Rivian’s stock rebound is driven by faster delivery growth, expanding software revenue, and AI-led autonomy ambitions, though profitability, liquidity, and mass-market launches remain key risks.

- Deliveries and revenue growth are inflecting higher, outpacing Tesla’s growth rates from a smaller base.

- Autonomy & AI strategy is boosting investor confidence in high-margin software potential.

- Analysts remain cautious on cash burn, margins, and execution of upcoming R2/R3 models.

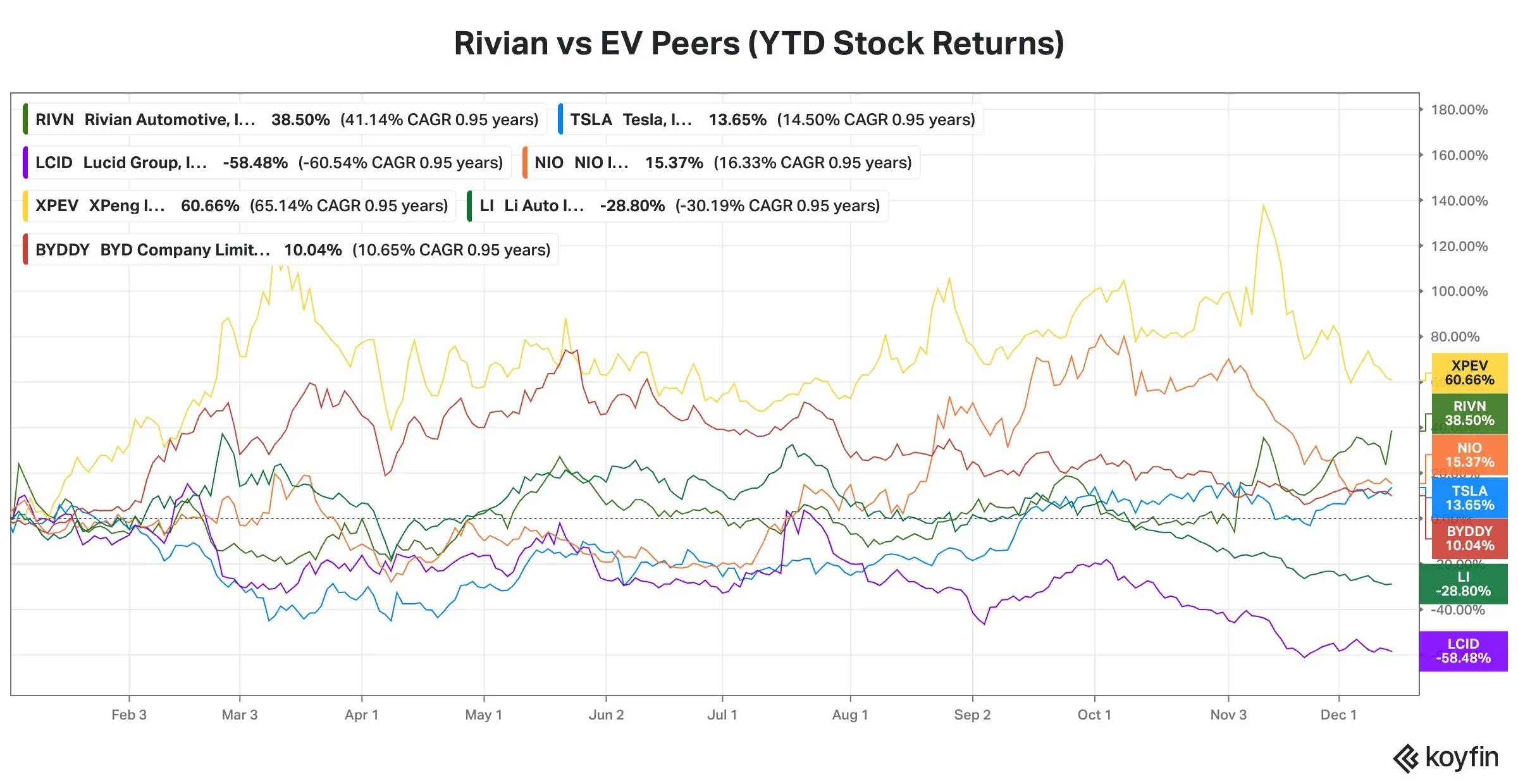

Electric vehicle (EV) startup Rivian Automotive, Inc.’s (RIVN) shares have turned the corner. After falling nearly 44% in 2024, Rivian’s stock has gained more than 38% this year, with much of the gains back-end loaded. More importantly, Rivian’s stock gain has outpaced that of its bigger peer and market leader, Tesla, Inc. (TSLA).

