Santiment data indicates that XRP's selling pressure may be primarily front-loaded, increasing the likelihood of a short- to medium-term bounce.

- TRX went against the general downtrend early Sunday, while Ethereum, Solana, and XRP stayed choppy in the last 24 hours.

- Ethereum and Solana withstand the pressure of deleveraging.

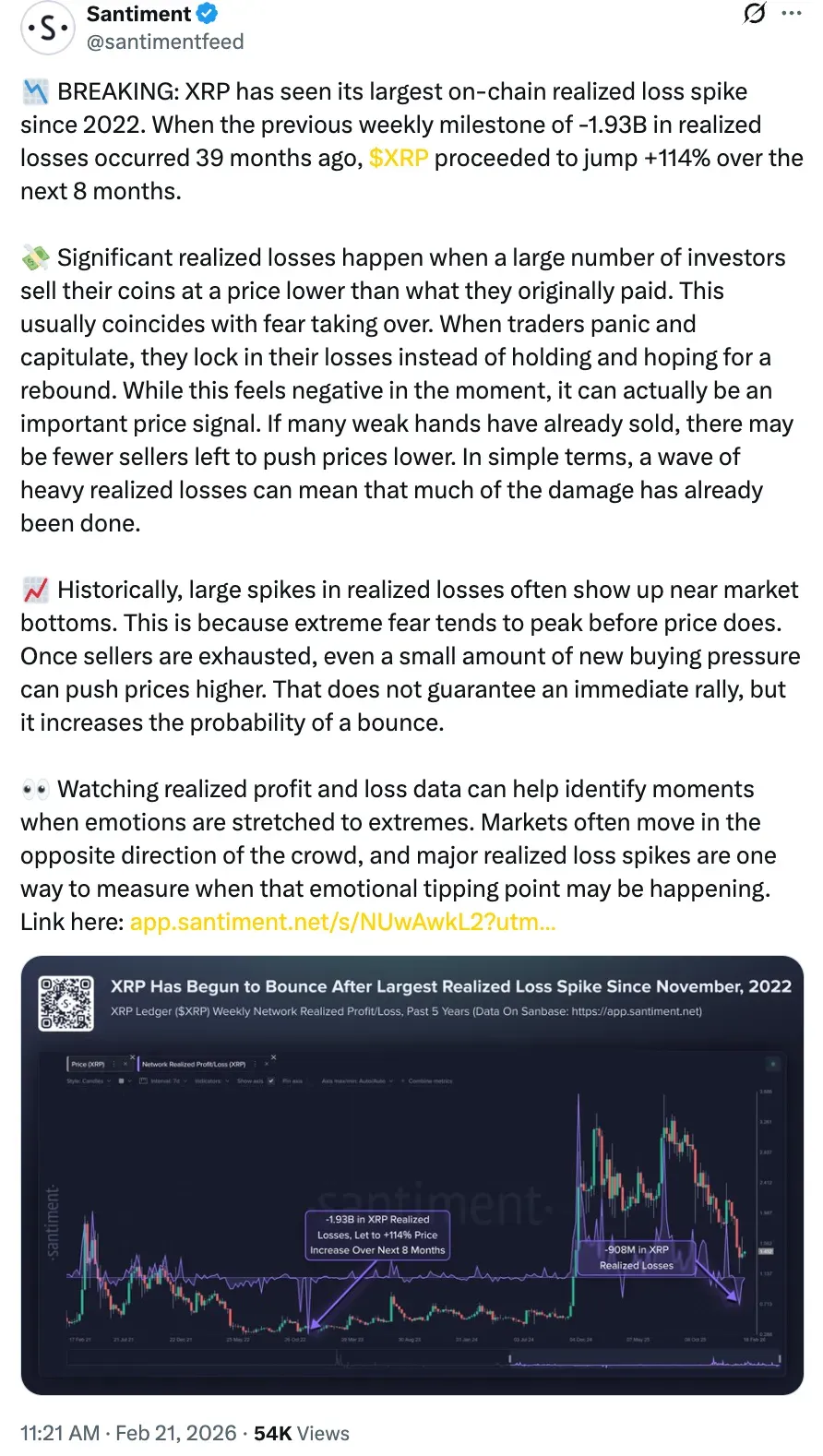

- According to Santiment data, XRP just had its biggest realized loss spike since 2022.

While Ethereum (ETH), Solana (SOL), and Ripple’s XRP (XRP) remained choppy, TRON (TRX) defied the downtrend early on Sunday.

TRON (TRX) was trading at $0.2879, up 1.1% over the last 24 hours and 2.2% over the last 7 days. This makes it the best-performing large-cap altcoin. Tron only had $34,510 in liquidations in the last 24 hours, indicating that there isn't much leverage on the coin. On Stocktwits, the retail sentiment around TRON remained in ‘neutral’ territory, with chatter at ‘high’ levels over the past day.

