Analysts cite Reddit’s 100% human-created content and fast-growing ad platform as key drivers of future revenue.

- Needham maintained a “Buy” rating with a $300 price target for Reddit

- The firm says Reddit is the fastest-growing company in its coverage.

- Needham added Reddit to its ‘Conviction buy’ list, replacing Roku.

Reddit’s stock (RDDT) was in the spotlight on Tuesday after analysts at Needham named it as its top pick for 2026 and added the stock to its ‘Conviction buy’ list by replacing Roku. Needham maintained its “Buy” rating, with a $300 price target, citing the platform’s 100% human-created content as the key differentiator.

According to TheFly, analysts at Needham believe Reddit’s authentic content optimizes trust and value for large language models (LLMs), making it attractive.They added that Reddit already generates over $100 million per year in fees from OpenAI and Google's Gemini, and this could double with Anthropic and Perplexity fees.

Needham also noted that Reddit is the fastest-growing company in its coverage, while its Performance Ads offer "full-funnel ad solutions" and a larger share of ad budgets.

OpenAI, Google AI Content Licensing Deal

Reddit has been partnering with OpenAI since 2024 to bring its content to ChatGPT under the deal. In this arrangement, both OpenAI and ChatGPT use Reddit’s application programming interface, which also distributes Reddit's content. As part of the deal, OpenAI also became Reddit's advertising partner.

Before its IPO, Reddit had also struck an AI content licensing deal with Google worth about $60 million per year, according to a report from Reuters. The deals underscored the company's efforts to generate more revenue amid fierce competition from other major players, such as Meta’s Facebook.

AI Bet Paying Off

Reddit has been seeing its AI-powered advertising tools attract more marketing spending on the platform. During the third quarter (Q3) earnings call, its Chief Operating Officer, Jennifer Wang, told analysts that Reddit’s total active advertiser count expanded by over 75% year-over-year.

It has prompted Reddit to forecast current-quarter revenue at the higher end of analyst estimates, according to Fiscal.ai data. The company expects fourth quarter revenue (Q4) to be between $655 million and $665 million, in line with analyst projections of $665 million.

How Did Stocktwits Users React?

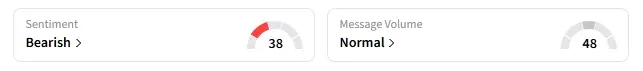

Retail sentiment around the RDDT trended in “bearish” territory amid “normal” message volume.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<