Brokerages turned bullish after the company issued a stronger-than-expected second-quarter earnings outlook and reported record quarterly revenue from its DRAM segment.

- Summit Insights expects technology shifts across AI, smartphones, PCs, and IoT to drive logic/foundry and DRAM investment in 2026.

- KeyBanc maintained an ‘Overweight’ rating and raised the price target to $450 from $380.

- Applied’s CEO, Gary Dickerson, expects the global semiconductor industry revenue to reach $1 trillion by 2026.

Shares of Applied Materials Inc. (AMAT) surged over 11% in pre-market trading on Friday after a wave of bullish brokerage calls, driven by the company’s stronger-than-expected second-quarter earnings forecast and a record quarterly revenue from its dynamic random access memory (DRAM) segment.

If pre-market gains hold through the opening bell, AMAT shares could climb to record highs.

Applied Materials Expects Q2 Earnings Growth

Applied Materials expects second-quarter (Q2) revenue of about $7.65 billion, plus or minus $500 million, and well above the $7.02 billion that analysts had projected, according to Fiscal.ai data. In the same quarter last year, the company reported a revenue of $7.10 billion. The company also guided for earnings per share of $2.64, topping Street estimates of $2.28.

For Q1, revenue slipped 2% to $7.01 billion but still beat expectations of $6.88 billion, while earnings came in at $2.38 per share, above the $2.21 forecast. DRAM revenue surged 34%.

Meanwhile, President and CEO Gary Dickerson said on Thursday that he expects global semiconductor industry revenue to reach $1 trillion by 2026, several years earlier than previously forecast.

Summit Sees Applied And Broader Semicap Sector To Outperform This Year

Summit Insights raised Applied Materials’ rating to ‘Buy’ from ‘Hold’, according to The Fly. The firm expects technology shifts across artificial intelligence, smartphones, PCs, and the Internet of Things (IoT) to drive logic/foundry and DRAM investment in 2026, with AI-driven wafer fabrication equipment demand potentially extending into early 2027.

While some uncertainty remains around spending at mainstream nodes, the analyst believes Applied Materials’ strong presence in faster-growing markets could help both the company and the broader semiconductor capital equipment sector outperform chip peers in 2026.

Meanwhile, KeyBanc maintained an ‘Overweight’ rating and raised the price target to $450 from $380, implying around 37% upside from Thursday’s closing price of $328.4. Analyst Steve Barger added that the main takeaway from the earnings was that AI has sparked a long-term growth cycle, giving the company an unusually strong visibility into future demand.

How Did Stocktwits Users React?

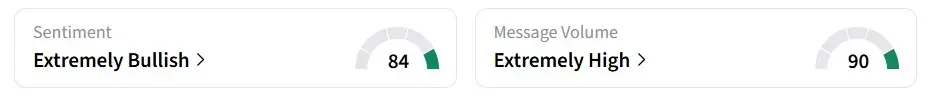

Retail sentiment on Stocktwits flipped to ‘extremely bullish’ from ‘bearish’ a day earlier, amid ‘extremely high’ message volumes.

One bullish user expects the stock to surge to $500.

The stock has gained nearly 37% so far in 2026.

Read also: RIVN Stock Surges 20% Pre-Market On Upgrade: Analysts See Edge With Rivals ‘Slow-Walking’ EV Transition

For updates and corrections, email newsroom[at]stocktwits[dot]com.<