In his role at Celgene Corp, Hand played a strategic role in transactions including the $74 billion acquisition of Celgene by Bristol Myers Squibb and its subsequent integration.

Shares of Tonix Pharmaceuticals Holding Corp. (TNXP) traded 12% higher on Wednesday noon after the company appointed Joseph Hand as General Counsel and Executive Vice President of Operations, effective immediately.

Before joining Tonix, Hand was Executive Vice President, Global Human Resources and Corporate Services and a member of the Executive Committee at Celgene Corporation.

In his role at Celgene Corp, Hand played a strategic role in transactions, including Bristol Myers Squibb's $74 billion acquisition of Celgene and its subsequent integration. Tonix said he also played a key role in the $13.4 billion divestiture of Otezla to Amgen.

Tonix is expecting approval from the U.S. Food and Drug Administration for TNX-102 SL analgesic tablets to manage Fibromyalgia by August. Hand’s appointment makes a key addition as the company readies for potential approval, it said.

Earlier this month, Tonix reported diluted net loss of $2.84 per share for the first quarter, compared to a loss of $535.72 per share in the corresponding quarter of 2024, and below an analyst estimate of a loss of $3.23 per share, as per Finchat data.

Quarterly revenue, however, fell to $2.43 million from $2.48 million in the same period of 2024, below an estimated $2.55 million.

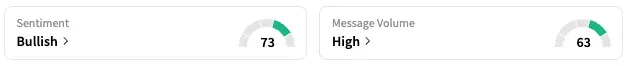

On Stocktwits, retail sentiment around Tonix jumped further into the ‘bullish’ territory while message volume rose from ‘normal’ to ‘high’ levels.

A Stocktwits user opined that Tonix is “grossly undervalued.”

TNXP stock is down by about 28% this year and 96% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<