Spot gold broke above $4,600 an ounce for the first time, while spot silver jumped to an all-time high of $84.62 an ounce on Monday.

- Multi-month corrections in silver are a thing of the past, with pullbacks now unfolding in just days, Oliver said.

- Silver has seen sharp volatility recently, sliding about 16% from record highs before rebounding to those levels within just 10 sessions.

- Escalating unrest in Iran and a criminal probe on Fed Chair Jerome Powell are seen as key triggers.

Silver’s breakout is likely to be explosive, with prices potentially racing past $200 an ounce sooner than expected and even reaching $500, veteran technical analyst Michael Oliver said on a YouTube podcast with the Living Your Greatness channel on Sunday.

Oliver argued that the structure of the silver market has fundamentally changed. He said, “You don't get these multi-month corrections anymore. Now they're measured in days. And frankly, we expect to see silver uh reach .. my minimum is like $200, but I wouldn't be shocked if it approached $500, to tell you the truth.”

Silver has seen sharp volatility recently, sliding about 16% from record highs before rebounding to those levels within just 10 sessions.

Gold, Silver Continue Record Run

On Monday, both gold and silver surged to fresh record highs as heightened geopolitical risks and news of a criminal probe tied to Federal Reserve Chair Jerome Powell drove investors toward safe-haven assets.

Spot gold (XAUUSD) broke above $4,600 an ounce for the first time, while spot silver (XAGUSD) jumped nearly 6% to $84.62. Gold futures for February 2026 rose 2.2% to $4,599.40 an ounce, and March 2026 silver futures surged 6.1% to $84.17.

What’s Driving The Gold, Silver Rally?

Precious metals hit fresh record highs early Monday as the Trump administration escalated its confrontation with the Federal Reserve by issuing DOJ subpoenas, raising concerns over central bank independence, inflation, and the safety of U.S. bonds, commodities expert and Head of Commodity Strategy for Saxo Bank, Ole Hansen wrote in a post on X on Monday.

“Safe-haven demand has been underpinned by escalating unrest in Iran, where ongoing protests continue to challenge the regime and stoke geopolitical risk premia,” he added.

The Donald Trump-led administration is reportedly weighing criminal charges against Federal Reserve Chair Jerome Powell tied to his testimony before Congress last summer regarding a Fed construction project, a move Powell has described as an attempt to exert greater political control over the central bank and its policy decisions.

Meanwhile, demonstrations across Iran escalated over the weekend as President Trump said the U.S. could engage directly with Iranian officials while considering a range of forceful responses, including military action, to Tehran’s violent suppression of protests.

Trump warned Iran’s leadership that any move by security forces to fire on demonstrators would trigger a U.S. attack. According to U.S.-based rights group HRANA, at least 490 protesters and 48 security personnel have been killed, with more than 10,600 people detained.

How Did Stocktwits Users React?

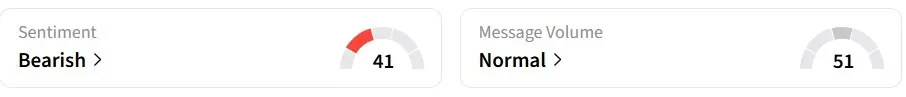

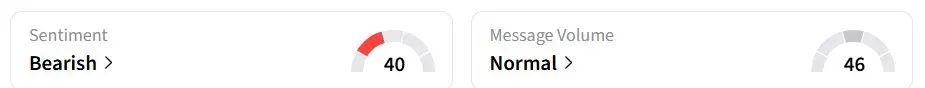

Despite the surge to record highs, retail sentiment on Stocktwits remained ‘bearish’ for both iShares Silver Trust (SLV) and SPDR Gold Shares ETF (GLD). Both SLV and GLD were trending on Stocktwits at the time for writing.

Year-to-date, SLV has gained 7.5%, outperforming GLD’s 3.2% rise.

Read also: Monero Surges To Record High, Outperforming Bitcoin – Even As Dubai Moves To Ban Privacy Tokens

For updates and corrections, email newsroom[at]stocktwits[dot]com.<