Barclays analyst Benjamin Theurer downgraded FMC to ‘Underweight’ from ‘Equal Weight’ and lowered the price target to $13 from $16.

- The insecticide and herbicide maker projected 2025 revenue of $3.92 billion to $4.02 billion in October, down from its previous forecast of $4.08 billion to $4.28 billion.

- The research firm stated that FMC faces a "tough" near-to-medium-term outlook, with management citing only limited growth potential over the next three years, the analyst noted.

- FMC previously warned that it would continue to grapple with tepid prices amid a high influx of generic products.

FMC stock slipped over 1% in premarket trading on Tuesday, after Barclays turned less optimistic about the company’s near-term results.

As per TheFly, Barclays analyst Benjamin Theurer downgraded FMC to ‘Underweight’ from ‘Equal Weight’ and lowered the price target to $13 from $16. The new price target was marginally below FMC stock’s Monday closing price of $13.10. FMC stock has fallen by over 73% this year.

What Did The Analyst Say?

The Barclays analyst expects the agriculture markets to see mixed results in 2026. The research firm stated that FMC faces a "tough" near-to-medium-term outlook, with management citing only limited growth potential over the next three years.

The insecticide and herbicide maker projected 2025 revenue of $3.92 billion to $4.02 billion in October, down from its previous forecast of $4.08 billion to $4.28 billion. FMC also cut its earnings-per-share estimates to $2.92 to $3.14, down from $3.26 to $3.70 earlier.

FMC stated pricing is expected to have a mid-to-high single-digit percentage-point impact on its full-year earnings, as it continues to grapple with a high influx of generic products, which are hampering sales of the company’s proprietary products. Its Latin American sales fell 8% year over year in the third quarter.

The company added that low customer liquidity caused credit constraints in Brazil and Argentina, further inhibiting growth. Prices of key crops such as soybeans and corn have remained under pressure for much of the year, prompting farmers to cut spending on insecticides and fungicides.

Debt Relief

On Monday, FMC amended its credit agreement to ease financial covenants and extend its covenant relief period to 2028. The amendment also limits subsidiary indebtedness to a maximum aggregate outstanding principal amount of $350 million, subject to certain exceptions. It limits increases to the company’s regular quarterly dividend above $0.08 per share.

What Are Stocktwits Users Thinking?

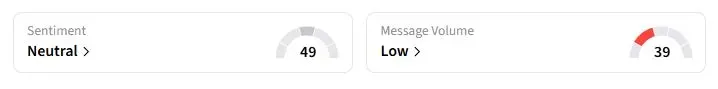

Retail sentiment on Stocktwits about FMC was in ‘neutral’ territory at the time of writing, compared to ‘bearish’ a day earlier.

One user on Stocktwits said he expects the share price to cross $50 by 2028 as new products get introduced, after the banks gave the company more time to recover.

https://stocktwits.com/ssdsddssd2/message/638580327

For updates and corrections, email newsroom[at]stocktwits[dot]com.<