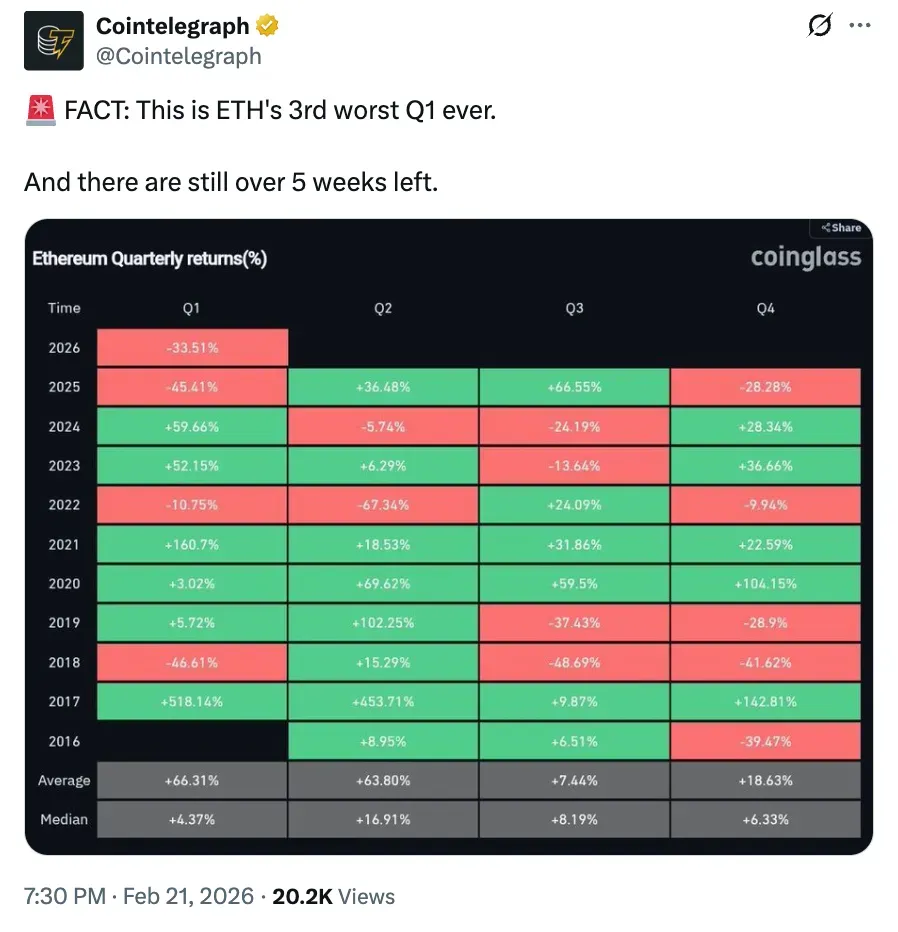

Ethereum Faces Third-Worst First Quarter

Ethereum is on track for its third-worst first quarter (Q1) ever. So far, the first quarter of 2026 is down 33.5%, putting it in the historical bottom tier alongside the deep risk-off quarters of 2018 and 2022. This puts ETH in a late-cycle de-risking phase where forced deleveraging and sentiment consolidation are doing the heavy lifting instead of individual protocol risk.

The historical tape shows that Q1 weakness has often been a liquidity reset, followed by stronger follow-through later in the year, especially in the 2020 to 2021 and 2023 to 2024 cycles. This suggests that the current underperformance is a cyclical volatility event within Ethereum's long-term adoption curve, not a structural breakdown. However, with five weeks left, there is still a risk of near-term downside as positioning continues to be adjusted.

Ethereum (ETH) was trading at $1,973.26, up 0.6% in the last 24 hours. According to Coinglass data, ETH saw $10.80 million in liquidations over the last 24 hours, reinforcing the idea that leverage was taken down while spot prices held up slightly. On Stocktwits, the retail sentiment around Ethereum remained in ‘extremely bearish’ territory, with chatter at ‘low’ levels over the past day.

Solana (SOL) was trading at $85.12, edging 0.9% higher over the past 24 hours. Still, SOL had the most pressure on the derivatives side, with $15.75 million in liquidations in the last 24 hours. On Stocktwits, the retail sentiment around Solana remained in ‘bearish’ territory, with chatter at ‘low’ levels over the past day.

XRP’s Upside Potential

Ripple’s XRP (XRP) was trading at $1.42, down 0.4% in the last 24 hours. XRP logged $2.28 million in total liquidations in the last 24 hours, per Coinglass. Santiment's data shows that XRP has just gone through a big capitulation event, and on-chain realized losses have reached their highest level since 2022. These spikes have usually happened when investors sell at big losses when fear is at its highest level. This pattern has been seen close to market bottoms in the past.

After the last similar event in late 2022, XRP's price rose sharply in the months that followed. This doesn't mean a price bounce will happen right away, but the data suggests much of the selling pressure may already have worn off. This makes it more likely that the price will rise in the short to medium term if buying interest starts to come back.

On Stocktwits, the retail sentiment around XRP remained in the ‘bearish’ territory, with the chatter at ‘low’ levels over the past day.

Read also: Tether To Shut Down One Of Its Stablecoins As Demand For It Tanks

For updates and corrections, email newsroom[at]stocktwits[dot]com.<