The Autonomy & AI Day event held on Thursday produced a skeptical reaction from traders. Still, the stock soared over 12% in the very next session as Wall Street analysts’ positive assessment led investors to change their stance. Does the turnaround point toward an inflection in Rivian’s fundamentals? Here’s a deep dive into the year that was for the company:

Rivian’s Accelerating Revenue

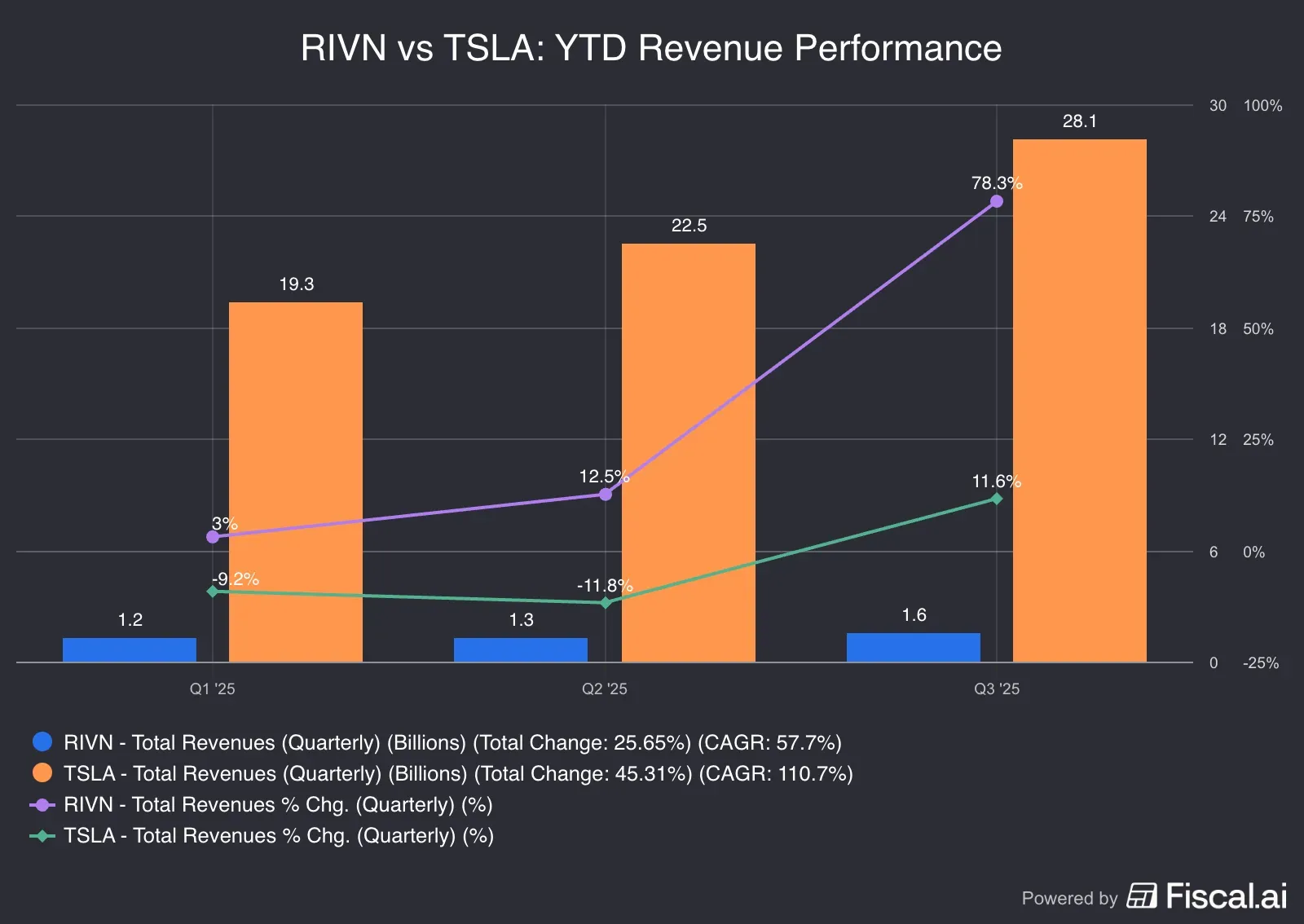

Rivian's topline was only about 6% of Tesla’s for the nine months ended September, but it outperformed Tesla in year-over-year (YoY) growth. The third quarter, notably, saw a scorching pace of development (78%), driven by strong software and services and automotive revenue. The management clarified on the earnings call that about half of the $416 million in third-quarter software and services revenue came from the software and electrical hardware joint venture we created with Volkswagen Group.

