Michael Saylor posted “Orange Dots Matter” after Strategy’s Q4 loss, keeping focus on Bitcoin buys and investor dilution concerns.

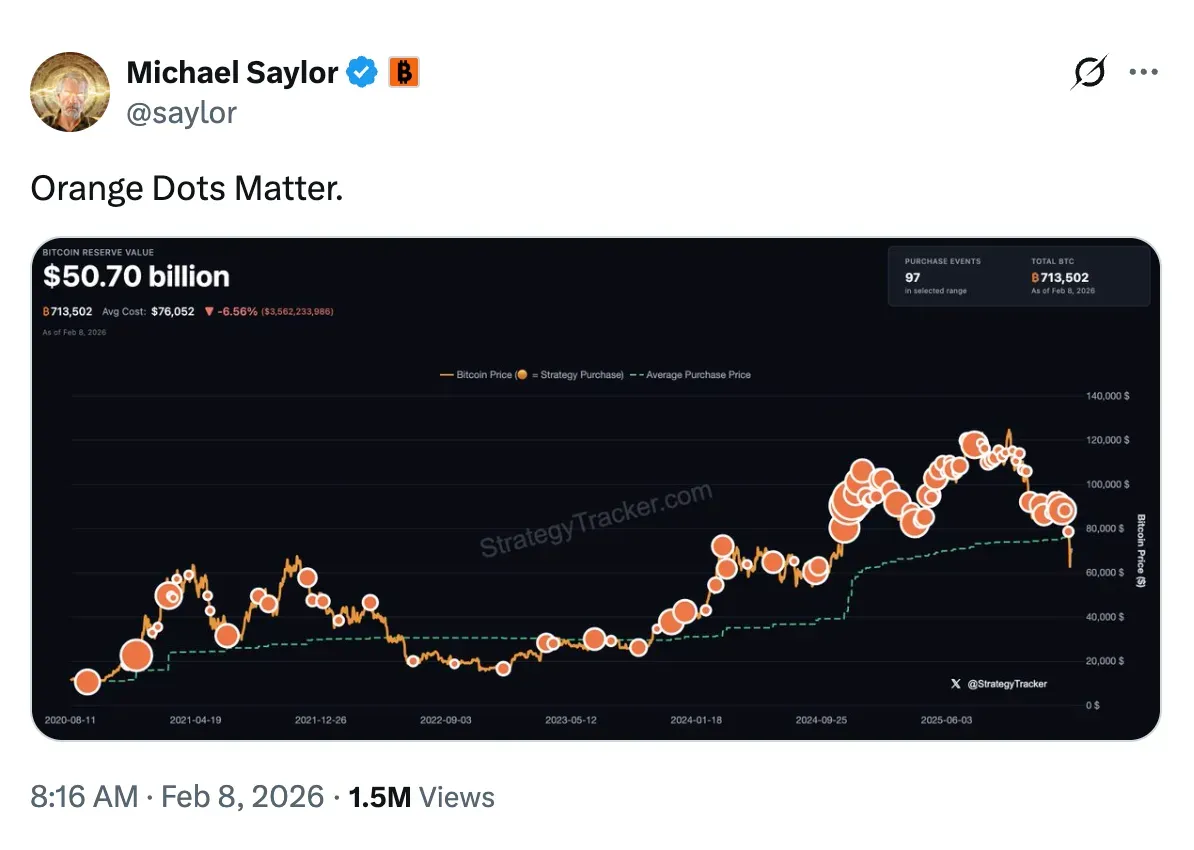

- Michael Saylor posted “Orange Dots Matter” on Sunday, sharing a chart tracking Strategy’s past Bitcoin purchases days after its fourth quarter earnings.

- Strategy’s Q4 results revived dilution concerns, with investors debating how future Bitcoin buys would be funded.

- CEO Phong Le outlined a worst-case scenario where Bitcoin falls to $8,000, while reiterating a long-term view that BTC could reach $1 million.

Strategy’s (MSTR) executive chairman, Michael Saylor, posted “Orange Dots Matter” on Sunday, sharing a chart that tracked the company’s past Bitcoin purchases.

Saylor posted the message just days after Strategy reported its fourth-quarter earnings, which showed a steep loss tied largely to unrealized Bitcoin markdowns during the period. Saylor also shared a chart that highlighted Strategy’s historical Bitcoin purchases, marked by orange dots layered over Bitcoin’s price. Bitcoin (BTC) was trading at $69,843, down by 0.9% over 24 hours. On Stockwits, the retail sentiment around BTC remained in the ‘neutral’ territory, as the chatter levels around it improved from ‘extremely low’ to ‘extremely high’ over the past day.

Earnings Pressure And Dilution Concerns

Strategy’s fourth-quarter results revived investor concerns around dilution. Shares moved higher on Friday, even as investors debated whether future Bitcoin purchases would require additional equity issuance, keeping focus on how the company funds its Bitcoin strategy.

Strategy (MSTR) was trading at $131.63, down by 2.43% in the pre-market hours on Monday. The stock closed at $134.93 on Friday. On Stockwits, the retail sentiment around MSTR remained in the ‘neutral’ territory, as chatter levels around it remained ‘extremely high’ over the past day.

Bitcoin Stress Test Scenario

During an earnings call, CEO Phong Le outlined what he called a worst-case stress scenario, saying Bitcoin would need to fall dramatically before threatening the company’s balance sheet.

“If we were to have a 90% decline in Bitcoin price, and the price was $8,000, right, which I still think is pretty hard to imagine, that is the point at which our Bitcoin reserve equals our net debt, and we will not be able to then pay off our convertibles using our Bitcoin reserve, and we’d either look at restructuring, issuing additional equity, issuing additional debt,” Le said.

MSTR CEO On Bitcoin Drawdowns

Le also pointed to Bitcoin’s past drawdowns to frame the company’s long-term outlook. “We’ve been through Bitcoin downturns in the past,” he said on a CNBC interview. “In 2022, Bitcoin went up to around $68,000 and then went down to $16,000. That was a 75% drawdown.”

Looking ahead, Le said Bitcoin could reach $1 million within seven years, adding that future pullbacks would likely be smaller in percentage terms than earlier cycles. Currently, Strategy holds 713,502 BTC.

Read also: Coinbase Super Bowl Commercial Taps Into Backstreet Boys Nostalgia – Marking Crypto’s Cautious Return To Big-Game Ads

For updates and corrections, email newsroom[at]stocktwits[dot]com<