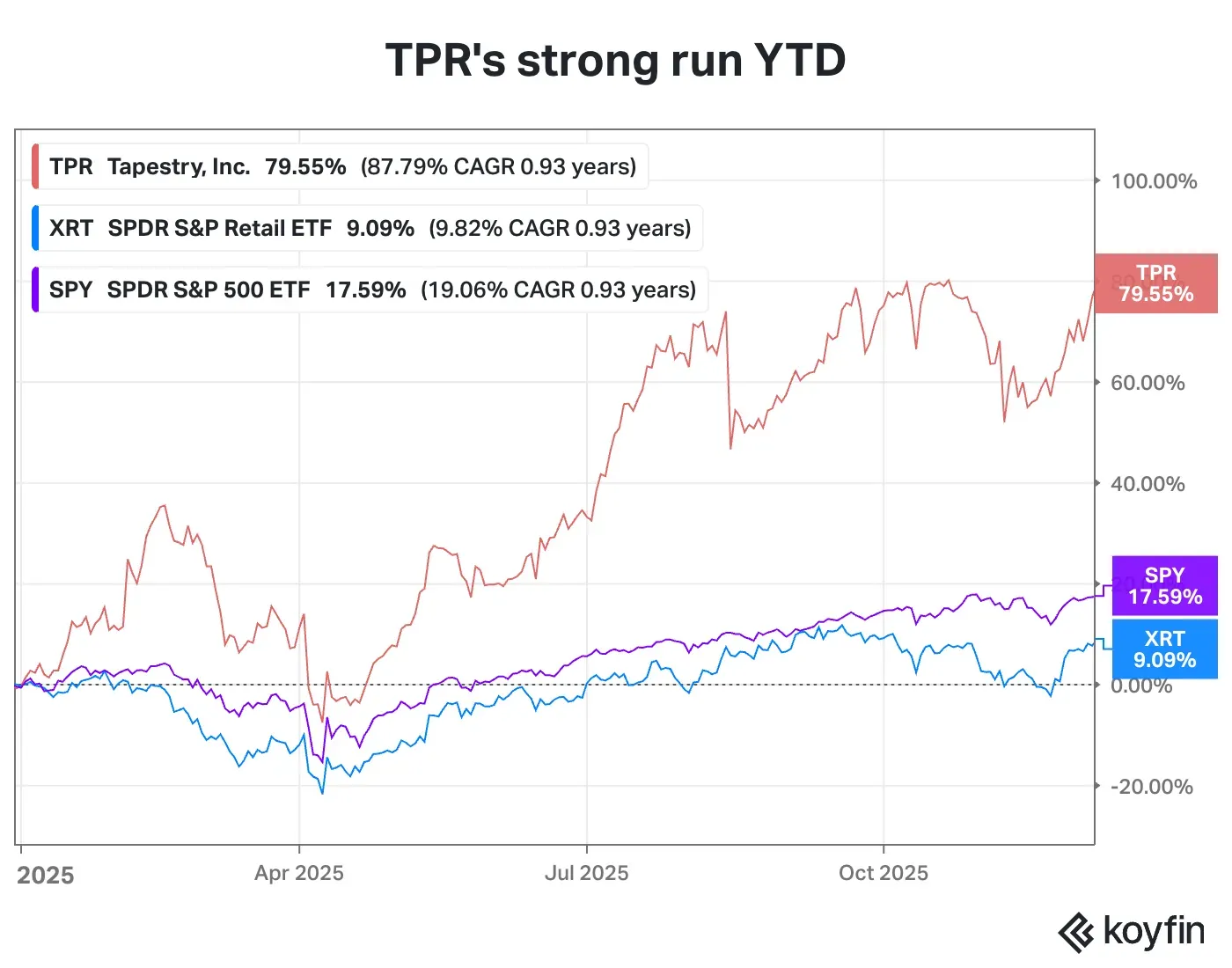

Tapestry opened at $116 on Tuesday and could breach its previous high of $118.56 from Oct. 15.

- Tapestry stock has gained about 23% since its earnings report on Nov. 6.

- After failing a few times earlier in the year, TPR could hit a new high.

- The momentum is driven by the company’s strong revival, led by its Coach handbags brand and marketing strategy.

Among the few retail brands to maintain an upward trajectory in the tariff era, Tapestry ranks among the top echelons.

The handbags and accessories company has swung back to topline growth in recent quarters, powered by its flagship Coach brand — and its stock is now nearing a fresh record.

Tapestry opened at $116 on Tuesday and could breach its previous high of $118.56 from Oct. 15 (intraday high), marking a clean breakout and possibly barrelling toward a new record high. TPR has logged three major rallies this year — during June-July, again in August–September, and now the latest surge, with shares up roughly 23% since its fiscal first-quarter earnings on Nov. 6.

The Coach Pump

Powering the performance is Coach, a brand of handbags and leather goods, which contributes about three-quarters of the company’s topline.

Tapestry has said that new Coach products, including the “Tabby” line and the “New York” collection, and its marketing strategy, which positions the brand as “affordable luxury,” are driving sales. Coach also got fewer discounts, boosting average revenue per product sold, and is becoming increasingly popular with younger customers, the company said.

Sales at Tapestry’s other two brands – Kate Spade and Stuart Weitzman – have been shrinking.

Gen Z Strategy

At its investor day event in September, Tapestry unveiled an “Amplify Growth Strategy” with four pillars: building emotional connections with consumers (especially Gen Z), driving fashion innovation, accelerating global growth, and focusing on staff.

Early signs have already emerged: in Q1, Tapestry reported record revenue of $1.70 billion, up 13%, including 22% growth in Coach sales. The company said it gained 2.2 million new customers in the quarter, and about 35% of them were Gen Z.

Retail and Analyst View

With those numbers, especially after the company had to significantly realign after its merger with Capri Holdings fell through late last year, it's easy to win analyst backing.

Currently, 15 of the 20 analysts covering the TPR have a ‘Buy’ or higher rating, while four rate it ‘Hold,’ and one rates it ‘Sell,’ according to Koyfin. Their average price target of $121.44 implies a mere 3.6% upside from the stock’s last close.

On Stocktwits, the retail sentiment reading for TPR shifted to ‘Bullish’ as of early Tuesday, from ‘Neutral’ the previous day, with several users noticing the recent rally.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<