CEO Jeff Green said the results fell short of the company’s expectations despite an acceleration in revenue growth and a record $12 billion spend on its platform in 2024.

Trade Desk, Inc. (TTD), a provider of a self-service platform for ad buyers, reported mixed fiscal year fourth-quarter results and issued sub-par forward guidance, sending its shares sharply lower in Thursday’s premarket session.

The Ventura, California-based company reported fourth-quarter adjusted earnings per share (EPS) of $0.59 and revenue of $741 million. While the bottom line exceeded the consensus estimate of $0.57, the top line trailed the company’s guidance of at least $756 million and the consensus estimate of $758.94 million

Nevertheless, the fourth-quarter performance marked an improvement from the year ago’s $0.41 and $606 million, respectively.

The adjusted earnings before interest, taxes, depreciation and amortization was $350 million versus the guidance of $363 million.

Jeff Green, CEO of Trade Desk, said, “The Trade Desk once again outpaced nearly every segment of digital advertising in 2024, delivering $2.4 billion of revenue – marking accelerated growth of 26% year over year – and a record $12 billion of spend on our platform.”

Yet the results fell short of the company’s expectations, he added.

Trade Desk guided first-quarter revenue to at least $575 million versus the $582.21-million estimate and adjusted EBITDA to about $145 million.

Green said, “In 2025 and beyond, we are uniquely positioned to help our clients take full advantage of data-driven advertising on the premium internet, helping them drive growth and brand loyalty for their businesses.”

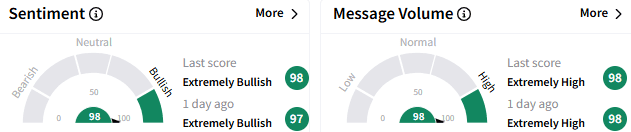

On Stocktwits, sentiment toward Trade Desk stock remained ‘extremely bullish’ (98/100), with the reading highest in over a year, and the message volume stayed at ‘extremely high’ levels.

Trade Desk is among the top five trending tickers on the platform.

A retail watcher said the post-earnings weakness presented an “epic buying opportunity.”

Another user predicted a reversal in the premarket losses.

In premarket trading, Trade Desk stock slumped 29.29% to $86.43, marking the lowest level since early August. If the pre-market losses sustain after the open, the stock is on track to record its biggest single-day loss ever, according to Koyfin data.

The stock has risen nearly 4% for the year-to-date (YTD) period.

For updates and corrections, email newsroom[at]stocktwits[dot]com <