Many supporters claim that the Public Integrity in Financial Prediction Markets Act was long due and is called a “commonsense reform” while others said it is not a “victimless act.”

- Rep. Ritchie Torres presented the Public Integrity in Financial Prediction Markets Act of 2026 to stop government employees and officials from trading prediction market contracts, citing that officials can benefit from insider information.

- Torres claimed that a disputed Polymarket deal involving Venezuelan President Nicolás Maduro urged him to introduce the three-page bill.

- This has garnered support from Democrats, with more than 30 co-sponsors, including former Speaker Nancy Pelosi.

In response to curb insider trading, House lawmakers on Friday introduced a bill that bars federal officials and staff from trading on prediction markets.

Democratic U.S. Rep. Ritchie Torres of New York unveiled the Public Integrity in Financial Prediction Markets Act of 2026, a three-page bill that would prohibit elected officials, political appointees, executive branch employees, and congressional staff from buying, selling, or exchanging prediction market contracts tied to government policy or political outcomes when they possess material nonpublic information.

The legislation was prompted by a high-profile trade on Polymarket in early January, where a newly created account wagered more than $30,000 that Venezuelan President Nicolás Maduro would be removed from office by January 31, 2026. Polymarket is a blockchain-based prediction market where users bet on events using the stablecoin USD Coin (USDC).

USD Coin (USDC) was trading at $0.99, down 0.1% in the last 24 hours. On Stocktwits, retail sentiment around USDC dropped from ‘neutral’ to ‘bearish’ zone, accompanied by ‘high’ chatter levels over the past day.

Hours later, when U.S. special forces captured Maduro in a major military operation, it raised questions about whether the trade relied on insider knowledge. The position reportedly paid out more than $400,000.

Torres said the episode exposed regulatory gaps. “Prediction-market profiteering by government insiders must be prohibited,” he said. He warned that such activity could allow officials to benefit personally from outcomes they help shape. The bill has drawn broad Democratic support, with more than 30 House members listed as co-sponsors, including former Speaker Nancy Pelosi.

Debate Over Prediction Markets Intensifies

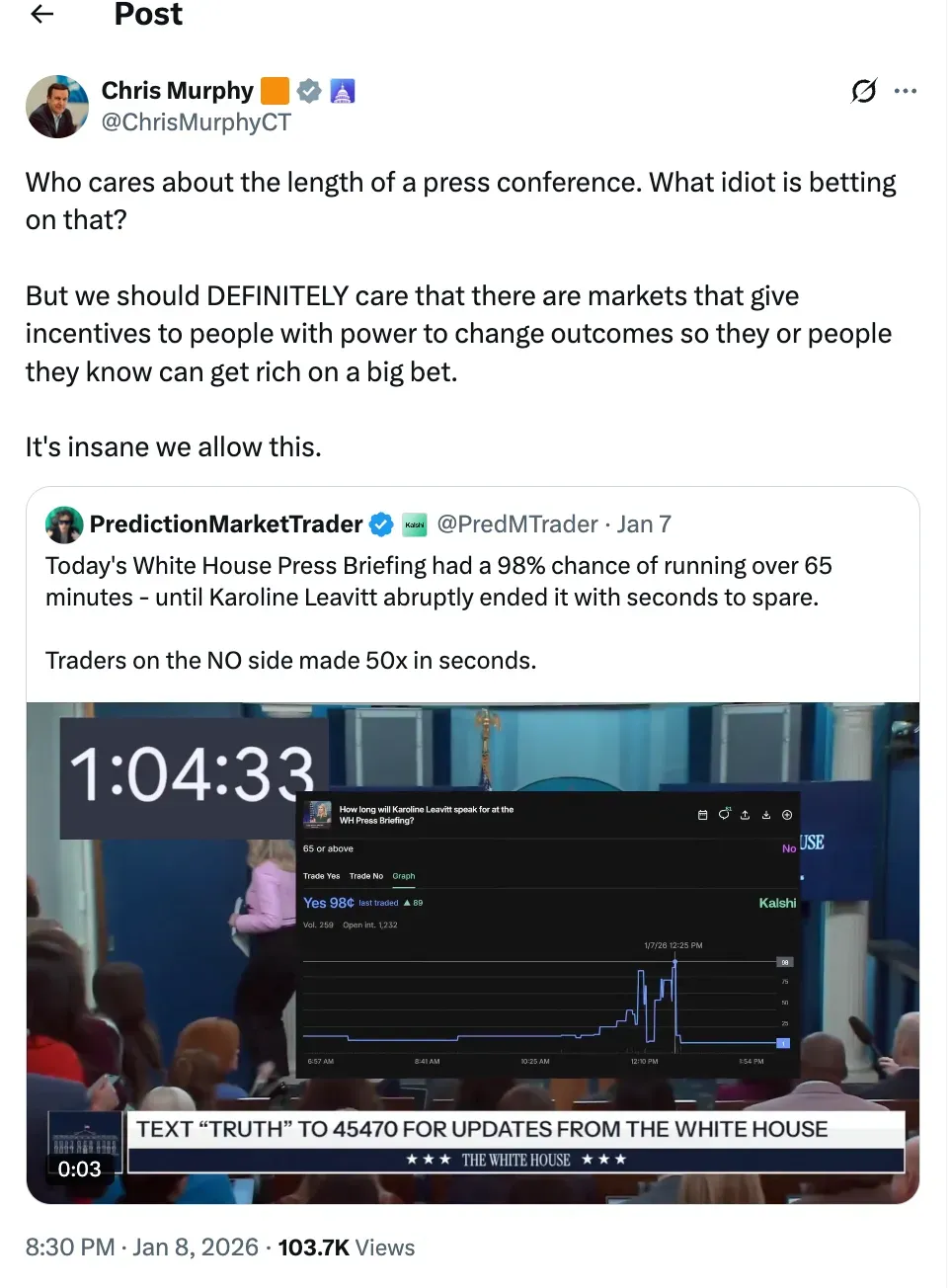

Sen. Chris Murphy echoed those concerns in a separate X post, saying some prediction markets can “give incentives to people with power to change outcomes so they or people they know can get rich on a big bet.”

Supporters of the bill argue that prediction markets pose ethical risks when accessed by insiders. Melinda Roth, a visiting law professor at Washington and Lee University, called the proposal a “commonsense reform,” saying the use of material nonpublic information to trade event contracts could not be considered “a victimless act,” said Eric Zitzewitz, Professor of Economics at Dartmouth College

Read also: Fox News Ad Targets DeFi Rules On Upcoming Crypto Bill

For updates and corrections, email newsroom[at]stocktwits[dot]com.<