The deal gives Critical Metals the long-term rights to 50% of all Tanbreez rare earth concentrate.

- The deal lifts CRML’s total committed offtake to 75% of Tanbreez’s rare earth concentrate, adding to earlier agreements with UCORE and ReAlloys.

- The Romanian joint venture will receive half of the mine’s output for its entire lifespan.

- Tanbreez is one of the world’s largest known rare-earth deposits, projected to contain over 27% of heavy rare-earth elements.

Critical Metals Corp. (CRML) shares rose more than 5% in premarket trading on Tuesday, after the miner announced a joint venture with Romania’s state-owned Fabrica De Prelucreare A Concentratelor De Uraniu S.R.L. (FPCU) aimed at building a fully integrated rare earth supply chain.

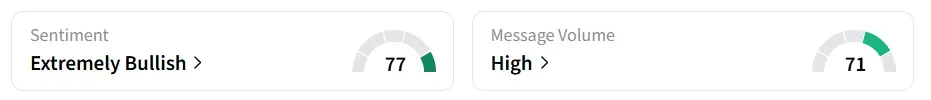

CRML was among the top trending tickers on Stocktwits.

Details of The Agreement

The term sheet gives CRML long-term rights to 50% of all Tanbreez rare earth concentrate and lays out plans to build, fund, and launch a modern rare earth processing facility in Romania. The planned Romanian facility will process this feedstock into rare earth metals and advanced materials, including aerospace- and military-grade magnets.

Tanbreez is one of the world’s largest known rare-earth deposits, projected to contain over 27% of heavy rare-earth elements. The site also offers a key supply chain advantage with direct shipping access to the North Atlantic Ocean.

The deal lifts CRML’s total committed offtake to 75% of Tanbreez’s rare earth concentrate, adding to earlier agreements with UCORE and ReAlloys. The Romanian joint venture will receive half of the mine’s output for its entire lifespan, helping supply European industries and defense sectors.

CRML and FPCU will finalize the technical and commercial framework for the joint venture, including plant design and commercialization plans. The American miner said that updated feasibility models and timelines are expected by the first quarter (Q1) of 2026.

Both CRML and the Romanian government will also apply for the recently announced €3.5 billion ($4.07 billion) package for the supply of rare earth metals to the EU.

“This is a monumental game-changer for CRML and the entire Western world. By capturing immense downstream value from Tanbreez concentrate, we're not just building a plant — we're dismantling China's stranglehold on rare earths and empowering Europe with independent, secure supplies for its defense and national security needs,” said Tony Sage, CEO and Chairman of CRML.

U.S. Rare Earth Push

The rare earth minerals sector has drawn significant attention this year, playing a key role in the U.S.-China trade tensions. With China dominating roughly 70% of global mining and nearly 90% of processing, the U.S. government has ramped up efforts to increase domestic production, investing in companies like Lithium Americas (LAC), MP Materials (MP), Critical Metals, and Trilogy Metals (TMQ).

Last month, MP Materials signed a three-way joint venture with Saudi Arabia’s state-owned miner Maaden and the U.S. Department of War (DoW) to build a major rare-earth refinery in the country.

How Did Stocktwits Users React?

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ zone over the past 24 hours, accompanied by ‘high’ message volumes.

However, one user expects CRML stock to record strong gains.

Year-to-date, the stock has gained nearly 45%.

€1 = $1.16<

Read Also: Here’s How Gold Is Performing Ahead Of Fed Rate Decision Tomorrow

For updates and corrections, email newsroom[at]stocktwits[dot]com.<