Investors absorbed a divided Fed, cautious inflation messaging, and softer labor signals, while retail traders still managed to find a positive spin.

- A split Fed delivered a quarter-point cut while maintaining a data-dependent stance amid lingering inflation concerns.

- Economists diverged on the path for 2026, with projections ranging from Q2 cuts to gradual, risk-focused easing.

- Retail traders stayed broadly optimistic, though sentiment toward tech softened on AI-bubble worries.

The year-end’s most anticipated catalyst finally arrived, but the in-line decision failed to really ignite markets. Stocks rose instead through a classic rotation from leaders to laggards.

On Wednesday, the iShares Russell 2000 ETF (IWM), an exchange-traded fund (ETF) that tracks the performance of small-cap stocks, climbed 1.36%, outperforming the SPDR S&P 500 ETF (SPY) (up 0.66%) and Invesco QQQ Trust (QQQ) (up 0.41%).

As a strong year wraps up, will the rate decision and the Fed’s messaging breathe life into the momentum that has flickered rather than flowed?

Reading The Fed

The central bank cut rates by a quarter-point to 3.5%-3.75%, the lowest since October 2022. The decision was not unanimous, with two hawkish policymakers — the Chicago Fed’s Austan Goolsbee and the Kansas City Fed’s Jeffrey Schmid — supporting the status quo. At the same time, newly appointed President Donald Trump-nominated Governor Stephen Miran called for a 50-basis-point cut. The three dissents were the most since 2019,

What restrained the markets from rallying hard is the central bank’s inflation focus. The Federal Open Market Committee (FOMC), which sets the Fed funds rate, the reference point for all key rates that impact consumers and businesses, reiterated its view that it would be data-dependent and also stated that it will “take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

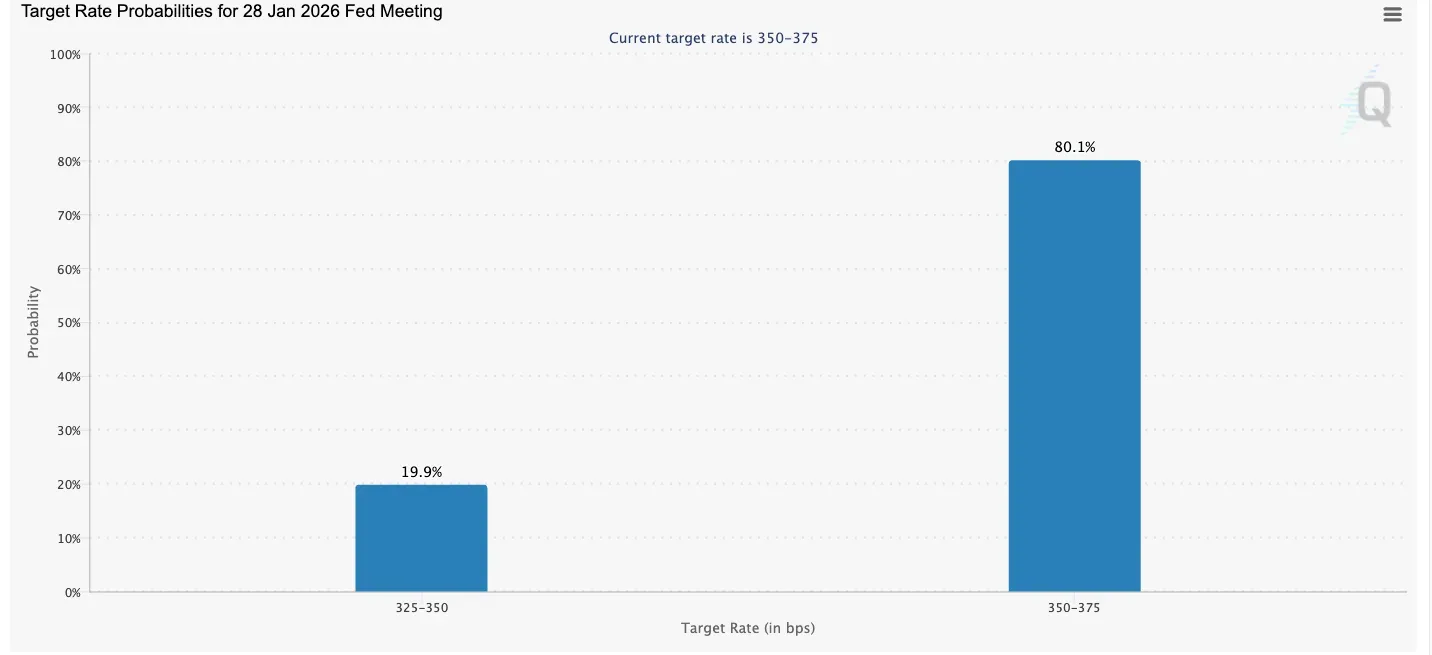

The CME FedWatch Tool now shows that futures traders have baked in an 80% probability of the central bank holding fire and a 20% probability of a quarter-point cut.