Source: Fiscal.ai<

Rivian vs. Tesla: Whose Deliveries Grew Faster?

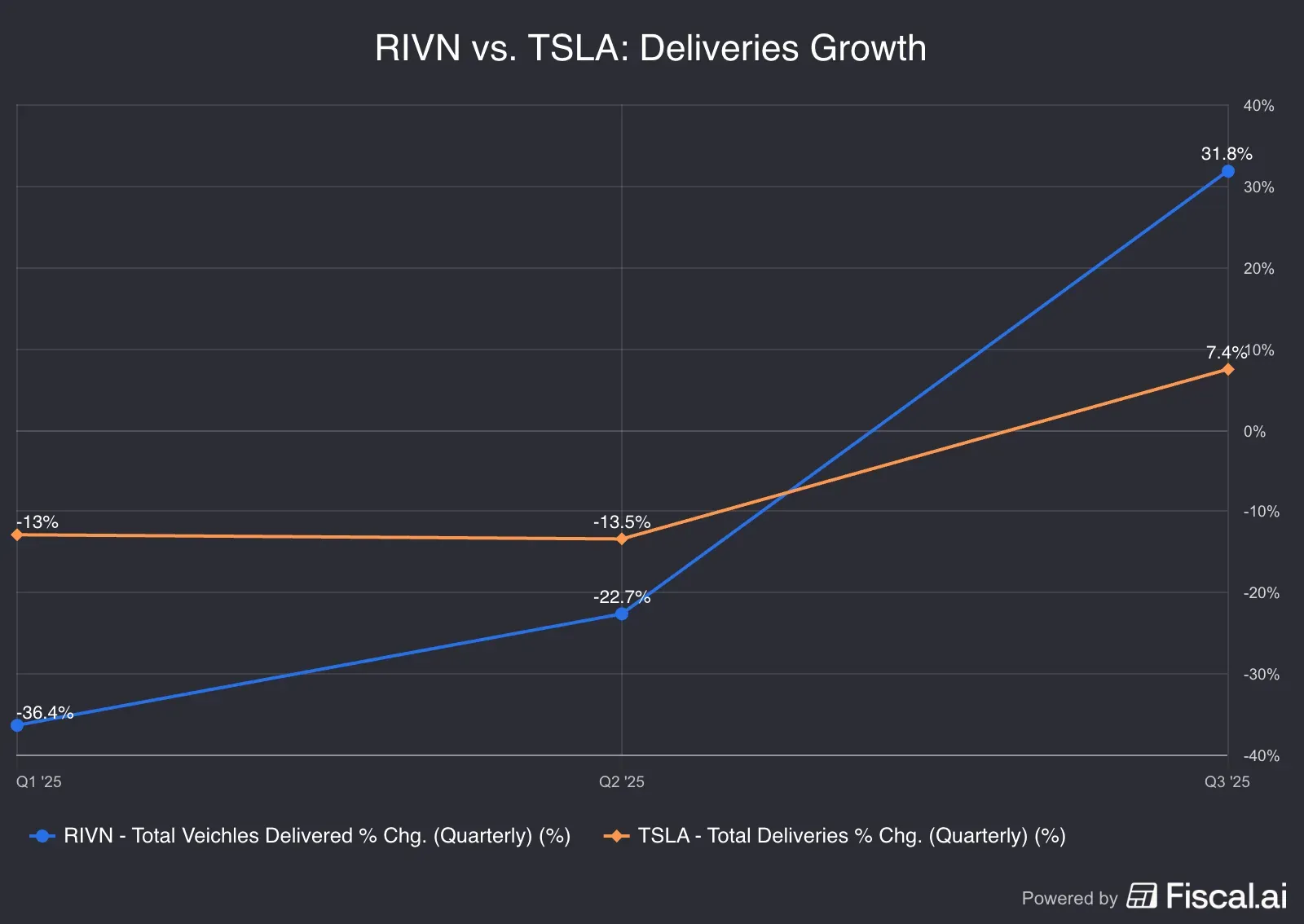

A comparison of deliveries for the year shows Tesla and Rivian's delivery growth inflecting higher after negative YoY growth in the first two quarters. Once the turnaround occurred, Rivian’s growth far outpaced that of its larger rival.

