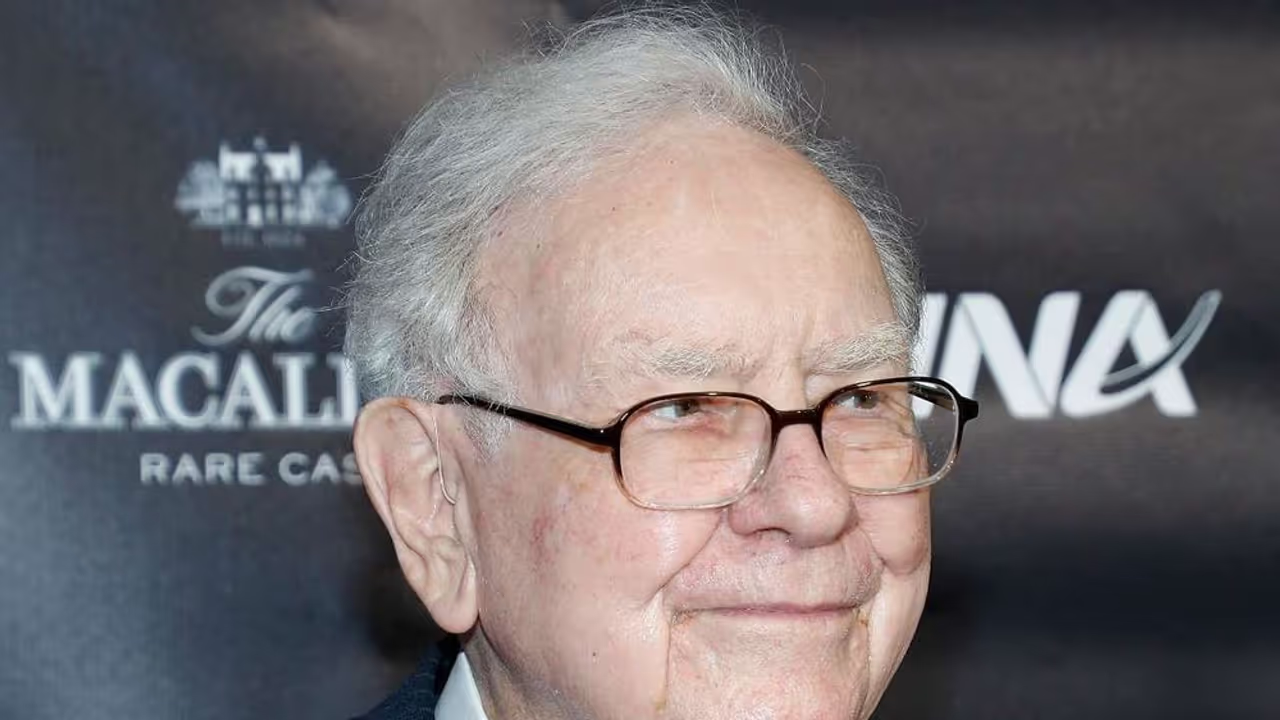

As Warren Buffett steps down after six decades at Berkshire Hathaway, he said “Greg will be the decider.”

- Buffett said he can’t imagine how much more Abel will accomplish in a week than he did in a month.

- He also praised Abel for being a sensible leader and noted that his successor prefers to live a normal life away from the spotlight, just like he does.

- The American investor confirmed that he would no longer speak at Berkshire’s annual shareholder meeting, breaking from a decades-long tradition.

Warren Buffett, the legendary investor and longtime CEO of Berkshire Hathaway, offered his strongest public endorsement of successor Greg Abel in his final interview as CEO, saying Berkshire has better odds of lasting 100 years than any other company.

Buffett stepped down from the top position at Berkshire on Dec. 31, 2025, after six decades in the role.

“Greg will be the decider,” Buffett said in an interview with CNBC, which will air on Jan. 13, 2026. Buffett added that he can’t imagine how much more Abel will get accomplished in a week than he did in a month

Buffett also added that he’d rather have Abel handle all his money than any of the top investment advisors or top CEOs in the United States.

Class B ordinary shares of BRK were down 0.21% in Friday’s pre-market trade at the time of writing.

Changing Dynamics

Abel has been a vice chairman at Berkshire's non-insurance business since 2018, after joining the company in 2000 as part of the purchase of MidAmerican Energy, and later building up the Berkshire Hathaway Energy unit into its success.

While Abel will take over as CEO, a move expected since 2021, Buffett will remain chairman of Berkshire. However, the American investor said he would no longer speak at Berkshire’s annual shareholder meeting in 2026, breaking from a decades-long tradition.

While Buffett will still be present at the meetings, he’ll be in the directors’ section instead of up on stage. Berkshire shares declined in May after Buffett announced his retirement.

Praising Abel

Buffett praised Abel for being a sensible leader and noted that his successor is not a “distorted individual.” He drew similarities between himself and Abel, saying Abel likes to live a normal life away from the spotlight, just like him.

The 95-year-old said that if Abel’s neighbors didn’t know him, they would never have any idea that he was going to helm a company with about 400,000 employees and that he is planning to be around for the next 50 or 100 years.

Since tendering his resignation as CEO, Buffett has been a vocal advocate for Abel’s abilities. In his Thanksgiving letter last year, he called Abel a great manager, a tireless worker, and an honest communicator. He also praised Abel’s ability to understand insurance business risks better than numerous other executives in the industry. Buffett cautioned against instating CEOs who would look to retire at 65 and become look-at-me rich.

How Did Stocktwits Users React?

BRK’s Class A shares were marginally down by 0.07% in Friday’s early morning trade.

On Stocktwits, retail sentiment around the company’s shares trended in the ‘bearish’ territory amid ‘low’ message volume at the time of writing. Meanwhile, retail sentiment around BRK’s Class B shares was in the ‘neutral’ territory amid ‘normal’ message volumes.

BRK’s Class A and Class B shares have both climbed over 11% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<