The drug candidate demonstrated a placebo-adjusted remission rate of 19.3% in the first study and 13.4% in the second study.

Shares of Paris, France-based Abivax SA (ABVX) spiked by over 400% in Wednesday's early premarket session following a positive late-stage readout from the clinical-stage biotech.

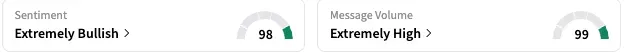

On Stocktwits, retail sentiment toward Abivax stock improved further into the ‘extremely bullish’ territory (98/100), with the message volume score spiking to a near-perfect “99,” suggesting ‘extremely high’ retail chatter.

The Abivax stock stream on the platform saw a nearly 260% increase in watcher count over the 24 hours leading up to late Tuesday. The 24-hour message volume change was 3,900%.

The stock was among the top five trending tickers on Stocktwits early Wednesday.

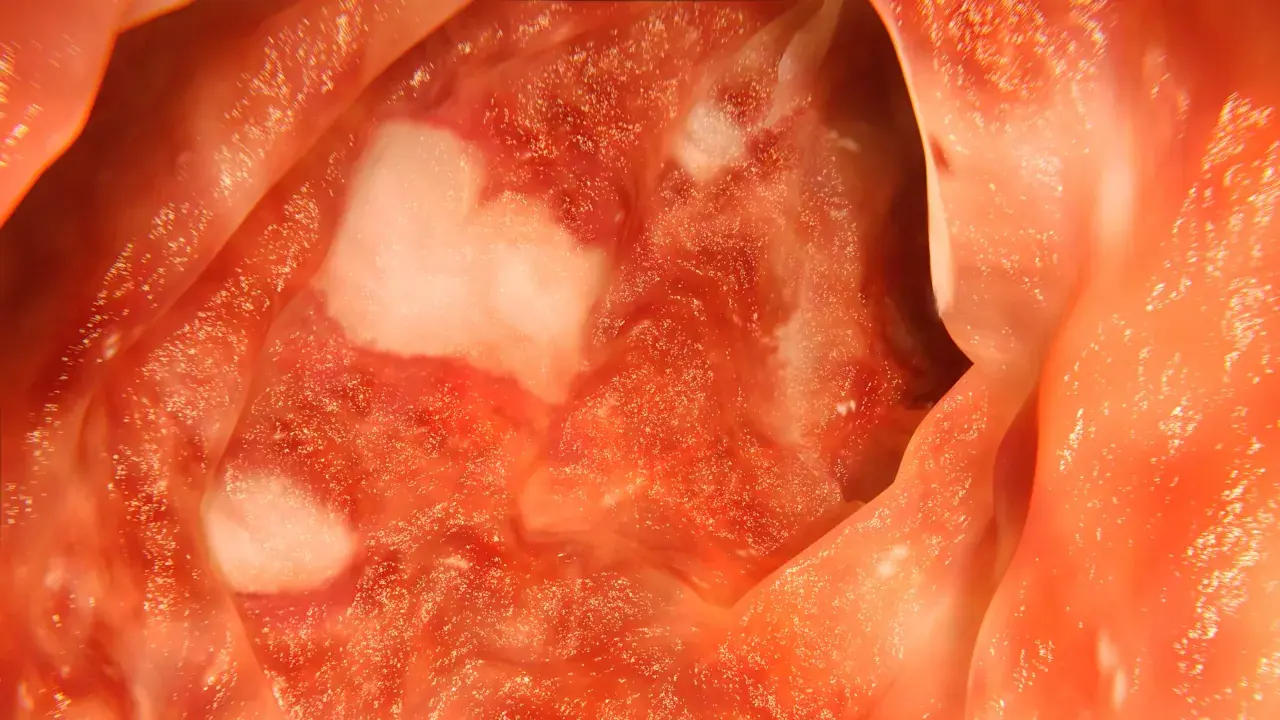

The frenzied retail activity followed the small-cap biotech's announcement of positive topline results from two Phase 3 studies evaluating its obefazimod in adult patients with moderately to severely active ulcerative colitis (UC).

Abivax evaluated a 50 mg once-daily oral dose of obefazimod, its lead candidate, in studies dubbed ABTECT 1 and ABTECT 2. The drug candidate demonstrated a placebo-adjusted remission rate of 19.3% in the first study and 13.4% in the second study.

It also met all key secondary endpoints, demonstrating “highly statistically significant and clinically meaningful benefits.”

The company said an ABTECT Maintenance trial is ongoing, with topline results expected in the second quarter of 2026. It added that out of the 1,275 patients randomized in the induction trials, 678 achieved a clinical response and were enrolled in part 1 of the maintenance trial.

Abivax CEO Marc de Garidel said, “The strength of these results reinforces our belief in obefazimod, our first-in-class miR-124 enhancer, and its potential to become a transformative new treatment modality for patients with UC.”

Contingent upon the 44-week maintenance trial producing successful results, the company plans to submit a New Drug Application (NDA) to the FDA in the second half of 2026.

Abiva engages in the development of therapeutics that harness the body’s natural regulatory mechanisms to stabilize the immune response in patients with chronic inflammatory diseases.

A bullish Stocktwits watcher flagged a potential move toward the $60-$80 level on Wednesday.

Another user, who identified themselves as a UC patient, said, “The addressable market is huge and physicians are always looking for another treatment option aside from TNFs, JAKs, interleukins, etc — some of the biggest blockbuster drugs currently treat UC/Crohns.”

Abivax stock is up over 36.5% for the year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<