Momentus had announced a 1-for-17.85 reverse stock split earlier this week.

- The reverse split will reduce the number of outstanding shares from around 25 million to roughly 1.4 million.

- The move, approved by shareholders in September, is aimed at maintaining Nasdaq’s listing compliance by meeting the $1.00 minimum bid price requirement.

- Earlier this month, the company announced that it was selected to participate in the Missile Defense Agency’s SHIELD contract vehicle, which carries a potential contract ceiling of $151 billion over 10 years.

Shares of Momentus Inc. (MNTS) traded 5% higher on Wednesday, ahead of its 1-for-17.85 reverse stock split, which comes into effect on December 18.

Every 17.85 shares of its Class A common stock will be automatically combined into one share, reducing the number of outstanding shares from around 25 million to roughly 1.4 million.

The move, which was approved by the company’s shareholders in September, is aimed at maintaining Nasdaq’s listing compliance by meeting the $1.00 minimum bid price requirement.

Momentus Latest Developments

The company has been in the limelight lately. On Tuesday, Momentus announced the successful completion of environmental testing for its Vigoride-7 Orbital Service Vehicle ahead of its planned launch on SpaceX’s Transporter-16 mission, targeted for March 2026. The testing included thermal and vibration trials designed to simulate the harsh conditions of launch and space.

Vigoride-7 will carry payloads for the U.S. Department of Defense, NASA, and commercial customers.

Earlier this month, the company announced it had been selected to participate in the Missile Defense Agency’s SHIELD contract vehicle, positioning it to compete for rapid task orders tied to national defense missions. The program is part of the Pentagon’s Golden Dome missile defense initiative and carries a potential contract ceiling of $151 billion over 10 years.

Momentus had also announced a warrant inducement agreement with an existing institutional investor for the immediate exercise of warrants covering up to 4.86 million shares. The warrants will be exercised for $0.77, generating about $3.7 million in gross proceeds, with the funds being for working capital and general corporate purposes.

How Did Stocktwits Users React?

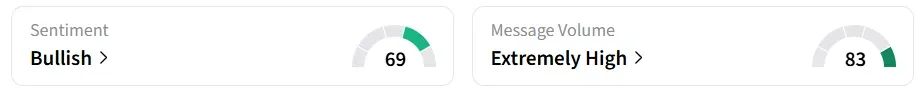

Retail sentiment on Stocktwits changed to ‘bullish’ from ‘extremely bullish’ a day earlier, amid ‘extremely high’ message volumes.

One user highlighted the company’s recent fundraising and runway.

Year-to-date, the stock has declined 93%.