Mixed signals keep Nvidia’s Stocktwits sentiment at ‘neutral.’

- Samsung is close to securing approval for a key AI memory chip and beginning shipments to U.S. chip customers, including Nvidia.

- Tech stocks and the broader market rebounded on Friday, with Nvidia shares rising nearly 8%.

- For Nvidia, investors are tracking the latest developments related to regulatory approval for the sale of its H200 to China.

Nvidia Corp. shares declined 0.4% in early premarket trading on Monday, correcting from a sharp rally on the previous trading day.

The chip designer’s shares ended 7.9% higher on Friday, nearly reversing losses in the days prior amid a sharp rebound in the border market. Nvidia’s stock is still down 11% from its peak on Nov. 3.

In recent news that could affect shares on Monday, Samsung is close to securing certification from Nvidia for the latest version of its AI memory chip, HBM4.

The Korean chip maker is preparing for mass production of HBM4 in February, according to a Bloomberg report, citing sources. Samsung is slated to begin HBM4 shipments to Nvidia and Advanced Micro Devices Inc. next month, according to the report.

The development comes amid an ongoing shortage of memory chips across industries, which has boosted shares of chipmakers such as Micron, SanDisk, and Western Digital, as investors expect robust demand and higher pricing.

Nvidia, a key supplier of chips and infrastructure used in AI data centers, is awaiting approval to resume sales of its H200s in China. The issue is caught up in a diplomatic quagmire between Washington and Beijing. Recent reports indicate that Beijing is close to approving imports, while the U.S. is considering additional restrictions.

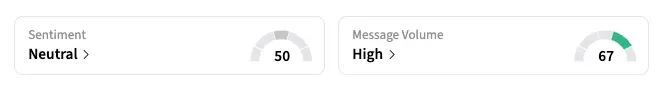

Owing to the mixed news, Stocktwits sentiment has stayed ‘neutral’ for NVDA as of Monday, unchanged over the past week.

“In the technology arena, the Nasdaq experienced an impressive recovery led by chip giants Nvidia and Broadcom, which jumped by about 8% in a single trading day,” a user said, referring to the market rally on Friday. “The increase in trading volumes, which were three times higher than average in some stocks, indicates the entry of "smart" money that is taking advantage of the declines to collect goods.”

For the year, Nvidia shares are down 0.6% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<