SanDisk’s latest board addition comes as demand for high-performance storage tied to AI remains strong.

- The board appointment expands SanDisk’s audit committee as the company scales operations following its spin-off.

- Shares have surged since the Western Digital spin-off, far outpacing storage peers.

- Data center and AI-linked demand continues to support results and visibility.

SanDisk shares rose after-hours on Friday after the flash-memory maker said it added Alexander R. Bradley, the chief financial officer of First Solar, to its board of directors and audit committee.

First Solar CFO Brings Capital Markets Expertise

Bradley has been First Solar’s CFO since 2016 and previously held senior roles in treasury and project finance there, working on financing large, capital-intensive projects.

Earlier in his career, he worked in investment banking and leveraged finance at HSBC, focused on the energy and utilities sector, and served as an officer and board member of the general partner at 8point3 Energy Partners.

Standout Performer Since Spin-Off

SanDisk was one of the strongest-performing stocks in 2025 since its spin-off from Western Digital. Western Digital announced the breakup in October 2024, proposing to distribute shares of the newly formed SanDisk to its shareholders. SanDisk returned to public markets on Feb. 13, marking its second listing after being acquired by Western Digital in 2016 for $16 billion.

Since debuting, SanDisk shares have surged more than fivefold, far outpacing Western Digital and Seagate Technology.

AI Demand Drives Fundamentals Higher

SanDisk sells flash-memory storage products including solid-state drives, memory cards, and USB flash drives.

Strong demand for NOT AND (NAND) flash used in artificial intelligence infrastructure, combined with industry-wide supply constraints and solid quarterly results, has supported the stock. Inclusion in the S&P 500 in late November also helped stabilize shares during broader volatility in AI-linked stocks.

SanDisk has increasingly focused on the data center market, which grew 26% sequentially in the quarter. The company said data center and AI infrastructure investment could exceed $1 trillion by 2030, citing strong demand for its storage-focused “Stargate” product line and ongoing hyperscaler qualifications.

How Did Stocktwits Users React?

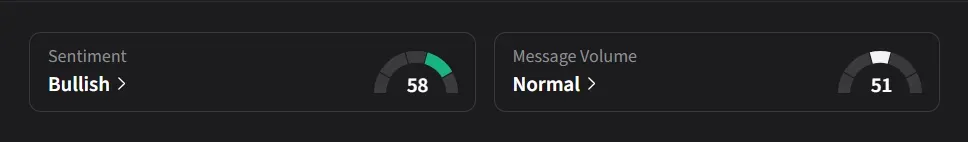

On Stocktwits, retail sentiment for SanDisk was ‘bullish’ amid ‘normal’ message volume.

SanDisk’s stock has surged 665% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<