Bitcoin’s dominance stands at nearly 58%, which could shoot up an early altseason.

- The altcoin market saw sharp losses and long-led liquidations, which were relieved after the Bank of Japan’s rate cut decision.

- Bitcoin outperformed as leverage, not spot selling, drove downside.

- Analysts view the move as mid-cycle deleveraging, not a cycle top.

Crypto markets traded in risk-off mode on Thursday night, with analysts now pointing out that a short bull run for Bitcoin could be on the way, fueled by the Bank of Japan's rate hike. Given Bitcoin's dominance, currently at 57.36%, it could spark a bull run through the broader market.

Bitcoin (BTC) outperformed the broader market, rising about 0.2% over the past 24 hours to trade near $86,900. Despite the pullback, Bitcoin held key intraday levels better than most altcoins. As per Coinglass data, Bitcoin recorded more than $178 million in liquidations, with long positions dominating, pointing to a broad reset in bullish leverage rather than spot-driven selling. On Stocktwits, retail sentiment around Bitcoin rose from ‘extremely bearish’ to ‘bearish’ territory, accompanied by 'low' levels of chatter.

Analysts Hint At Altseason

Glassnode analyst Quinten François said on X that liquidation-led capitulation typically does not occur near cycle tops, but instead has historically appeared during mid-cycle corrections rather than terminal peaks. Bitcoin’s relative strength also followed the Bank of Japan’s rate hike, a dynamic that has previously coincided with Bitcoin’s short-term upside moves.

