The Richard Branson-founded company said that commercial spaceflights remain planned for summer 2026, with private astronaut flights beginning in the fall.

Virgin Galactic (SPCE) stock jumped 14.6% in extended trading on Thursday after the company said it would raise its prices for space flights and remains on track to resume commercial flights in 2026.

“Specific pricing has not been set, although we expect the price will increase relative to our last price of $600,000,” CEO Michael Colglazier said on a call with analysts.

Virgin Galactic, like its rival Blue Origin, is one of the top players in a nascent industry that aims to conduct short spaceflights for tourism and research purposes.

The Richard Branson-founded company said that commercial spaceflights remain planned for summer 2026, with private astronaut flights beginning in the fall.

Virgin Galactic halted commercial spaceflights in June last year in a bid to upgrade its Delta spacecraft.

The company also reported first-quarter revenue of $460,000, which topped Wall Street’s expectations of $400,000, according to Bloomberg.

It reported a net loss of $84 million, compared to a year-ago loss of $102 million, due to lower operating expenses.

The company projected negative free cash flow between $105 million and $115 million for the second quarter. It expects that cash spending will continue to decline through 2025.

The company had cash, cash equivalents, and marketable securities of $567 million as of March 31.

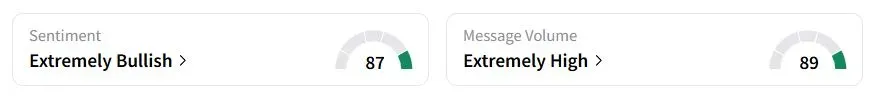

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (87/100) , while retail chatter was ‘extremely high.’

“Long-term investors should really be loading up over the next 3 months and buying dips if they come,” one user said.

Virgin Galactic stock has fallen 44.3% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<