Fresh catalysts include Tata AMC’s GIFT IFSC fund approval, Tata Capital’s IPO extension, and a 1:10 stock split boosting investor sentiment.

Tata Investment shares have been in an uptrend, rising 6% on Thursday. Over the past six months, the stock has clocked in over 20% gains.

Earlier this week, Tata Asset Management received approval from the International Financial Services Centres Authority (IFSCA) to launch Tata India Dynamic Equity Fund – GIFT IFSC. On September 16, the company announced the creation of a retail-focused inbound feeder fund. This fund is designed to direct global investments into India's equity market through Non-Resident Indians (NRIs) and Overseas Citizens of India.

Tata Asset Management received regulatory approval from IFSCA earlier this year to establish operations as a Registered Fund Management Entity (Retail) at GIFT City, Gujarat.

Additionally, news reports suggest that Tata Capital which is gearing up for a $2 billion initial public offering (IPO) has got an extension till October from the Reserve Bank of India (RBI). Earlier, the company was required to complete its listing by September end.

Three years ago, the RBI mandated that all unlisted large NBFCs go public by September 30, 2025. Consequently, Bajaj Housing Finance listed in August 2024, and HDB Financial followed in June 2025.

The other tailwind for Tata Investment comes from its announcement of a first ever 1:10 stock split in August. The record date has not been fixed yet.

What Is The Retail Mood?

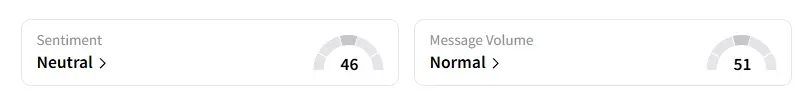

Data on Stocktwits shows that retail sentiment has been ‘neutral’ for a week on this counter. It was ‘bearish’ a month ago.

Tata Investment shares have risen 9% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<