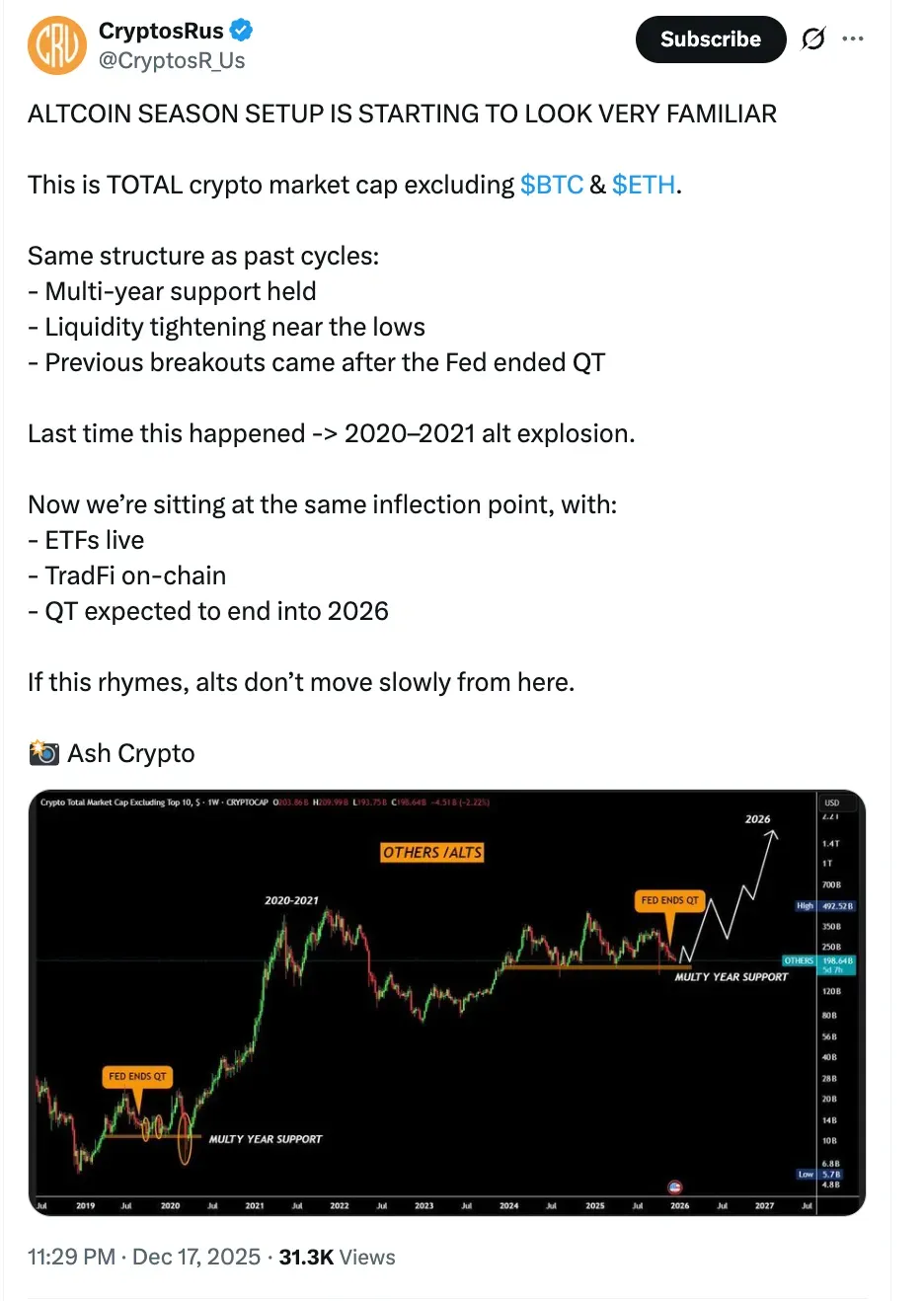

A crypto Key Opinion Leader (KOL) said on X that the altcoin market may be approaching a familiar pre-breakout phase, seen before bull runs.

Sentiment Remains Fragile

Ethereum (ETH) traded around $2,920, up about 3% over the past 24 hours, even as it saw roughly $132 million in liquidations during the period. ETH was the second-largest contributor to total market liquidations after Bitcoin, as leverage continued to be flushed from derivatives markets. On Stocktwits, retail sentiment around Ethereum (ETH) rose from ‘extremely bearish’ to ‘bearish’, accompanied by low levels of chatter.

Binance Coin (BNB) traded at $838.84, up 0.1% over the last 24 hours, with relatively low liquidation activity seen in the last 24 hours. Around $1.94 million came from long positions and about $338,000 in shorts. On Stocktwits, retail sentiment around Binance Coin remained ‘bearish’, with chatter remaining at ‘normal’ levels.

Ripple (XRP) fell nearly 1% over 24 hours to around $1.84, extending its short-term downturn. The token saw about $13 million in liquidations, with long positions once again dominating as traders were forced to de-risk amid broader market weakness. On Stocktwits, retail sentiment around Ripple (XRP) shifted from ‘bearish’ to ‘neutral’, with chatter rising from ‘low’ to ‘normal’ levels.

Solana (SOL) posted one of the steepest declines among large-cap altcoins, falling about 1.8% over the past 24 hours to trade around $121. Liquidation data showed approximately $34 million in SOL-related liquidations during the period, with long positions accounting for the bulk of forced exits—signaling crowded bullish positioning ahead of the selloff.

However, following the Bank of Japan’s rate hike, Solana saw a brief 0.8% rebound within an hour, suggesting short-term relief buying after the policy announcement. On Stocktwits, the retail sentiment around Solana dipped from ‘neutral’ to ‘bearish’ territory, along with ‘normal’ levels of chatter over the past day.

Dogecoin (DOGE) traded largely flat over the past 24 hours near $0.12. Liquidations totaled roughly $7 million, pointing to continued pressure on meme-linked assets as speculative appetite continued to fade. On Stocktwits, retail sentiment around Dogecoin improved from ‘extremely bearish’ to ‘bearish’, while chatter remained at low levels.

Cardano (ADA) traded at $0.36, slipped 1.5% over the past day, recording nearly $3.7 million in 24-hour liquidations, primarily from long positions—highlighting weak conviction among swing traders. On Stocktwits, retail sentiment around Cardano stayed in ‘extremely bearish’ territory, as chatter increased from ‘low’ to ‘normal’ levels.

Market Structure And Outlook

In total, crypto markets recorded nearly $540 million in liquidations over the past 24 hours, with close to $390 million coming from long positions. More than 161,000 traders were liquidated, underscoring forced deleveraging as the primary driver of price action.

Analysts generally see the move as a leverage reset rather than a structural breakdown, even though short-term sentiment is still shaky. Bitcoin's relative strength suggests that traders are moving their money around defensively as they reevaluate risk throughout the whole crypto market.

Read also: Bitcoin, Ethereum Stand To Gain As Crypto Czar David Sacks Signals CLARITY Act Markup In January

For updates and corrections, email newsroom[at]stocktwits[dot]com.<