A Verizon executive said that competitive pressure intensified as peers persisted with their holiday promotions into the first quarter.

Shares of AT&T, Inc. (T) and Verizon Communications, Inc. (VZ) took a hit on Tuesday after their first-quarter and full-year outlook at Deutsche Bank’s 33rd Annual Media, Internet & Telecom Conference failed to impress investors.

According to an exchange filing, Verizon announced at an investor event on Tuesday that Verizon Consumer Group postpaid net additions for the first quarter would be impacted by 3-5 points of incremental churn above the prior year period level due to the recent pricing actions.

Verizon also attributed the anticipated softness to flat to slightly-down postpaid gross additions from the year-ago period.

TheFly reported that Verizon’s Chief Revenue Officer, Frank Boulben, said at the conference that the first quarter was a bit unusual. As peers persisted with their holiday promotions into the first quarter, competitive pressure intensified, he added.

AT&T, which previewed CFO Pascal Desroches's presentation at the Deutsche Bank Conference, said the Dallas, Texas-based company remains on track to meet all of the 2025 and multi-year financial and operational guidance and capital allocation plans issued in its fourth-quarter earnings call.

AT&T expects 2025 adjusted earnings per share (EPS) of $1.97 to $2.07 and first-quarter adjusted EPS of $0.48 or higher. The Finchat-compiled consensus estimates call for $2.14 and $0.53, respectively.

The company estimates a full-year free cash flow (FCF) of over $16 billion, with the first-quarter FCF at over $2.8 billion. The guidance suggests that excluding DIRECTV's contribution from the year-ago quarter, first-quarter FCF will be consistent with or better than the year-ago level.

AT&T expects to receive about $1.4 billion to $1.5 billion in cash payments from DIRECTV related to its agreement to sell its 70% stake in the latter to TPG. It continues to expect to close the sale by mid-2025 and receive an after-tax cash payment of $5.4 billion in 2025 and $500 million in 2029.

AT&T also said it expects to achieve its net leverage target of net-debt-to-adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) in the 2.5 times range in the first half of 2025 and maintain leverage within this range through 2027.

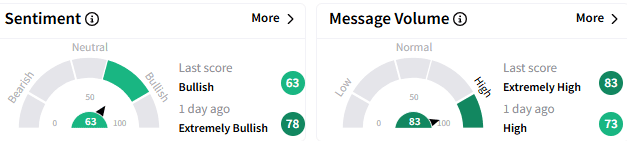

On Stocktwits, the retail sentiment toward Verizon stock tempered but was ‘bullish’ (66/100) compared to the ‘extremely bullish’ stance seen a day ago. The message volume perked up to ‘extremely high’ levels.

A bullish watched did not see the logic in the sell-off, given the relatively attractive valuation vis-a-vis tech stocks.

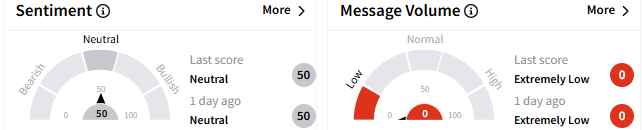

Sentiment toward AT&T stock stayed at a ‘neutral’ level (50/100), with the message volume muted at ‘extremely low’ levels.

Verizon stock fell over 6.5% to $43.41 in late morning trading, while AT&T was down nearly 3.50% at $26.33.

For the year-to-date period, these stocks were up over 18% and 21%, respectively, riding on their defensive appeal amid the market volatility.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<