Treasure Global announced that Pusparajan a/l Vadiveloo would assume the role of the new Chief Financial Officer.

- The company’s former CFO, Chan See Wah, resigned on December 15.

- Vadiveloo, a former financial controller at the company, will assume the top leadership role effective Dec. 17, 2025, the company said.

Treasure Global Inc. (TGL) named insider Pusparajan a/l Vadiveloo as the company’s new Chief Financial Officer after Chan See Wah resigned from the position on December 15.

Vadiveloo, formerly a financial controller in the company, will assume the top leadership role from Dec. 17, 2025, the company said. Vadiveloo brings more than 11 years of experience in accounting and finance, as well as expertise in the information technology, telecommunications, and manufacturing industries, and is a member of the Malaysian Institute of Accountants (MIA).

Shares of TGL were up over 15% on Wednesday.

Capital Raise And Reverse Stock Split

Earlier this month, Treasure Global raised $2.5 million through a registered direct offering, selling 250,000 shares of common stock to institutional investors.

The company also executed a 1-for-20 reverse stock split to regain compliance with Nasdaq’s minimum $1 bid requirement. The split reduced Treasure Global’s outstanding shares from roughly 16.96 million to about 848,100.

Treasure Global is known for its ZCITY Super App, which offers e-payments and loyalty rewards. The company has over 2.7 million registered users across Malaysia as of June. It has significant investments in LLM technology that improve customer interactions and service efficiency.

Treasure Global is gearing up to launch the OXI Wallet and the UNIRWA token in the first half of 2026. The company’s strategy is geared toward investments in AI, loyalty systems, and digital platform capabilities to improve platform functionality and user engagement.

How Did Stocktwits Users React?

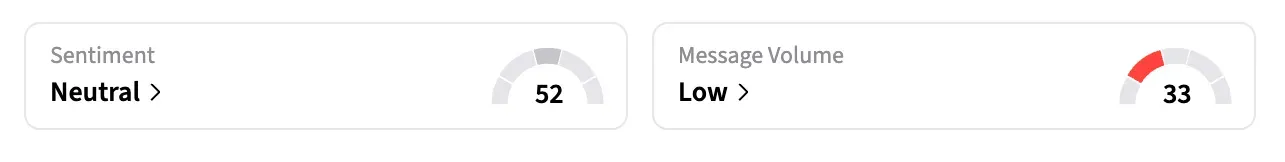

On Stocktwits, the retail sentiment around TGL remained ‘neutral’ over the last week, while message volume remained at ‘low’ levels.

Shares of TGL are down more than 96% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<