Tata Steel’s March quarter earnings show steady improvement in revenue and profits. Technical analysts see bullish momentum with possible breakout above key resistance levels.

Tata Steel shares are in focus on Tuesday after a steady recovery in March-quarter earnings, reigniting bullish sentiment in both fundamental and technical circles.

Consolidated revenue rose to ₹56,218 crore, up from ₹53,648 crore in the December 2024 quarter. Operating profit increased to ₹6,559 crore, maintaining a stable operating margin of 12%.

Net profit jumped to ₹1,201 crore, a sharp improvement from ₹295 crore in Q3 and ₹759 crore in Q2.

The board announced a 131% dividend payout, a strong turnaround from the negative payout in FY24.

On the technical front, SEBI-registered analyst Harika Enjamuri noted that Tata Steel displayed bullish momentum on both daily and weekly charts.

A golden crossover on the daily chart, rising RSI (61.91), and strong volumes suggested upward strength.

In the short term (1–3 days), Tata Steel's price might test ₹155.28 and potentially break through it if trading volume is strong, according to Enjamuri's analysis.

Over the coming weeks, assuming positive market sentiment, Tata Steel could rally towards ₹160–₹169, while ₹144–₹141 will serve as immediate support during pullbacks.

SharesNservices echoed the sentiment, highlighting resistance levels at ₹158–₹160, and a breakout above ₹162 could lead to targets of ₹168, ₹176, ₹182, and even ₹200. Support was seen at ₹120–₹125, indicating limited downside.

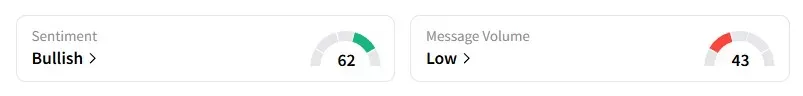

Data on Stocktwits shows that retail sentiment is ‘bullish’ on the counter.

Tata Steel shares gained 8% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<