Source: Fiscal.ai<

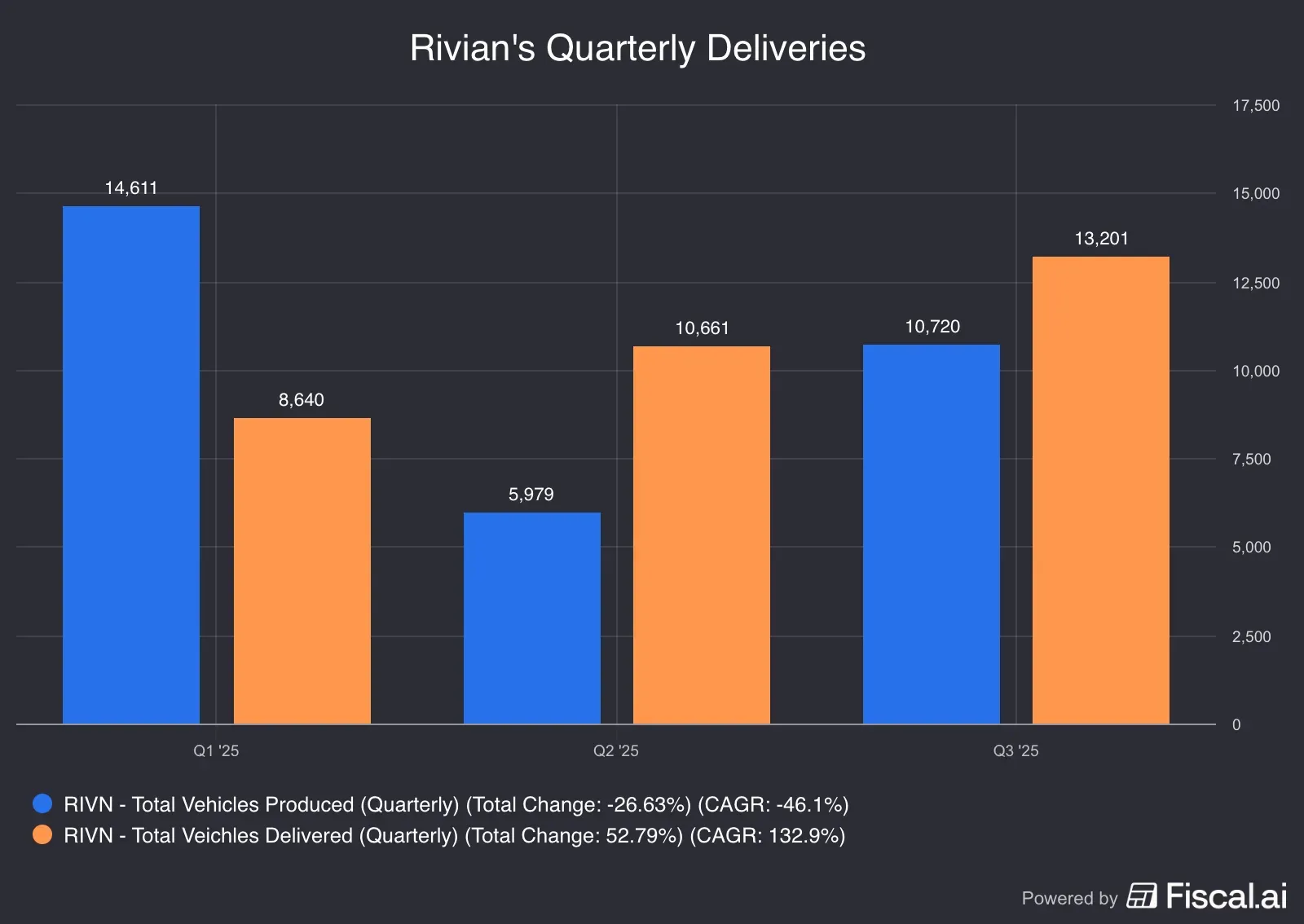

In absolute terms, Rivian’s deliveries have grown sequentially in each of the three quarters of 2025, marking a record for the company.

