Last month, the company surprised analysts by projecting 50 billion euros in annual sales in 2030, compared with the 9.8 billion euros it logged last year.

- The Düsseldorf-based company reported a backlog of 64 billion euros at the end of the third quarter of 2025, a fivefold increase from its order book of 12.9 billion euros at the end of 2020.

- U.S. President Donald Trump has also pushed the EU countries to raise their defense spending goals to cut reliance on Washington, D.C

- Recent drone sightings in several NATO member states have also raised concerns, underscoring the need for robust air defense systems.

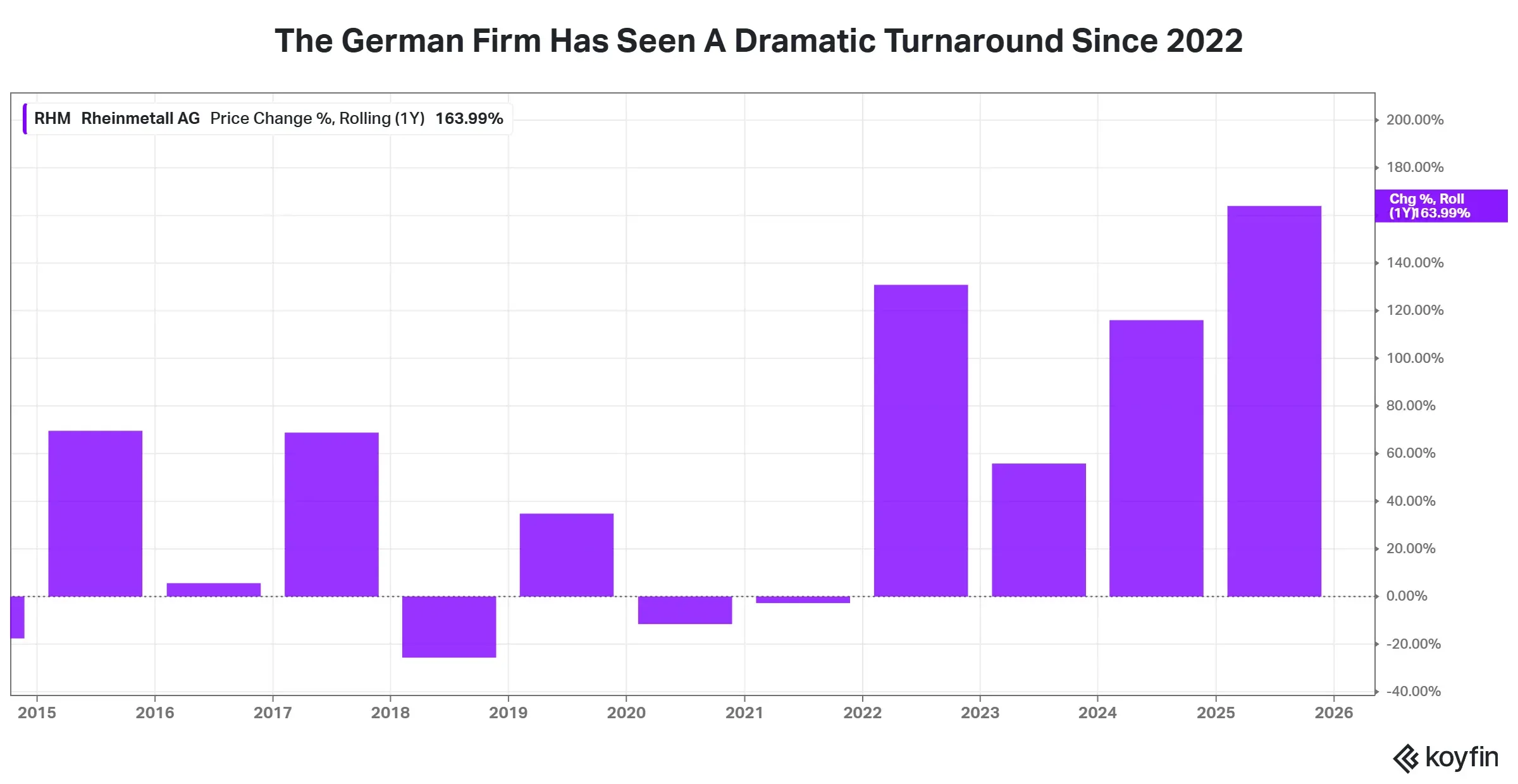

Rheinmetall’s stock has jumped around 164% this year in Europe, while its American Depositary Receipts have fared even better by more than tripling, keeping the German defense firm’s shares on track for their largest-ever annual gains.

Last month, the company surprised analysts by projecting 50 billion euros ($58.7 billion) in annual sales in 2030, compared with the 9.8 billion euros it logged last year. Its ambitious projections came amid renewed interest in defense spending in Europe and a lack of progress in Ukraine peace efforts.

Soaring Backlog

The Düsseldorf-based company reported a backlog of 64 billion euros at the end of the third quarter of 2025, a fivefold increase from its order book of 12.9 billion euros at the end of 2020. The company stated that the most significant share of its 2030 sales will come from its weapons and ammunition division and its vehicle systems segment, driven by demand in Germany.

The meteoric rise, despite the absence of any major U.S. orders, was driven by increased defense spending in Europe following the Russian invasion of Ukraine. U.S. President Donald Trump has also pushed the EU countries to raise their defense spending goals to cut reliance on Washington, D.C. The European Union unveiled a new “ReArm Europe” strategy earlier this year, earmarking 800 billion euros to boost European defense capabilities, with Rheinmetall expected to be a key beneficiary of the spending increase.

Recent drone sightings in several NATO member states have also raised concerns, underscoring the need for robust air defense systems. Last week, the German firm won a significant order from the Netherlands for its Skyranger 30 air defense systems, valued at triple-digit million euros.

What Are Analysts Saying?

As reported by investing.com, Bernstein reaffirmed its fundamental stance on the stock last week but raised its price target to 2,050 euros from 1,980 euros, citing an improved risk-reward trade-off amid a 20% decline in share price since September.

The analysts noted that, following the slump, the stock trades in line with European peers in defense in 2028 but at a discount in 2030, despite higher growth/margin expectations for this stock than its sector.

What Are Stocktwits Users Thinking?

Retail sentiment about the U.S. ADR of Rheinmetall was in the ‘neutral’ territory at the time of writing.

Rheinmetall stock got a further boost this year after it replaced Kering SA in the Euro Stoxx 50 benchmark.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<