Railtel trades above key EMAs and shows a supertrend breakout on the weekly chart.

Railtel shares surged nearly 10% on Wednesday, taking its monthly gains to 37%. SEBI-registered analyst Sameer Pande sees bullish potential for this stock going ahead.

Its technical indicators support this outlook. The 14-day Relative Strength Index (RSI) stands at 74 on the daily time frame, and on the weekly time frame, it stands around 61.

The Average Directional Index (ADX) is at 35.73, indicating a strong prevailing trend. According to Pande, this trend is likely bullish given the current price action.

Additionally, the supertrend breakout on the weekly timeframe indicates ongoing bullish momentum.

The stock is trading above its 20-day Exponential Moving Average (EMA) (₹376) and its 50-day EMA (₹351), indicating an uptrend.

Pande sees strong support around ₹400 to ₹380 levels, with resistance around ₹440-470. He recommends a stop loss at ₹372 on a closing basis, with an upside target of ₹499 projected by July 17.

Railtel Corporation of India is a prominent provider of telecom infrastructure. It specializes in high-capacity DWDM technology and MPLS networks to cater to the communication requirements of Indian Railways and other clients.

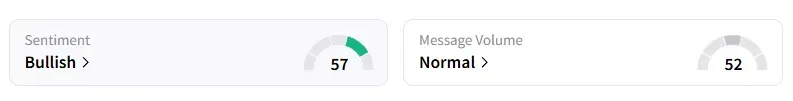

Data on Stocktwits shows retail sentiment on this counter is ‘bullish’.

Railtel shares have risen 10% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.<