Source: Fiscal.ai<

Rivian & Autonomy

At Thursday’s event, Rivian suggested it is plunging headlong into an AI-first autonomy stack. The company plans to release an end-to-end “Large Driving Model,” and the hands-free driving feature will be updated this month. It has also developed an in-house chip to process data from the road and feed the AI model that powers its self-driving.

Delving into the AI-centric approach, Scaringe said:

“Our approach to building self-driving is really designed around this data flywheel. We're a deployed fleet, has a carefully designed data policy that allows us to identify important and interesting events that we can use to train our large model offline, before distilling the model back down into the vehicle.”

Following the event, Goldman Sachs raised its price target for Rivian stock to $16 from $13 but kept a ‘Neutral’ rating, according to The Fly. The event underscored how Rivian views the vehicle as a platform for high-margin software, with future opportunities in advanced autonomy, third-party integrations, and potentially broader licensing, the firm said.

Needham, which has a ‘Buy’ rating on the stock, upped the price target to $23 from $14. Analysts at the firm said the event increased their confidence in the company’s software-defined vehicles, which are increasingly becoming industry table stakes. They see Rivian's vertical integration allowing for fuller control, driving faster learning and feature iterations across driver interface and autonomy technology, giving it a “durable competitive advantage.”

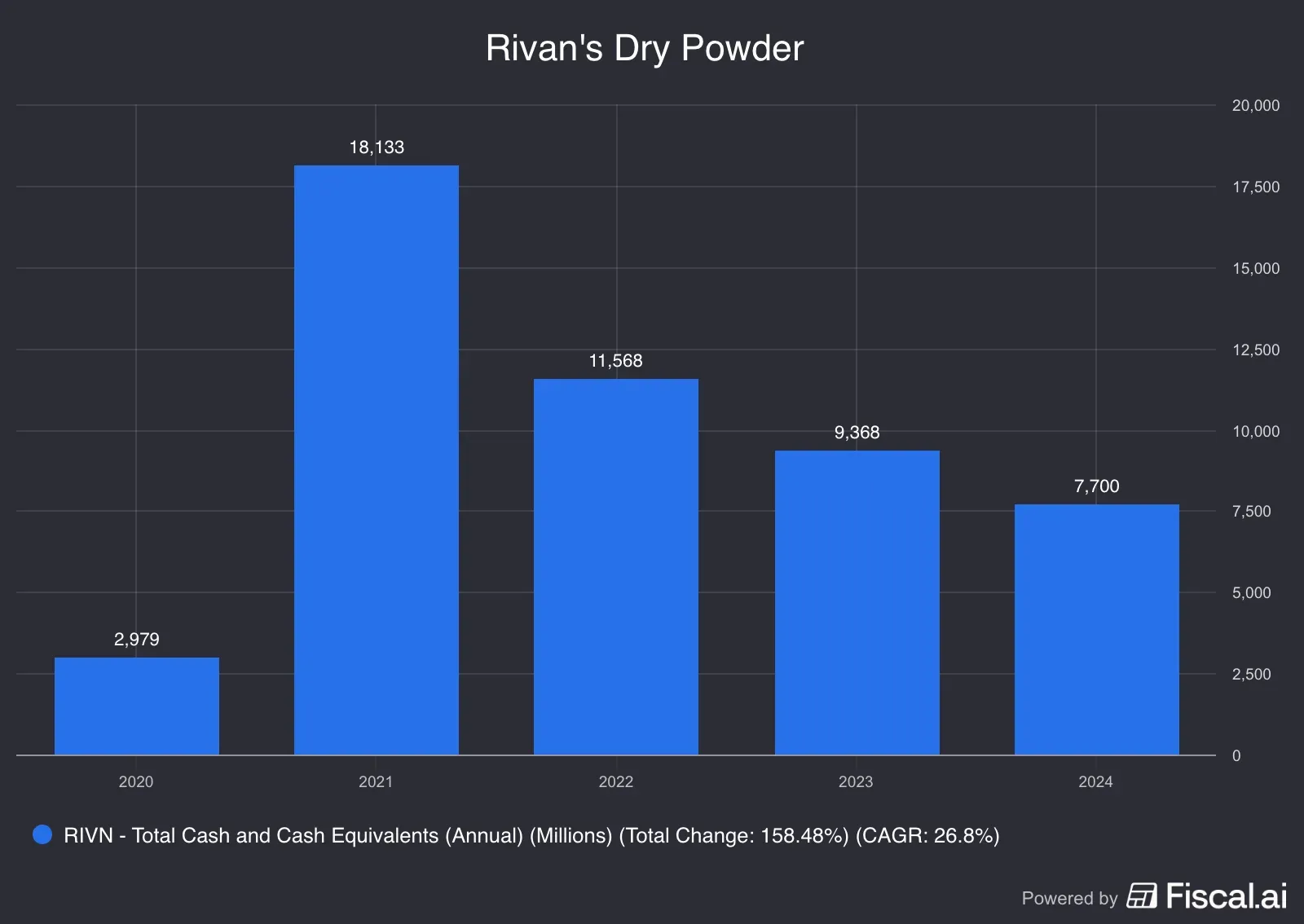

But RBC Capital Markets analysts remained skeptical. The Autonomy+ offering has potential to boost margins, though the low take-rates may persist without an eyes-off solution, the analysts said. Also, the analysts expressed concerns about liquidity and the profitability of the upcoming R2 and R3 models. The latter is a smaller, entry-level crossover/hatchback announced in March 2024.

Source: Fiscal.ai<

Rivian Stock vs. EV Rivals

The Irvine, California-based company’s stock has generated the second-best returns among the U.S.-listed peers. Only XPeng (XPEN), a Chinese EV startup, fared better than Rivian, thanks to its strong delivery growth, roaring reception to its new model launches, international expansion and artificial intelligence (AI) as well as its tech investments.

