According to LiveLaw, the apex court refused to stay the criminal proceedings initiated by the I-T Department after the raids at several of his properties conducted in August 2017.

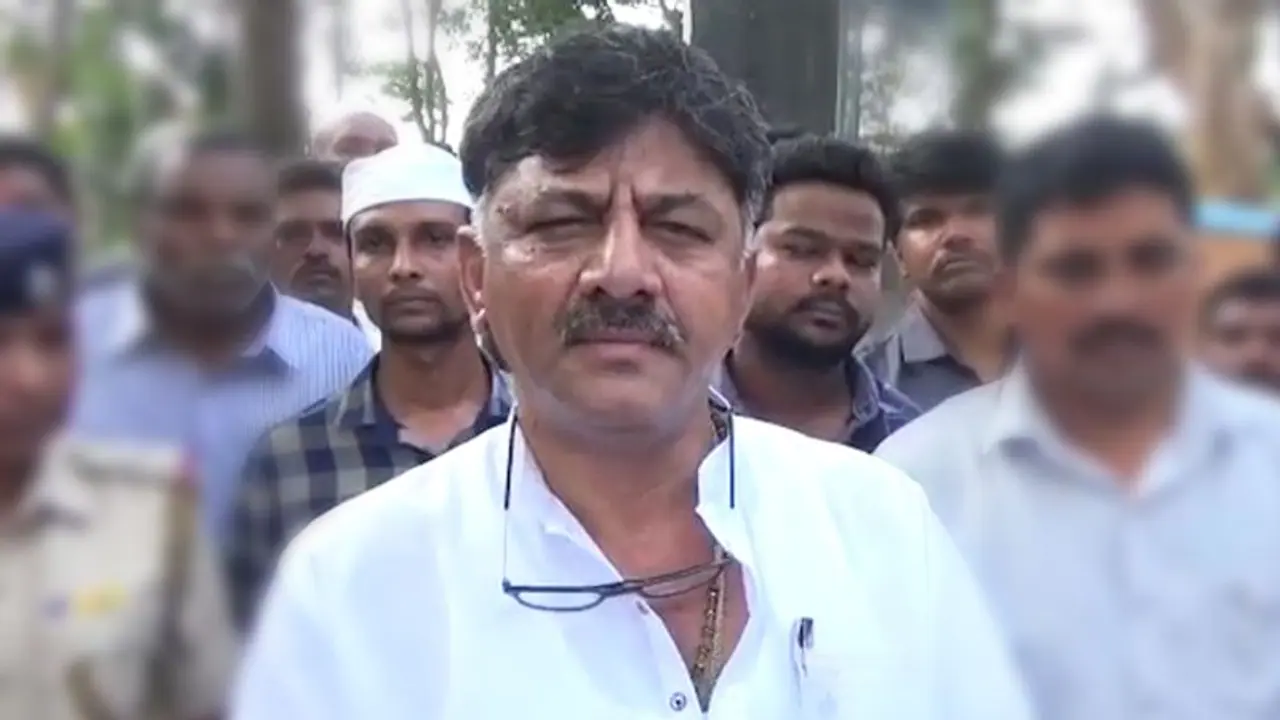

New Delhi: The Supreme Court on Thursday (August 27) refused to order a stay on the Income Tax proceedings against Karnataka Congress President DK Shivakumar.

The bench of Chief Justice SA Bobde and Justices AS Bopanna and V Ramasubramanian granted four weeks’ time to the I-T department to file its reply in case of undisclosed wealth discovered in a raid conducted at Shivakumar’s premises in 2017.

According to LiveLaw, the apex court refused to stay the criminal proceedings initiated by the I-T Department after the raids at several of his properties conducted in August 2017.

The Supreme Court was hearing the case after DK Shivakumar filed a Special Leave Petition in November 2019 seeking relief from the I-T Department’s case.

In November last year, the Karnataka high court had dismissed DK Shivakumar’s plea, seeking to quash the I-T Department’s case against him.

Shivakumar had appealed to the high court after the Bengaluru sessions court had dismissed his plea.

The Special Leave Petition filed by Shivakumar argues that an amount found during the course of a search cannot be treated as undisclosed income without waiting for the assessee to file return of income, LiveLaw reported.

DK Shivakumar’s counsel argued that the money found could be considered as undisclosed only if conditions of section 69A of the Income Tax Act were met.

According to section 69 of the I-T Act, in any financial year, if any money, bullion, jewellery or other valuable articles are found unrecorded by an assessing officer, and the assessee does not offer a valid explanation for not declaring such an income, then the assessing officer can declare the asset(s) as income of the assessee.

However, in Shivakumar’s case, his lawyers argued that even if the money is found to be income under section 69A, in DK Shivakumar’s case, he could not be charged with concealing income. The petition states that Shivakumar haad not filed for return of income when the search and seizure operation was conducted by the Income Tax Department.

Hence, his lawyers argued that only if Shivakumar had filed for return of income and had not included the money found by the I-T Department in it, could he be charged with concealing income. His counsel stated that Shivakumar had time till September 30, 2018 and that the assessment conducted by the Income tax Department was not appropriate.

“Consequently, the sanction for the prosecution would also have been vitiated by non-application of mind,” LiveLaw quoted the Special Leave Petition as stating.