The oil major now expects $25 billion in earnings and $35 billion in cash flow growth in 2030, an improvement of $5 billion in both metrics compared with its previous plan.

- Exxon now expects to produce 5.5 million barrels of oil equivalent per day (boepd), slightly higher than its previous estimate.

- A large chunk of the increase will come from the prolific Permian Basin, where the company believes output can reach 2.5 million boepd by the end of the decade.

- The oil major expects earnings to grow about 13% per year through 2030, with strong cash-flow gains and faster per-share growth supported by ongoing buybacks.

Exxon Mobil (XOM) stock gained over 3% on Tuesday, after the oil and gas company raised its earnings and production forecasts.

The oil major now expects $25 billion in earnings and $35 billion in cash flow growth in 2030, an improvement of $5 billion in both metrics compared with its previous plan. Exxon CEO Darren Woods said the updated plan reflects lasting improvements in the company's operations.

“We are more profitable than we were five years ago, and we expect that to continue as the advantages we’ve unlocked position us for even greater opportunities in the years ahead,” he said.

Permian, Guyana To Lead Production Gains

Exxon also raised its 2030 production target. It now expects to produce 5.5 million barrels of oil equivalent per day (boepd), slightly higher than its previous estimate. A large chunk of the increase will come from the prolific Permian Basin, where the company believes output can reach 2.5 million boepd by the end of the decade, compared with its prior goal of 2.3 million.

It also expects output to rise in Guyana, where it hopes to bring new projects online. Earnings from the upstream business are projected to climb by more than $14 billion from 2030.

Exxon said it is using artificial intelligence to determine drilling routes and cut costs across its operations. In the Permian, the company now expects its supply cost to be about $30 a barrel, roughly $5 lower than its earlier estimate.

The oil major expects earnings to grow about 13% per year through 2030, with strong cash-flow gains and even faster per-share growth supported by ongoing buybacks. Over the next five years, it projects around $145 billion in surplus cash flow at $65/barrel and sees return on capital employed rising above 17% by the end of the decade.

What Are Stocktwits Users Thinking?

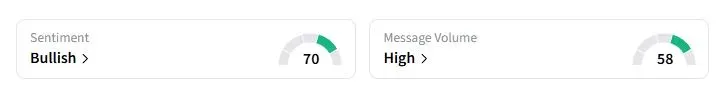

Retail sentiment on Stocktwits about Exxon moved to ‘bullish’ from ‘neutral’ a day ago.

One user said upstream oil stability and global energy tightness suggest Exxon is a steady foundation when markets wobble.

Including Tuesday’s gains, Exxon stock has risen over 11% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<