Robinhood Chain is a Layer-2 network built on Ethereum, and its testnet allows users to experiment with applications before the planned mainnet rollout later this year.

- During the test phase, developers can access testnet-only assets, including ‘Stock Tokens’ tied to Tesla, Amazon, Palantir, Netflix, and AMD.

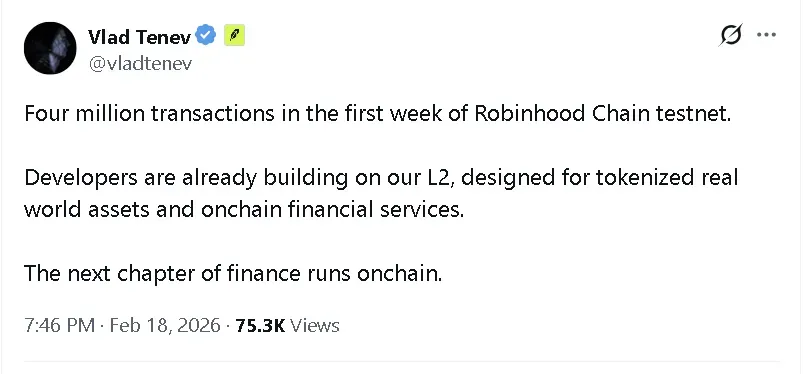

- CEO Vlad Tenev said the volume of transactions within the first week of its launch shows traction among developers.

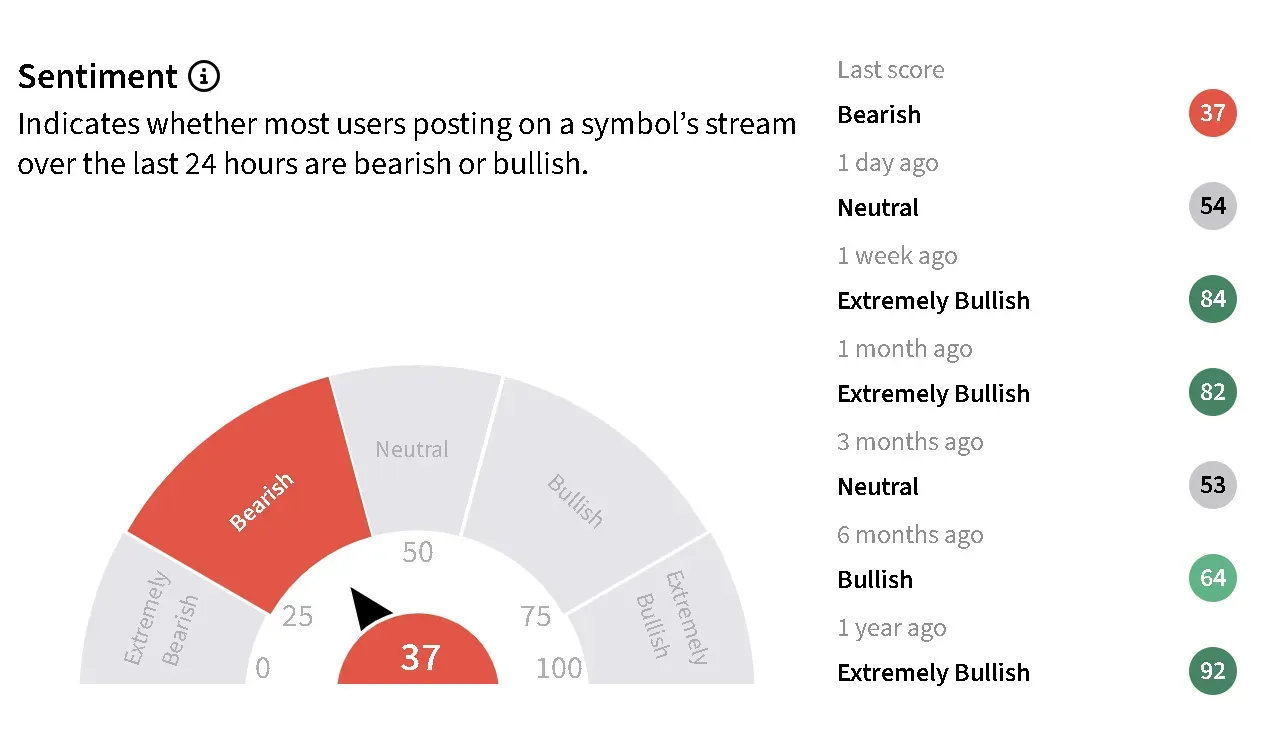

- HOOD’s stock edged higher in overnight trade, but sentiment around the shares deteriorated over the past day, according to Stocktwits data.

Robinhood (HOOD) CEO Vlad Tenev said Thursday that the company’s Robinhood Chain testnet processed four million transactions in its first week, signaling early developer activity around its blockchain push.

“Developers are already building on our L2, designed for tokenized real world assets and onchain financial services,” Tenev wrote on X. “The next chapter of finance runs onchain.”

HOOD’s stock moved 0.65% higher in overnight trade on Thursday after edging 0.3% lower during the regular session. On Stocktwits, retail sentiment around the company fell to ‘bearish’ from ‘neutral’ territory over the past day.

What Is Robinhood Chain?

Robinhood Chain is a Layer 2 network built on Ethereum. The testnet, a pre-launch environment for developers, allows users to experiment with applications before the planned full mainnet rollout later this year.

Robinhood Chain Testnet Gains Early Traction

During the test phase, developers can access testnet-only assets, including ‘Stock Tokens’ tied to Tesla (TSLA), Amazon (AMZN), Palantir Technologies (PLTR), Netflix (NFLX) and Advanced Micro Devices (AMD). Users who sign up receive five free ‘Stock Tokens’ for each company, worth 0.5 testnet ETH, redeemable every 24 hours.

Robinhood has committed $1 million to the 2026 Arbitrum Open House program and said infrastructure providers, including Alchemy, Allium, Chainlink, LayerZero, and TRM, are integrating with the network.

Growing Interest In Real-World Assets

Interest in tokenized real-world assets (RWA) has grown this year, with firms such as Grayscale Investments highlighting it as one of the primary crypto sectors to watch in 2026. Total value locked across decentralized finance platforms stands near $96.5 billion, according to DefiLlama. About $19.8 billion is tied to RWAs, surpassing capital locked in decentralized exchanges.

Read also: Coinbase CEO Predicts ‘Win-Win-Win’ Result – CLARITY Act Approval Odds Climb to 90% On Prediction Markets

For updates and corrections, email newsroom[at]stocktwits[dot]com.<