The gaming platform's strong earnings and outlook are expected to revive the stock, which has been caught up in the tech selloff.

- Roblox said its revenue increased by 43% in Q4, while bookings rose 63%.

- The video games company projected revenue growth of 23% to 29% this year.

- Results come as RBLX stock has declined by over 25% so far this year.

Roblox Corp.'s shares gained as much as 27% before settling 7.4% higher in the after-market session on Thursday, following the gaming company’s strong fourth-quarter results and forecast for 2026.

Revenue increased 43% to $1.4 billion, while bookings rose 63% to $2.2 billion and topped analysts' expectations of $2.09 billion, driven by a combination of robust user growth and strong monetization, the company said.

Bookings, a key revenue measure for gaming companies, refer to the total value of in-game purchases and subscriptions made by users during a period, including revenue that hasn’t yet been recognized.

Daily active users grew 69% 144 million in the December quarter, while engagement hours grew 88%.

The company expects bookings of $1.69 billion to $1.74 billion in the current first quarter and $8.28 billion to $8.55 billion for 2026, both higher than analysts’ expectations.

Roblox attributed the strong results and outlook to last year’s releases, such as “Steal A Brainrot” and “Grow A Garden”, as well as its other existing games, which brought in scores of new users. Roblox stressed that it has a strong opportunity to expand with older audiences, after initially focusing on younger users.

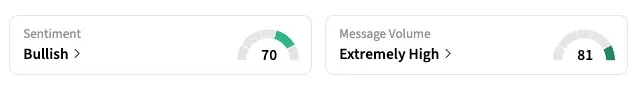

On Stocktwits, retail sentiment for RBLX shifted to ‘bullish’ as of late Thursday, from ‘neutral’ the previous day.

“$EBLX strong earnings call and report looking good to me short term, swing time frame, and possible long term bouncing from oversold on daily chart,” said a user.

Another user was more skeptical of a potential stock bounce on Friday: “picked the wrong day to report anything. Will crash regardless of what is said, good or bad.”

Tech stocks have come under pressure in recent days, as concerns mount over heavy AI-related spending and the risk that AI tools could upend the status quo by eating into demand for some legacy software.

Roblox stock declined in the last four out of five sessions, and was down over 25% for the year as of its last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<