The game development engine firm said for fiscal year 2026’s first quarter, it expects revenue in the range of $480 million to $490 million, below the consensus estimate of $491.78 million.

- In Q4, the company reported a revenue of $503 million, a 10% year-on-year increase, while adjusted earnings per share stood at $0.24.

- The stock has garnered a 1,833% increase in retail chatter on Stocktwits over the past month.

- Unity shares had been under pressure recently, triggered by Google’s new AI tool.

Unity Software Inc. (U) has drawn significant interest from retail traders on Wednesday, after the company reported its fourth-quarter (Q4) earnings and provided an outlook for fiscal year 2026.

The game development engine firm said for the first-quarter (Q1) of fiscal year 2026, it expects revenue in the range of $480 million to $490 million, which is below the analysts’ consensus estimate of $491.78 million, according to Fiscal AI data.

Following the announcement, Unity stock tanked 34% to April 2025 lows on Wednesday morning.

How Did Stocktwits Users React?

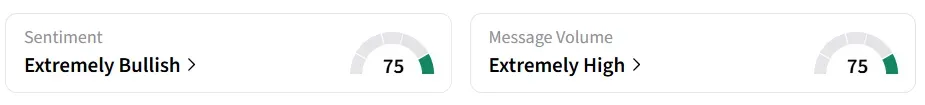

However, on Stocktwits, retail sentiment around the stock jumped to ‘extremely bullish’ from ‘bearish’ territory the previous day. Message volume changed to ‘extremely high’ from ‘high’ levels in 24 hours.

The stock has garnered a 1,833% increase in retail chatter over the past month.

A bullish Stocktwits user said they believed the turnaround to profitability and revenue growth is intact for Unity.

Another user called the selloff an “overreaction.”

Unity’s Q4 Performance

In Q4, Unity reported $503 million in revenue, a 10% year-on-year increase and an adjusted earnings per share (EPS) of $0.24. Both revenue and EPS surpassed the analysts’ consensus estimate of $492.82 million and $0.21, respectively, according to Fiscal AI data.

Create Solutions revenue climbed to $165 million, up 8% YoY, driven by robust subscription growth. Grow Solutions revenue rose 11% YoY to $338 million, fueled by Unity Vector, which accounted for 56% of the segment’s revenue.

Unity shares had been under pressure recently, following the launch of a new AI tool from Alphabet Inc.’s (GOOG, GOOGL) Google. Named Project Genie, the tool enables users to generate immersive digital worlds instantly from simple text prompts or images, then navigate those environments in real time.

However, Unity CEO Matthew Bromberg reassured developers, stating that such tools expand creative possibilities but are not yet ready to replace traditional game engines.

U stock has declined by over 1% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<