SBI Life’s stock climbed 4% as investors focused on robust FY25 performance. Operational metrics show improvement with asset growth under management and new business value.

SBI Life Insurance’s shares gained 4% on Friday as markets rewarded its strong quarterly earnings performance, led by improved solvency and rising renewals.

While fourth-quarter (Q4) net profit remained flat at ₹814 crores, FY25 profit surged 27% to ₹2,410 crores, driven by an 11% growth in individual new business premiums and a 13% rise in renewal premiums.

Improved persistency ratios and a 1.96 solvency ratio offset Q4’s 5% premium income dip.

Key growth drivers included a 15% jump in assets under management (₹4.48 lakh crore) and a 10% rise in first-year premiums.

The value of new business (VNB) grew 7% annually to ₹5,954 crore, with margins stabilizing at 27.8%.

The company reported an Individual Rated Premium of ₹19,350 crore and held a 22.8% private market share in FY25.

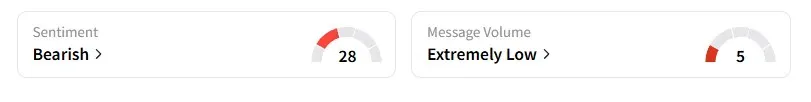

Data from Stocktwits showed that retail sentiment remained ‘bearish' late on Friday morning.

SBI Life stock has gained 20% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<