Alliance Global cut TLRY’s target price to $10 from $20, citing limited visibility into the company’s long-term sales trajectory and cash flow.

- Tilray’s Q2 revenue rose 3% to $217.5 million, beating estimates of $211.5 million, according to Fiscal.ai data

- The management reaffirmed its fiscal 2026 adjusted EBITDA outlook of $62 million to $72 million.

- Tilray is currently operating at an annualized run rate of about $150 million, CEO Irwin D. Simon told analysts on a call on Thursday.

Tilray Brands (TLRY) stock gave up most of its early gains to trade about 2.5% higher on Friday after Alliance Global slashed its price target on the stock, pointing to limited visibility into the company’s long-term sales trajectory and cash flow following its second-quarter (Q2) fiscal 2026 results.

Analyst Aaron Grey reduced Tilray’s target price to $10 from $20 while maintaining a ‘Neutral’ rating. He said the quarter came in largely in line at the consolidated level, with “some strengths offsetting some weaknesses,” but the firm stayed on the sidelines, looking for clearer insight into the company’s sales and cash flow outlook.

Q2 Print

Tilray’s second-quarter (Q2) revenue rose 3% to $217.5 million, beating estimates of $211.5 million, according to Fiscal.ai data. The revenue increase was driven by a 36% jump in international medical cannabis sales. Net loss narrowed to $43.5 million from $85.3 million a year earlier.

Operating cash flow remained negative, though it narrowed to $8.5 million compared to $40.7 million last year. The firm’s management reaffirmed its fiscal 2026 adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) outlook of $62 million to $72 million, citing long-term opportunities tied to U.S. cannabis rescheduling and medical expansion.

Chairman and CEO Irwin D. Simon told analysts on a call on Thursday that Tilray is currently operating at an annualized run rate of about $150 million, driven mainly by international markets. Simon also added that Europe, particularly Germany, the U.K., and Poland, represents a significant growth opportunity.

How Did Stocktwits Users React?

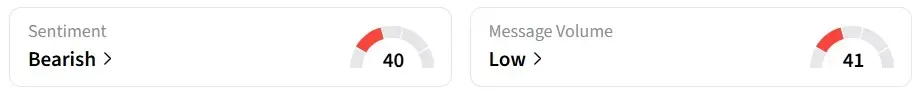

Despite the intraday gains, retail sentiment on Stocktwits for TLRY remained in the ‘bearish’ territory over the past 24 hours.

However, some users were bullish, with one highlighting Tilray’s strong results.

The stock has declined 24% over the past year.

Read also: OKLO Stock Surged 20% In Premarket Today – What’s The Meta Agreement About?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<