The stablecoin sector grew 48.9% in 2025 to hit a record $311 billion market cap. And speculation was not the main driver here.

New Delhi [India], February 19: Capital markets spent the last 12 months ruthlessly repricing risk. The result is a market that now values deep liquidity and uptime far more than novelty. The trial-and-error phase of 2020–2022 is effectively over. In its place, we are seeing a hard consolidation around platforms that can guarantee scale and execution certainty.

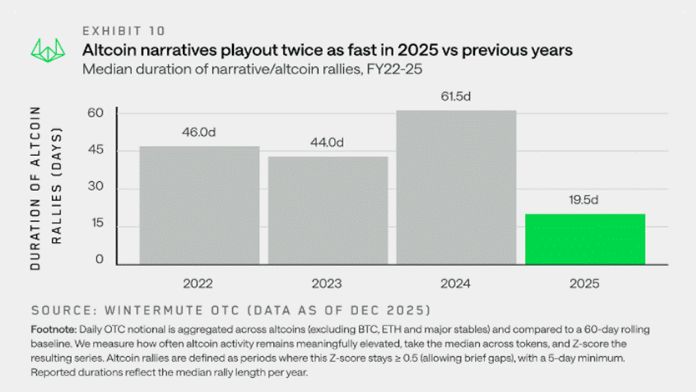

Data from 2025 confirms this contraction in speculative attention spans. According to Wintermute's 2025 OTC report, the median altcoin rally shortened to just 19 days, a sharp decline from roughly 61 days the previous year.

This metric suggests that "narrative bursts" are fading faster than ever because capital is no longer spreading broadly across the ecosystem. Instead, it is concentrating. The market is signaling that the winners of the next cycle are infrastructure plays, not consumer-facing novelties.

Data Shows Sustained, Repeat Usage

While price volatility has dampened for smaller assets and narrative plays, systemic volume remains historically high on established infrastructure. This divergence indicates that the market is maturing rather than retreating; users are prioritizing platforms that can handle throughput without failure.

Binance Co-CEO Richard Teng notes in the State of Blockchain report that this shift places a premium on trust mechanisms that go beyond simple transaction matching. "Binance's 2025 numbers show scale, and most importantly, what that scale requires: regulatory anchors like ADGM authorization, resilience and security programs that prevent real losses," Teng stated. "Strong data protection and AI governance, and product design that reduces friction for legitimate users while raising the cost of abuse."

This appetite for regulated execution venues is visible across the industry. Institutions kept trading even as retail mania cooled. CME Group recorded an average $12 billion in daily crypto derivatives volume for 2025, a record driven by micro-bitcoin and micro-ether futures. We see this demand mirrored in Binance's 2025 figures: the platform processed $34 trillion in total volume, including more than $7.1 trillion in spot trades.

The data points to a specific market structure: liquidity is attracting liquidity. As Wintermute's analysis suggests, capital is clustering in major assets like BTC and ETH and large-cap tokens, largely bypassing the long tail of applications that lack deep infrastructure.

Stablecoins as Execution Primitives

Perhaps the clearest indicator of the shift toward infrastructure is the dominance of stablecoins. Once viewed primarily as trading pairs, they have evolved into the unexciting but critical rails of the new financial system.

The stablecoin sector grew 48.9% in 2025 to hit a record $311 billion market cap. And speculation was not the main driver here. Instead, corporate treasury desks and cross-border settlement flows fueled the expansion. The GENIUS Act in the US played a specific role in this shift. By moving stablecoins out of the regulatory grey zone, the legislation gave companies the confidence to deploy them for actual business utility rather than just trading.

Utility data supports this view. On the Binance platform, more than 98% of B2C payments via Binance Pay were settled in stablecoins during the year. This suggests they are becoming the default medium of exchange for the crypto economy.

While flashy consumer apps capture headlines, backend infrastructure, specifically stablecoins, is currently generating more systemic value. They are the ultimate execution tool.

Infrastructure Advantages Compound Over Time

In this new phase of the market, competitive moats are built on security, compliance, and balance sheet strength rather than user interface design or marketing. Security infrastructure, in particular, has become a determinant of volume. Noah Perlman, Chief Compliance Officer at Binance, highlights how security investments directly correlate with platform integrity.

"Analysis of independent industry data shows a steep reduction in our direct illicit exposure between early 2023 and mid-2025," Perlman said. "Even as Binance handled growing volumes comparable to the next six largest exchanges combined."

The rise of Digital Asset Treasury Companies (DATCos) reinforces the need for massive, reliable infrastructure. DATCos collectively held $134 billion worth of crypto by January 1, 2026, after deploying at least $49.7 billion in 2025 alone. These are corporate entities with fiduciary responsibilities; they require established, secure rails to enter the market.

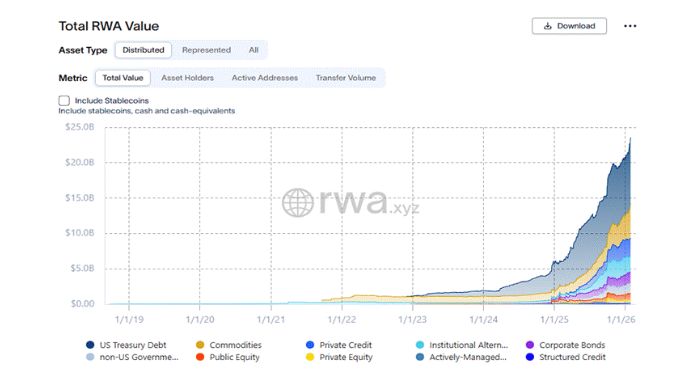

Similarly, the tokenization of real-world assets (RWA) relies entirely on execution reliability, not experimental apps. RWA.xyz data shows that tokenized real-world assets grew 261% in 2025 to over $20 billion. Connect this to the value of security infrastructure: in 2025, Binance's ri

sk controls prevented $6.69 billion in potential fraud losses for 5.4 million users.

Infrastructure plays are "sticky." Once liquidity and security are established, it becomes mathematically difficult for new, experimental apps to compete for institutional flows.

Why Binance Benefits From This Consolidation

The market has effectively voted for integrated access—trading, custody, and settlement—over fragmented applications. The 300 million registered user milestone reached by Binance is not just a vanity metric; it is proof that users are consolidating onto platforms that offer a continuous environment of services.

The central thesis holds: the next winners are those capable of handling the work of regulation and scale. As crypto integrates further with traditional finance through ETFs and tokenization, companies that resemble global financial infrastructure rather than tech startups will likely capture the majority of value in 2026 and beyond.