Next Move - A Pause?

Source: CME<

Making sense of the central bank’s commentary, LPL Chief Economist Jeffrey Roach said, “Inflation must significantly cool for the committee to cut more than two times in 2026. Growth expectations and unemployment forecasts are too strong for committee members to pencil in three cuts.” The economists expressed hope that inflation will materially ease throughout next year.

Roach sees no cut in the first quarter of next year as the FOMC is positioned for higher productivity, implying stronger growth despite softer job creation.

“Investors should expect the Fed to remain on hold in Q1, especially if the economy responds to the tailwinds from fiscal and policy support. The first cut next year may come in Q2.”

Bolvin Wealth Management Group President Gina Bolvin, however, had a different take. “With its third straight rate cut, the Fed is sending a clear message: it’s no longer just watching inflation—it’s managing risk,” she said.

Goldman Sachs Chief U.S. Economist David Mericle saw a dovish tilt from the Fed, according to the Fly. The economist said the central bank now thinks payroll growth may have been overstated by 60,000 per month, leaving the May-September change in payrolls at a negative 20,000. He also noted that Powell said in his press conference that “A world where job creation is negative" is a situation the FOMC needs to watch "very carefully." He attributed Wednesday's positive market performance to Powell’s other dovish comments on the labor market, along with continued confidence in progress on inflation. Following the Fed meeting, Goldman maintained its view that the FOMC will deliver two normalization cuts in March and June 2026 to a terminal rate of 3.00%-3.25%.

What Does It All Mean for the Market?

