Bessent had appeared before the House Financial Services Committee to discuss the Financial Stability Oversight Council’s annual report.

- Bessent was responding to Senator Brad Sherman’s question on whether he had the authority to direct U.S. banks or taxpayer funds to buy bitcoin or Trump coins.

- He said the government will retain seized bitcoin.

- Last month, Standard Chartered estimated that dollar-backed stablecoins could draw nearly $500 billion in deposits from U.S. banks by the end of 2028.

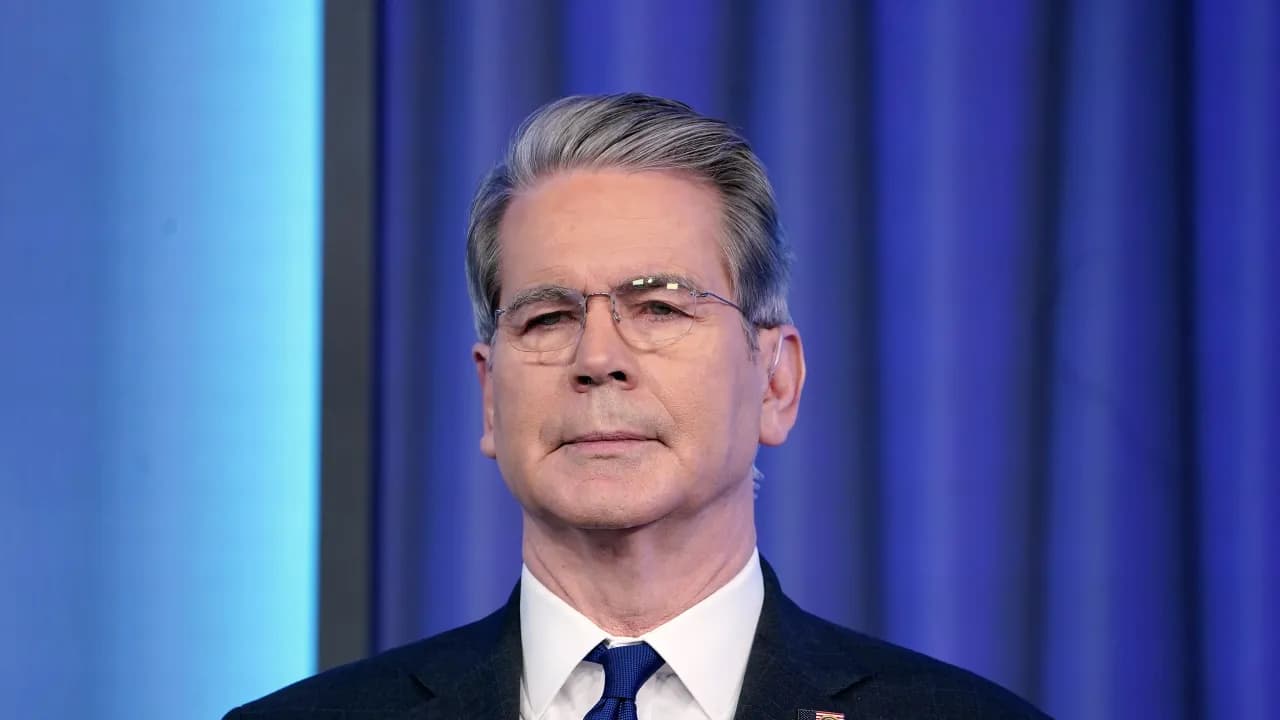

The United States Secretary of the Treasury Scott Bessent said on Wednesday that he lacks the authority to use U.S. tax dollars to purchase bitcoin.

Bessent had appeared before the House Financial Services Committee to discuss the Financial Stability Oversight Council’s annual report.

“I am Secretary of the Treasury, I do not have the authority to do that, and as Chair of FSOC, I do not have that authority,” Bessent said in response to Senator Brad Sherman’s question about whether he could direct U.S. banks or taxpayer funds to purchase bitcoin or Trump coins.

Government Will Retain Seized Bitcoin

Bessent added that the government will retain seized bitcoin, citing the seizure of $1 billion in bitcoin linked to the criminal marketplace Silk Road in 2020. “$500 million of bitcoin was retained, and that $500 million has become over $15 billion,” Bessent added.

Bitcoin has been under heavy selling pressure for a while. The cryptocurrency was down nearly 3% to $73,503 on Wednesday, having declined more than 26% over the past year and around 16% so far in 2026.

Banks Vs Stablecoins

The Trump administration has pushed for a broader adoption of dollar-pegged tokens, having signed a law establishing a federal regulatory framework for stablecoins last year. Last month, Standard Chartered estimated that dollar-backed stablecoins could draw nearly $500 billion in deposits from U.S. banks by the end of 2028.

Earlier this week, a White House meeting aimed at resolving a months-long standoff between major U.S. banks and cryptocurrency firms ended in a deadlock, highlighting deep industry divisions over digital-asset legislation.

While the session was described as constructive, key disputes, particularly over whether stablecoins should offer interest or rewards, remained unresolved. Banks have warned that such incentives could drain deposits and threaten financial stability.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<