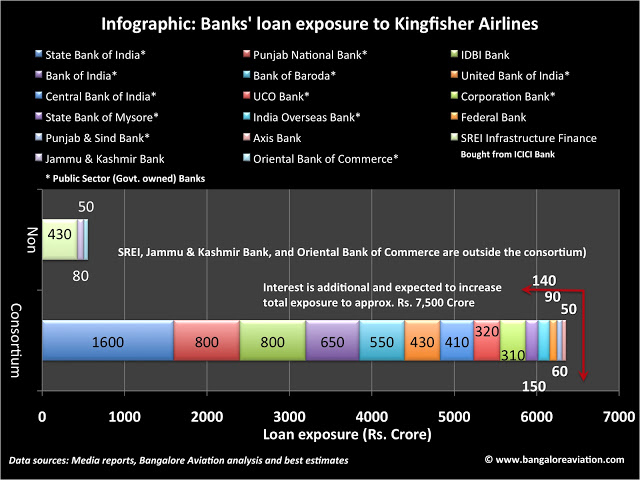

Vijay Mallya owes over ₹6,000 crore in debt to a consortium of banks The DRT has said if the sale of the properties do not suffice then the applicants could proceed against Mallya and other properties of the defendants

The banks have finally got hold of Kingfisher baron Vijay Mallya’s properties. The liquor baron was declared a Proclaimed Offender on March 2, 2016 by a special PMLA court in Mumbai on a plea of Enforcement Directorate in connection with its money laundering probe against him in the alleged bank loan default case.

Serving as another blow to Mallya, the Debt Recovery Tribunal (DRT) Presiding Officer K Sreenivasan in his order stated: "I hereby ask the bankers to start the process of recovery of ₹6203,35,03,879 crore and 42 paise at the interest rate of 11.5 per cent per annum from Mallya and his companies, including UBHL, Kingfisher Finvest and Kingfisher Airlines.” The interest payable is applicable from July 26, 2013.

It has been a long pending decision since the case was first put before the DRT in 2013.

So now the amount will be recovered from:

- United Breweries Holdings limited

- Kingfisher Finvest

- Kingfisher Airlines

Also, till now there were debates how the loan taken by Mallya was against Kingfisher Airlines as a company and not by Mallya, the individual. The company and the individual are two different entities; the company is an artificial entity created by law and members, shareholders and stock partners etc..are separate. Now, in this case the banks have been allowed to pierce the Corporate Veil.

Piercing the corporate veil or lifting the corporate veil is a legal decision to treat the rights or duties of a corporation as the rights or liabilities of its shareholders. Usually a corporation is treated as a separate legal person, which is solely responsible for the debts it incurs and the sole beneficiary of the credit it is owed.

So now that the Corporate Veil has been lifted, the promoters and the real culprits running the company will be held liable.

Read: UB City no longer belongs to Vijay Mallya; it is ‘sold’

What else will be included?

The DRT decreed that if, in spite of the sale of the properties mentioned in schedules, the OA (the Original Application) amount was not fully realised, then the applicant bank was at liberty to proceed against the person (Mallya) and other properties of the defendants as required under law and also as advised. In case this measure also fails, the banks were could sell the hypothecated, mortgaged, movables and immovable properties described in schedule of the main petition, according to law as sought by the applicant bank.

What has already been seized?

The Enforcement Directorate (ED) had attached assets worth ₹6,630 crore as it seized his farmhouse, flats and FDs in relation with the money laundering case. Under this provisional attachment order, issued under the provisions of the Prevention of Money Laundering Act (PMLA), a farm house in Mandwa in Alibaugh worth ₹25 crore, multiple flats in Kingfisher tower in Bengaluru worth ₹565 crore, fixed deposits of Mallya with a private bank to the tune of ₹10 crore and shares of USL, United Breweries Limited and McDowell Holding company, jointly held by the liquor baron and UBHL and his controlled entities, worth ₹3,635 crore have been seized. The total value of these properties come upto ₹4,234.84 crore but the present market value of these properties and assets is ₹6,630 crore approximately. With a previous attachment, the ED has attached property worth ₹8000 crore from Mallya in this money laundering case.

Ray of hope

The DRT, however, has said that the defendants will be allowed time to appeal provide they pay 50 per cent of the amount and interest as mentioned and the recovery process will begin in Bengaluru only after the appeal option is exhausted and the appellate tribunal (in Chennai) upholds this order.

With inputs from PTI