Source: Koyfin<

Rivian’s Outlook

CFO Claire McDonough reaffirmed the 2025 delivery guidance range of 41.5K to 43.5K at the September quarter earnings call. The executive also reiterated the adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) loss guidance range of $2 billion to $2.25 billion and a roughly breakeven gross profit outlook for the whole year.

Rivian is widely expected to launch its next-generation R2 model in the first half of 2026. During the third-quarter earnings call, CEO RJ Scaringe said the R2 is addressing the most significant market opportunity with the right product, given the attractiveness of the addressable market. He noted that the average new vehicle purchase price in the U.S. is now just over $50,000, and the most popular configuration is a 5-seat SUV or crossover.

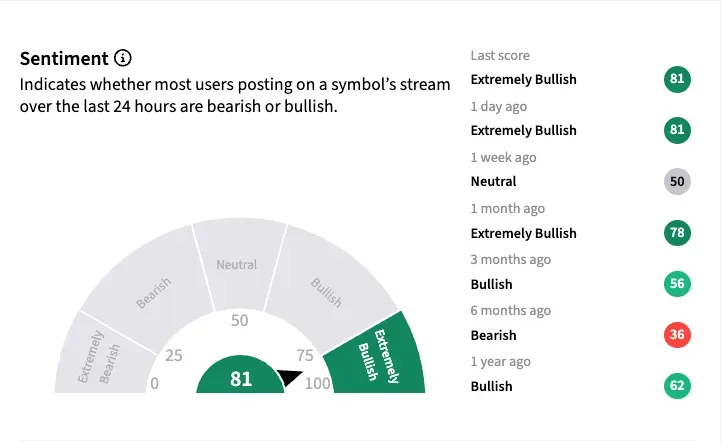

Rivian — A Retail Favorite?

For much of the year, the EV maker has managed to elicit a positive mood from among retailers on the Stocktwits platform, with sentiment to ‘extremely bullish’ levels since its Autonomy & AI Day event. Signaling increased interest, the stock's watcher count has risen by about 9% over the past year.

A bull among the retail community said that Rivian’s revenue will likely increase by 30%-50% in 2026, while Tesla’s may remain flat or increase by up to 8%. “Today, I'm EXTREMELY bullish on Rivian stock. So far, in 2025, Rivian has not disappointed!” they said. “Just because Rivian was over-valued in 2021 when it IPOed does not mean it's over-valued NOW.”

Another user called Rivian’s autonomy “great compared to decades of promises from Elon. It solved FSD V10 in less than a year.”

Wall Street analysts, however, do not share the same degree of optimism. Of the 25 analysts covering the stock, more than half (14) are on the sidelines, according to Koyfin. Only eight are either bullish or strongly bullish, and three have sell recommendations. The average analyst price target for Rivian is $15.75, implying nearly 15% downside from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<