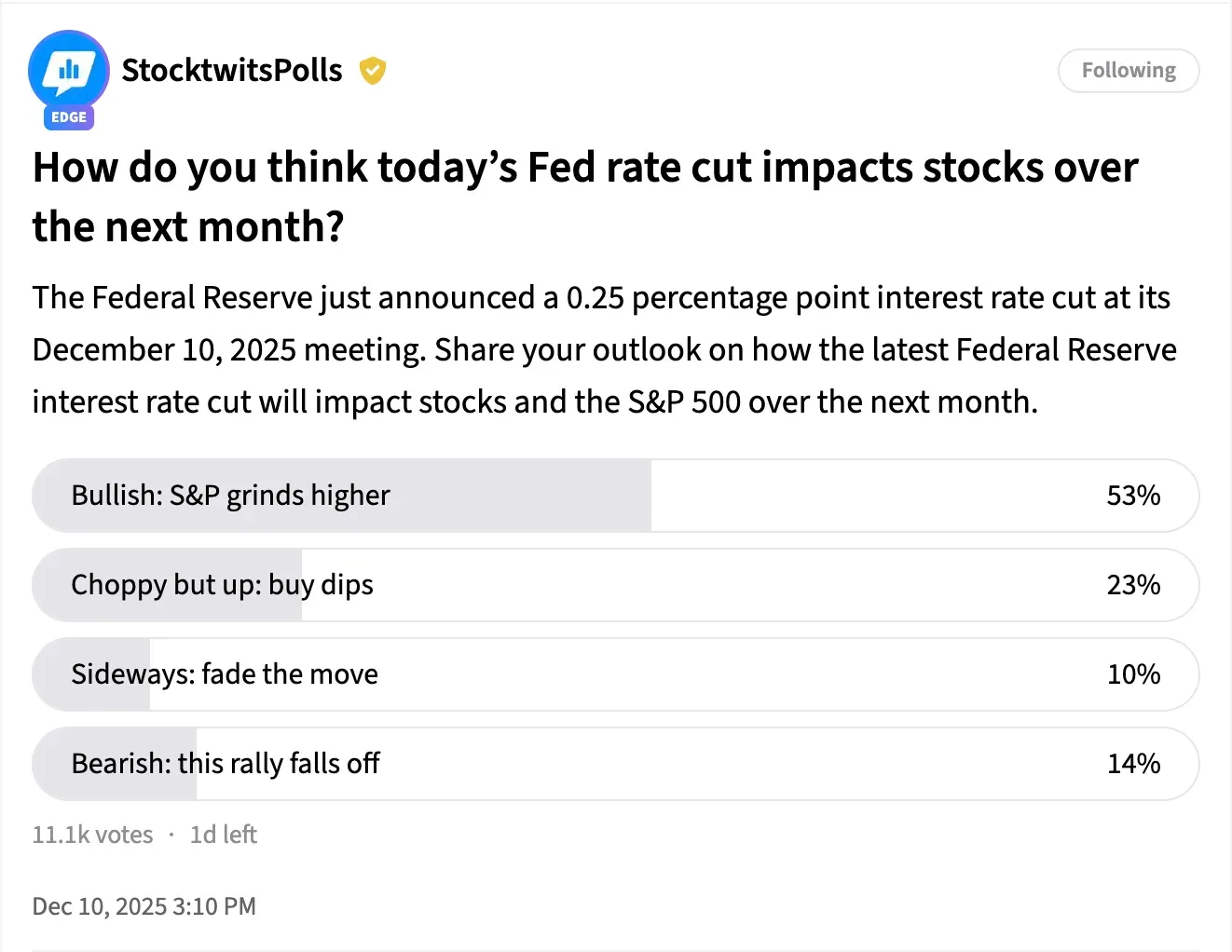

When Stocktwits users were asked in an ongoing poll about the impact of the December rate cut on the market, most were positive. To the question “How do you think today’s Fed rate cut impacts stocks over the next month?” 54% chose “Bullish: S&P grinds higher.” Twenty-two percent expected “choppy but up” market, and positioned themselves to ‘buy dips.”

Fourteen percent of the respondents were “bearish,” expecting “this rally falls off,” while the remaining 10% said they expected the market to move “sideways.”

Writing on the poll’s timeline, one user said, “I think most people were likely expecting 2 to 3 rate cuts next year, so 1 is likely bearish. However, I would also say it’s not a foregone conclusion to still think 2 to 3 rate cuts are in order.”

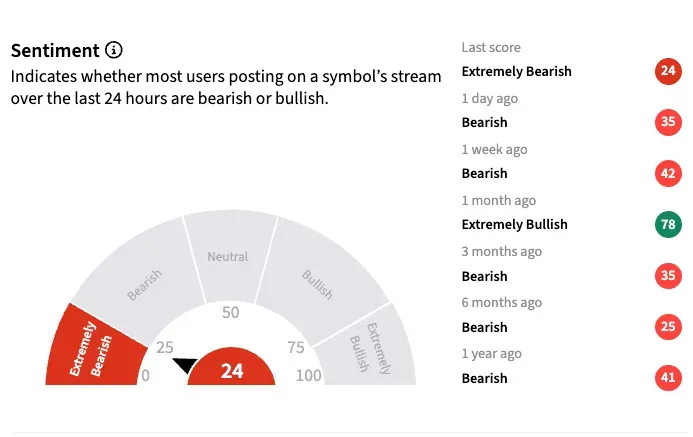

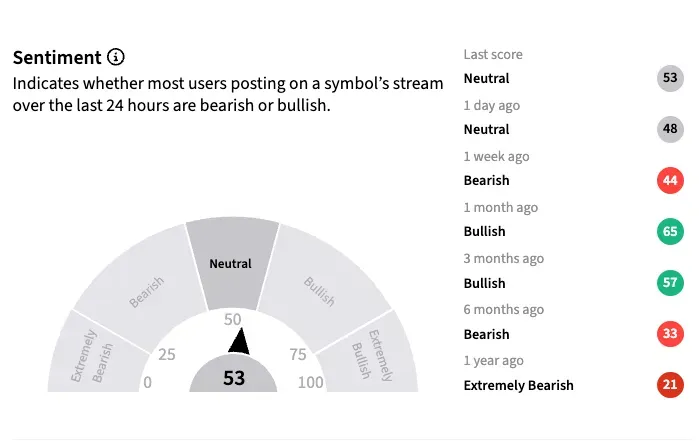

The market mood captured by the sentiment meter on Stocktwits, however, painted a sour outlook for the QQQ ETF, potentially reflecting worries about AI bubble following Oracle’s results. The mood toward the SPY ETF remained ‘neutral.’

Bolvin sees a “more flexible, data-reactive central bank heading into 2026.” “Rate cuts may continue—but gradually, and only if the data allows.” Under such a scenario, she recommended selectivity, quality, and staying alert to turning points in growth and inflation.

The Future Funds’ Gary Black said he does not see Wednesday’s action as a “hawkish cut,” primarily as the Fed starts buying short-term treasuries beginning next week as it ends its quantitative tightening.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<