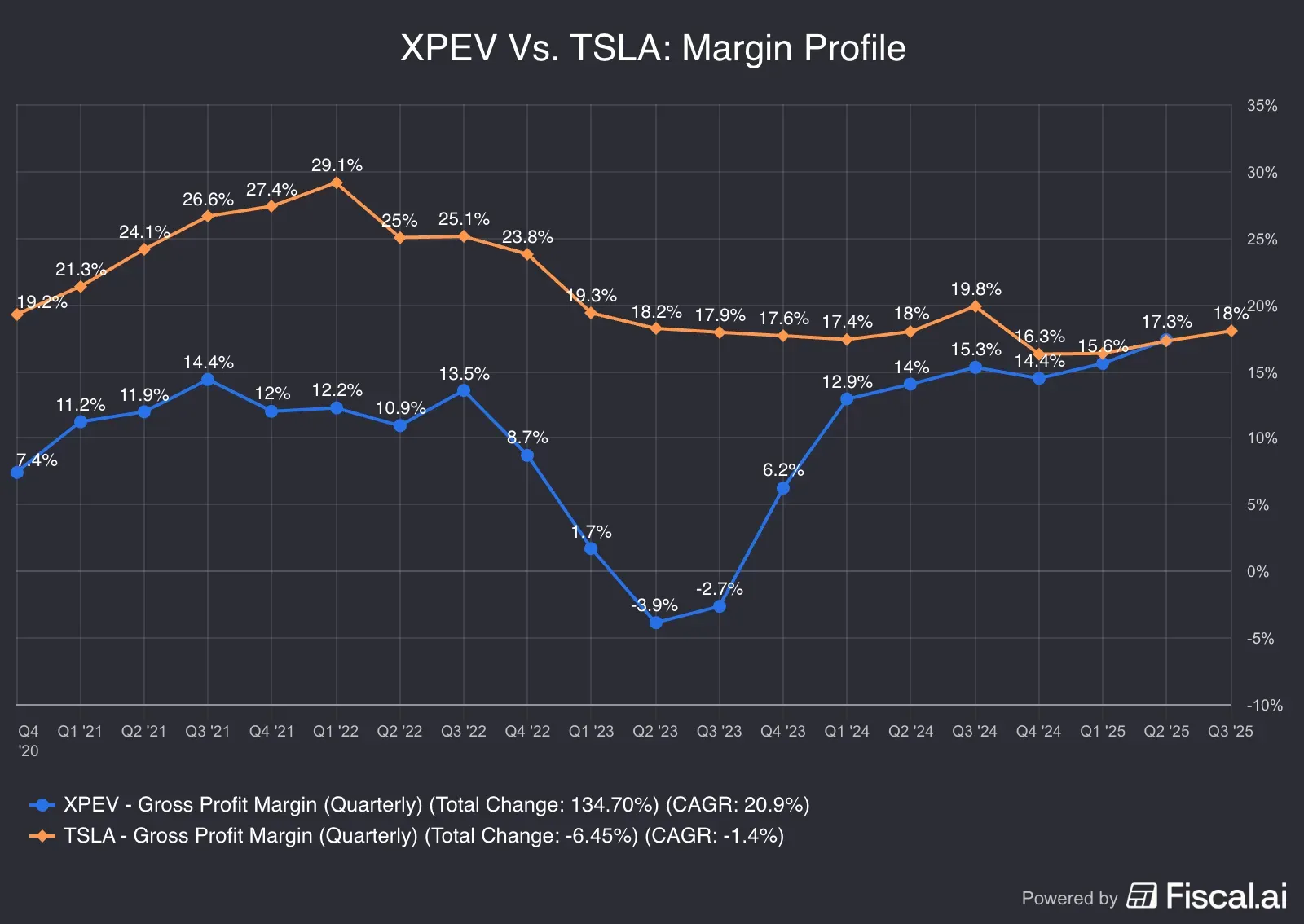

Gross margin has been on an upward trajectory since it inflected higher in the fourth quarter of 2023. Tesla, meanwhile, has traced a downtrend, stung by slowing deliveries and revenue growth and the absence of the high-margin regulatory EV credit.

Source: Fiscal.ai<

XPeng’s Robotics Opportunity

The Chinese EV maker, which prides itself on being a tech innovator, showcased its “IRON” robot earlier this year. The robot, which has a lifelike exterior and posture, will likely be mass-produced by the end of 2026 and introduced in factories and sales channels.

But Retail Holds Back

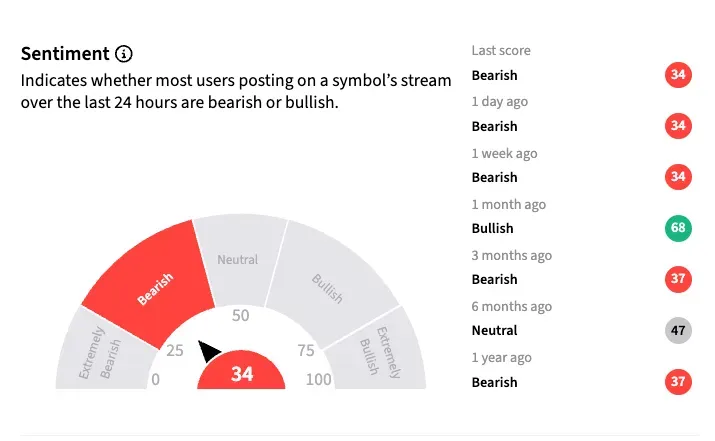

Sentiment among Stocktwits users toward XPEV was ‘bearish’ at the last reading, and it has remained depressed for much of this year.

Wall Street analysts, however, are optimistic. Nearly 80% of the 29 analysts covering the stock have ‘Buy’ or ‘Strong Buy’ ratings. The average analyst price target for the stock is $28.38, implying a 57% upside from the last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<