GSK will acquire RAPT for $58.00 per share in cash, a 65.2% premium over Friday’s closing price of $35.1.

- GSK signed an agreement to acquire RAPT Therapeutics for around $2.2 billion.

- The deal centers on an experimental allergy drug that could reshape treatment frequency and expand patient access.

- The transaction is expected to close in the first quarter of 2026.

Shares of RAPT Therapeutics (RAPT) surged 63% in pre-market trading on Tuesday after GSK Plc announced a definitive agreement to acquire the California-based clinical-stage biopharmaceutical company for around $2.2 billion.

Under the agreement, GSK will acquire RAPT for $58.00 per share in cash, a 65.2% premium over Friday’s closing price of $35.1. GSK’s upfront investment is estimated at about $1.9 billion. The transaction is expected to close in the first quarter of 2026.

If the level holds after the opening bell, RAPT shares will climb to their highest levels since May 2024.

What Is The Deal About?

The agreement centers on Ozureprubart, a long-acting anti-immunoglobulin E (IgE) monoclonal antibody currently in phase IIb development for the prevention of food allergy reactions. IgE remains the only approved systemic therapy proven to protect patients from severe allergic and inflammatory immune responses. The acquisition will add to GSK’s respiratory, immunology & inflammation pipeline.

The deal grants GSK global rights to Ozureprubart, excluding mainland China, Macau, Taiwan, and Hong Kong. GSK will also assume responsibility for success-based milestone and royalty payments owed to RAPT’s partner, Shanghai Jeyou Pharmaceutical.

Existing anti-IgE therapies typically require injections every two to four weeks, but Ozureprubart has the potential to reduce dosing frequency to once every 12 weeks. It may also expand treatment access to roughly 25% of patients who are currently ineligible for existing therapies.

The Food and Drug Administration (FDA) had cleared the company’s investigational new drug (IND) application to advance Ozureprubart into a Phase IIb food allergy trial in September, and in October, RAPT launched the prestIgE study, a randomized, double-blind, placebo-controlled trial. Phase IIb data from the prestIgE trial are expected in 2027, with phase III studies planned in both adult and pediatric populations.

How Did Stocktwits Users React?

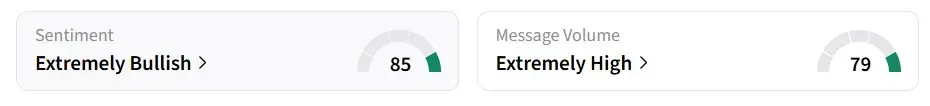

Retail sentiment on Stocktwits for RAPT turned ‘extremely bullish’ from ‘bullish’ over the past 24 hours, amid ‘high’ message volumes, while sentiment for GSK’s U.S.-listed shares remained in the ‘neutral’ zone.

Over the past year, RAPT stock has gained more than 250%.

Read also: Why Is NVDA Stock Down 3% In Premarket Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<