Formerly known as MicroStrategy, the Michael Saylor-led enterprise now holds over $41 billion of Bitcoin, but its total holdings of the apex cryptocurrency remain shy of 500,000 tokens.

Strategy (MSTR) shares remained down by around 1.5% in mid-day trade on Monday after the company disclosed one of its smallest Bitcoin (BTC) purchases to date.

The stock fell as much as 3% in morning trade before trimming its losses.

A filing with the U.S. Securities and Exchange Commission (SEC) showed that Strategy acquired 130 Bitcoin between March 10 and March 16 at an average price of $82,981 per token.

According to Bitcoin Treasuries data, this is one of the company’s smallest Bitcoin purchases since it began accumulating the cryptocurrency in 2020, with only two smaller acquisitions recorded – 32 BTC in March and 122 BTC in April last year.

Formerly known as MicroStrategy, the Michael Saylor-led enterprise now holds over $41 billion of Bitcoin, but its total holdings of the apex cryptocurrency remain shy of 500,000 tokens.

The purchase follows Strategy’s announcement last week that it will issue up to $21 billion in preferred stock to fund additional Bitcoin acquisitions.

The initiative is part of the company’s broader “21/21 Plan,” which aims to raise $42 billion over three years – half through equity and half through fixed-income securities.

Despite its continued Bitcoin accumulation, the stock remains under pressure as investors weigh concerns over dilution. Bitcoin has struggled, trading around $83,000 after declining more than 14% over the past 30 days.

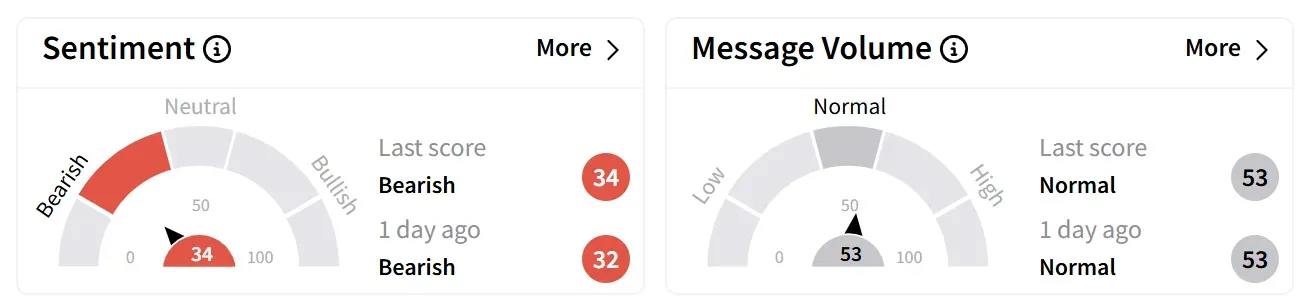

On Stocktwits, retail sentiment around Strategy improved marginally but remained in ‘bearish’ territory.

One investor questioned whether the company's relentless Bitcoin purchases could eventually absorb so much liquidity that it leaves no room for market spreads.

Another speculated that a major short squeeze could be in the works.

Strategy shares are down nearly 4% in 2025 but have climbed more than 67% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<

Read also: ETH Struggles Below $2K While Standard Chartered Slashes Price Target Citing More Weakness Ahead – Retail’s Wary Too