Tom Lee said Bitmine’s $200 million investment in MrBeast could evolve into a financial platform that captures Gen Z and Gen Alpha, reaping boons for the company as well.

- During Tom Lee’s keynote speech at Consensus Hong Kong, he pegged Jimmy Donaldson’s company as the next major crypto on-ramp.

- His comments come on the heels of MrBeast's announcement of its acquisition of the neobank Step.

- Lee said BMNR could benefit from the upcoming generational wealth shift, with Step positioned to serve Gen Z and Gen Alpha as they engage more with digital assets.

Bitmine Immersion Technologies (BMNR) chairman and Fundstrat founder Tom Lee said on Wednesday that his company’s ‘moonshot’ bet on MrBeast could become the Robinhood, SoFi, and Chime for Gen Z and Gen Alpha.

“MrBeast is the leading creator for Gen Z and Gen Alpha. That’s a 120 million people,” Lee said during his keynote address at Consensus Hong Kong, pegging Jimmy Donaldson’s company as the next major crypto on-ramp. “He is basically the next Robinhood, SoFi, Chime combined.”

According to him, MrBeast is poised to hold the same mantle as Charles Schwab (SCHW) did for baby boomers, BlackRock (BLK) for Generation X, and Robinhood (HOOD) for millennials.

Lee’s bullish sentiment stems from MrBeast’s pivot from a media company to a foray into the financial sector earlier this month, with its acquisition of the neobank Step. "MrBeast has a chance to be the financial institution of their generation," Lee said.

Why Bitmine Is Backing MrBeast

Lee was outlining one of the four pillars of Bitmine’s growth strategy, which centers on ‘moonshot’ investments in external companies. The company’s $200 million bet on MrBeast in January, earlier this year, marks the firm’s second such investment.

Bitmine also holds a $19 million stake in Eightco Holdings (ORBS), a company backed by Wall Street analyst Dan Ives that holds Worldcoin (WLD) in its treasury – the native cryptocurrency behind a digital identity project co-founded by OpenAI CEO Sam Altman that uses iris verification.

Lee said that Step’s consumers may not be the wealthiest in the market, but neither were the folks on Robinhood when the platform first launched. “There’s a huge amount of wealth transfer that’s going to take place,” he said. Lee added that MrBeast’s investment in Step bodes well for Bitmine because the company can align its investment with Step's, as it captures the Gen Z and Gen Alpha market, citing the potential for a “digital asset life.”

BMNR Stock Falls Alongside Ethereum

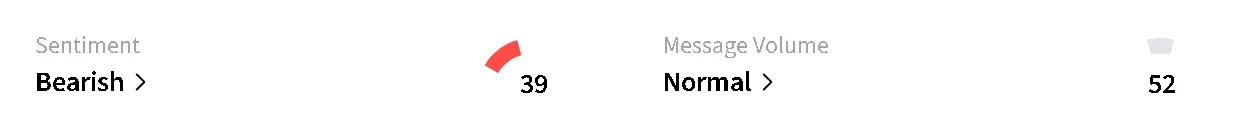

BMNR’s stock was down as much as 2.5% in pre-market trade, with retail sentiment on Stocktwits trending in ‘bearish’ territory over the past day. Meanwhile, chatter simmered down to ‘normal’ from ‘high’ levels.

Some users voiced concerns that neither Lee nor Strategy’s executive chairman, Michael Saylor have been able to get their respective stocks up.

Others feared BMNR’s share price could plummet if Ethereum’s (ETH) price continued to fall.

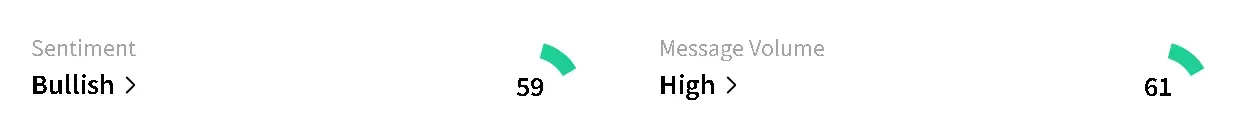

Ethereum’s price dropped 3.2% in the last 24 hours, slipping under the $2,000 threshold as the broader cryptocurrency market was cautious ahead of the U.S. Employment Report later in the day. Retail sentiment around the leading altcoin, however, remained in ‘bullish’ territory amid ‘high’ levels of chatter.

The company announced on Monday that its total holdings, which include its ‘moonshot’ investments, cash, Bitcoin (BTC), and Ethereum (ETH), crossed $10 billion. Bitmine currently holds over 4.3 million ETH and around 190 BTC, alongside $595 million in cash. Arkham data indicates the company has picked up at least around 40,000 ETH this week.

Read also: Tinder And Facebook On Blockchain? Cardano Founder Says That Will 'Change Everything'

For updates and corrections, email newsroom[at]stocktwits[dot]com.<