The company announced that a strategic investor would invest 15,000 bitcoins in exchange for a significant equity stake in the insurance firm.

- The two parties plan to form a partnership focused on innovation across the AI and crypto value chain.

- The company plans to launch an innovation lab to develop AI-powered trading and risk management systems, blockchain infrastructure, and new AI-crypto products.

- Tian Ruixiang has a hearing with Nasdaq on February 17 over issues surrounding its stock price, which is below Nasdaq’s minimum bid requirement.

Shares of Tian Ruixiang Holdings (TIRX) jumped more than 200% on Tuesday after the company announced that a strategic investor would invest 15,000 bitcoins in exchange for a significant equity stake in the insurance firm.

At the current rate, 15,000 bitcoins would be worth around $1.16 billion.

Beyond the investment, the two parties plan to form a partnership focused on innovation across the AI and crypto value chain. This includes launching a global innovation lab to develop AI-powered trading and risk management systems, blockchain infrastructure, and new AI-crypto products for institutional and retail users.

TIRX said the overall plan is valued at $1.5 billion, adding that the partnership is expected to strengthen its balance sheet and support its expansion into digital assets.

Recent Business Updates

Last week, Tian Ruixiang said that it was in advanced talks to acquire a Hong Kong-based brokerage focused on offshore asset allocation and wealth management. The target company generates over $200 million in annual revenue and has achieved roughly 50% growth over the past five years.

Separately, Tian Ruixiang signed a memorandum of understanding with SwiftStart, which is considering a potential $80 million equity investment at $1.50 per share.

Nasdaq Notice On Minimum Bid Price Requirement

The company recently announced that it received a notice from Nasdaq for failing to meet the minimum bid price requirement after its shares traded below $1 for 30 consecutive business days. Because the company conducted a reverse stock split within the past year, it is not eligible for a standard 180-day compliance period. A hearing on the issue is scheduled for February 17.

TIRX’s five-for-1 reverse share split came into effect on Sept. 5, 2025.

How Did Stocktwits Users React?

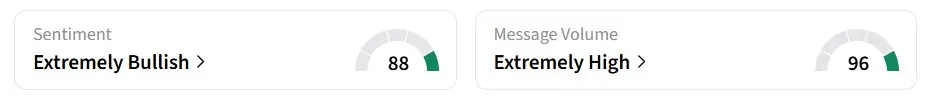

Retail sentiment for TIRX shares on Stocktwits remained in the ‘extremely bullish’ territory over the past 24 hours, amid ‘extremely high’ message volumes.

One user said the stock movement was due to a ‘perfect storm’ of short interest and bullish news.

The stock has shed more than 50% of its value so far this year.

Read also: Pfizer Reports Positive Weight-Loss Trial Results, Strong Q4 – So Why Is PFE Stock Falling?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<