Starbucks posted a 5.5% increase in first-quarter revenue to $9.92 billion, which also came above Wall Street estimates of $9.65 billion, according to Fiscal.ai data.

- North America and U.S. comparable sales rose 4%, driven by a 3% increase in transactions and a 1% lift in average spending per visit.

- For fiscal 2026, the company expects global and U.S. comparable store sales growth of at least 3%, with net revenue rising at a similar pace.

- Starbucks plans to open about 600 to 650 net new stores worldwide in fiscal 2026.

Starbucks shares rose more than 7% in premarket trading on Wednesday after the coffee giant delivered U.S. comparable transaction growth for the first time in eight quarters.

North America and the U.S. comparable sales rose 4%, driven by a 3% increase in transactions and a 1% lift in average spending per visit.

“What we’re really delighted about is that the North American comp result is driven by transactions and specifically the fact that both non-rewards customers and rewards customers grew transactions. So, two things happened: people came back to the brand, and we also drove engagement with our existing customers,” Brian Niccol, chairman and CEO, said in a call with analysts.

FY2026 Outlook

For fiscal 2026, the company expects global and U.S. comparable store sales growth of at least 3%, with net revenue rising at a similar pace.

It also forecast a slight year-over-year improvement in non-GAAP operating margin and earnings per share of $2.15 to $2.40. Starbucks plans to open about 600 to 650 net new stores worldwide.

Q1 Revenue Beats Estimates

Starbucks posted a 5.5% increase in first-quarter (Q1) revenue to $9.92 billion, which also came above Wall Street estimates of $9.65 billion, according to Fiscal.ai data. However, earnings of $0.26 per share were significantly below Street estimates of $0.59 per share.

The company said operating margin fell to 9% due to higher labor spending tied to the “Back to Starbucks” strategy and inflation pressures from elevated coffee prices and tariffs. Starbucks earmarked $500 million for the “Back to Starbucks” strategy to improve staffing, service, and operations.

“Our Q1 results demonstrate our ‘Back to Starbucks’ strategy is working, and we believe we’re ahead of schedule,” Niccol added, pointing to renewed sales momentum.

International comparable sales grew 5%, led by higher traffic and ticket sizes, while China posted a stronger 7% increase driven by a 5% jump in transactions. Net revenue from China rose 11% to $823.4 million as store count increased 4% to 8,011 locations.

How Did Stocktwits Users React?

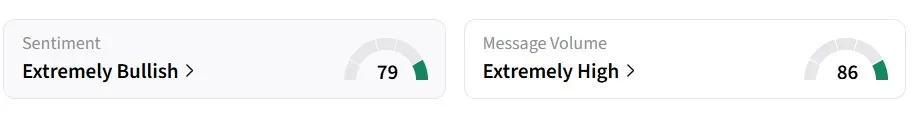

Retail sentiment on Stocktwits flipped to ‘extremely bullish’ from ‘bearish’ a day earlier, amid ‘extremely high’ message volumes. SBUX was among the top trending tickers on the platform at the time of writing.

One user sounded bullish about the sector.

Another user expects the stock to climb to $120.It is currently trading around $103.

Over the past year, the stock has declined by around 3%.

Read also: This Nano Cap Cybersecurity Stock Surged Over 70% In Pre-Market Today – What Is The Portugal Connection?

For updates and corrections, email newsroom[at]stocktwits[dot]com.<