Analyst Saurabh Sahu believes the stock has the potential to rise to the ₹830 to ₹850 range, while recommending a strict stop-loss at ₹775 to manage the downside risk.

State Bank of India (SBI) shares are back in the spotlight with analysts turning bullish after a technical breakout pattern and rising volumes. A recent board-approved stake sale in Yes Bank has also added to investor optimism.

SBI shares surged 3% on Monday, extending their monthly gain to 6%, after the bank’s board approved divesting a 13.19% stake in Yes Bank to Japan’s Sumitomo Mitsui Banking Corporation (SMBC) for ₹8,888 crore at ₹21.5 per share.

SEBI-registered analyst Saurabh Sahu observed that SBI stock recently formed a strong bullish candle accompanied by increased trading volume, signaling renewed buyer interest in the ₹760 to ₹770 price range.

This uptick in volume follows a period of decline, which Sahu interpreted as a bullish indicator.

He suggested that a breakout above the ₹805 level, confirmed by a candle closing above this price accompanied by substantial volume, would likely validate the continuation of the bullish trend.

Sahu believes the stock has the potential to rise to the ₹830 to ₹850 range, while recommending a strict stop-loss at ₹775 to manage the downside risk.

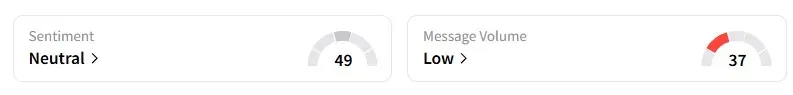

Data on Stocktwits shows that retail sentiment on the counter remains ‘neutral.’

SBI shares gained 1% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<