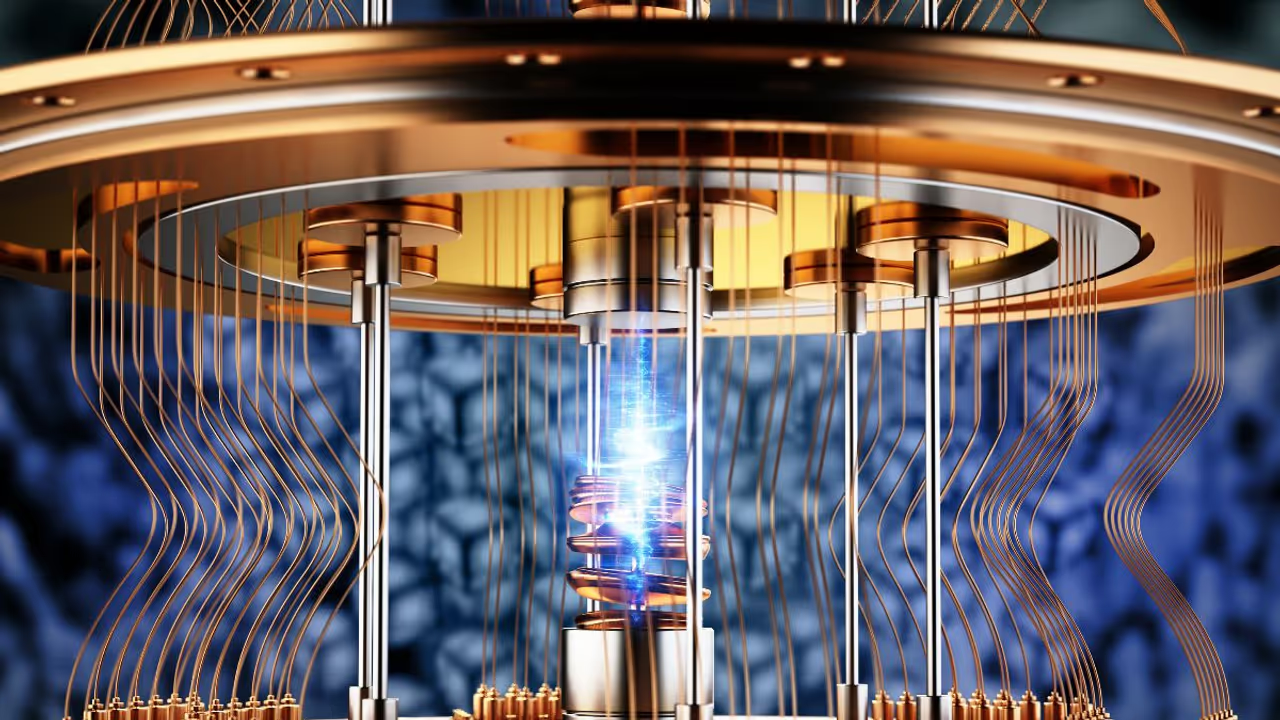

The two companies will together invest over $100 million over the next five years to speed up the development and commercialization of superconducting quantum computing.

Shares of Rigetti Computing Inc. (RGTI) surged over 4% on Thursday as the company secured a $35 million investment from Quanta Computer and entered into a strategic collaboration agreement.

The two companies will together invest over $100 million over the next five years to speed up the development and commercialization of superconducting quantum computing.

Quanta will invest $35 million into Rigetti and purchase shares of the company at a price of $11.59 per share, once it gets regulatory approval.

In addition to this, Alliance Global Partners have raised the price target for Rigetti from $15 to $16 and maintained a ‘Buy’ rating after the company’s fourth-quarter results, according to The Fly.

Rigetti posted a loss of $0.68 per share in Q4, ballooning from a loss of $0.09 a year earlier and far higher than an estimated $0.07 loss per share.

The Berkeley-based quantum integrated circuit maker reported revenue of $2.27 million in this period, declining from $3.38 million in the same period during the previous year, and falling short of an expected $2.5 million.

However, the $35 million investment news flipped the sentiment of investors on Stocktwits to the ‘bullish’ (63/100) territory. Increased retail chatter also pushed the message volume to ‘high’ (74/100) levels.

One user highlighted their bullish outlook for Rigetti, placing a price target of $10 on the stock.

Rigetti’s stock has seen a massive surge, gaining more than 1,133% in the past six months. Over the past year, the stock is up over 309%.

Data from FinChat shows out of the five brokerage ratings for RGTI stock, four have a ‘Buy’ rating, while there’s one ‘Outperform’ recommendation.

The average price target was $14.60, implying a 72% upside from Thursday’s close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<